In the context of economic development, the ever-increasing growth of enterprises has and continues to demand capital to serve their business. However, domestic capital does not meet the requirements of enterprises, therefore, foreign capital is extremely necessary.

Encouragement for enterprises to develop their businesses required the Vietnamese Government to expand the regulations on foreign loan registration to create effective capital mobilization channels to support enterprises. However, knowing how to register foreign loans in Vietnam is an issue presenting challenges for enterprises. CNC appreciates this problem and has prepared this detailed, step-by-step guide to equip enterprise clients with information related to the Foreign loans registration in Vietnam

Included is important content related to foreign loan registration, such as:

- Loans subject to registration

- Cases need to register loan changes

- Entities subject to application for registration or registration for loan changes

- Processes for loan registration

- Loan registration dossier

- Opening and use of foreign borrowing and foreign debt repayment accounts

- Disbursements, fund withdrawals, money transfer for foreign loan arrangement, and”

- Reporting Regulations

- What is a foreign loan?

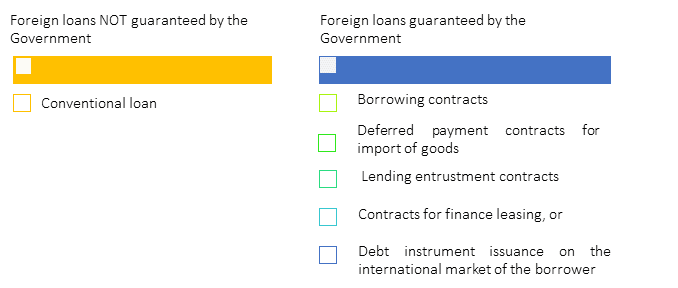

The term foreign loan is generic and refers to the various types of foreign loans, including:

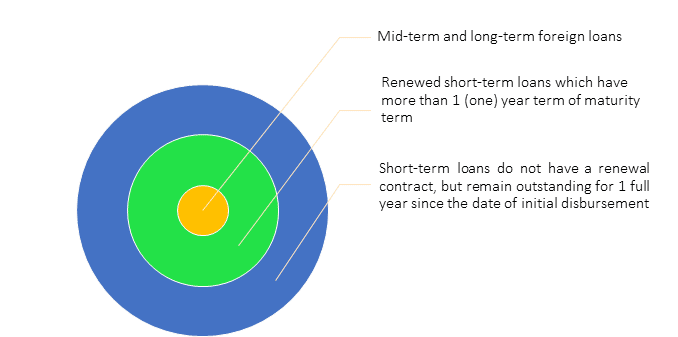

Loans subject to registration

Article 9, Circular No. 03/2016/TT-NHNN

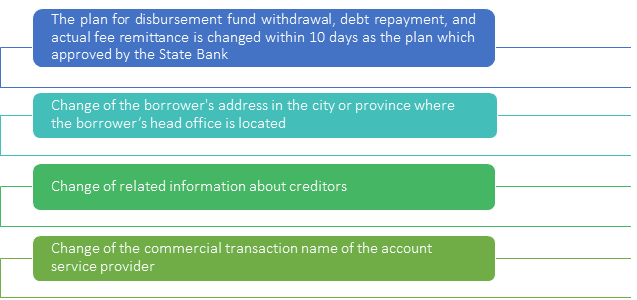

Registering loan modifications

In the event there are any changes to any foreign loans, those changes must be registered, by the borrower, with the State Bank of Vietnam. In some instances, the borrower need only notify the State Bank of Vietnam of any changes in writing. Such instances include:

Article 15, Circular No. 03/2016/TT-NHNN

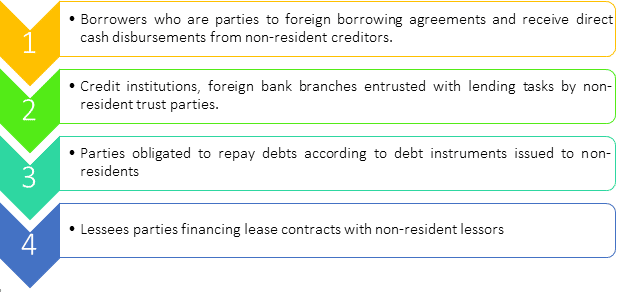

Entities subject to application for registration or loan change registration

Borrowers subject to application for registration or loan change registration, include:

Loan Registration Process

Loan Registration Process

Useful note

Borrowers must be ware of the term of the loan – any delay of registration affects the results of the application resulting in penalties. Borrowers must submit their dossiers within a strict 30-day time period that starts after:

Article 13.3, Circular No. 03/2016/TT-NHNN

Loan registration dossier

|

No. |

Documents | Qty. |

Status |

|

| 1 | Loan registration form |

01 |

||

| 2 | Legitimate dossiers of both the borrower and the loan user when a borrower is not a loan user, including:

(i) Establishment permit(s), (ii) Business registration certificate(s), (iii) Enterprise registration certificate(s), (iv) Investment registration certificate(s), or (v) Cooperative federation registration certificate in accordance with laws and amendment(s) or supplementation documents (if applicable). |

01 |

Copy (countersigned by the borrower) | |

| 3 | Written proof of borrowing purposes, include: |

01 |

Copy (countersigned by the borrower) or original |

|

| Mid-term and long-term foreign loans. | (i) Production and business plans, investment projects;

(ii) Borrower’s foreign debt restructuring plans of the. |

|||

| Renewed short-term loans and Short-term loans don’t have renewal contracts but remain outstanding for 1 full year from the date of the initial disbursement. | (i) A report that outlines the use of short-term loans conformity to eligibility regulations and conditions for short-term foreign borrowing (documentary evidence attached hereto), and

(ii) A debt repayment plan. |

|||

| 4 | Foreign loan agreements and agreements on renewals of short-term loans into mid-term or long-term loans (if applicable); or a written document of disbursement attached to the framework agreements.

|

01 |

Copy and Vietnamese translation (countersigned by the borrower) | |

| 5 | Secured loan written guarantee of commitment:

(i) Letter of guarantee, or (ii) Contract of guarantee – or other commitment. |

01 |

Copy and Vietnamese translation (countersigned by the borrower) |

|

| 6 | Written approval of the competent authority

(When a borrower is a state-owned enterprise, apart from a commercial bank in which 100-percent of the charter capital is held by the State) |

Copy (countersigned by the borrower) |

||

| 7 |

Report of compliance with the regulations of the State Bank of Vietnam regarding credit limits and safety ratios of credit institutions, foreign bank branches of the latest month-end date prior to the date of effecting foreign loan agreements, and Written proof of incompliance with the laws on credit limits and safety ratios approved by the Prime Minister or the Governor of the State Bank of Vietnam in accordance with applicable laws. (Borrowers present as credit institutions or foreign bank branches.) |

01 |

Original | |

| 8 | Account service provider confirmation |

01 |

Original | |

| 9 |

Documents or invoices indicating legally distributed Vietnam-dong profits gained from direct investments of the creditor who is the foreign investor making the capital contribution to the borrower, and A statement of account service providers on distribution and transmission of profits to the home country of the creditor. (respective of foreign borrowing in Vietnam dong (VND)) |

01 |

Original | |

| 10 |

Explanatory statement on demands for foreign borrowing in Vietnam dong (VND) respective of foreign borrowing in Vietnam dong under permission of the Governor. |

01 |

Original | |

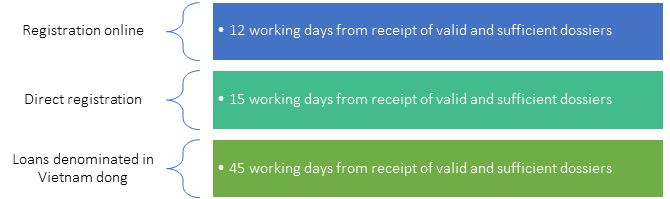

Once submission is complete, The State Bank will approve or reject confirmation of loan registration, in writing, within the following permitted periods:

Opening/Use of Foreign Borrowing and Foreign Debt Repayment Accounts

Opening/Use of Foreign Borrowing and Foreign Debt Repayment Accounts

Foreign borrowing and foreign debt repayment accounts refers to the payment account that the borrower opens at an account service provider to disburse and/or withdraw funds, and repay debts incurred from foreign loans and other money transfer activities related to foreign borrowing and foreign debt repayment and foreign loan guarantees.

|

No. |

Borrowers | Type of loan | Type of account |

Notes |

| 1 |

Foreign direct investment enterprises borrowers |

Medium-term and long-term foreign borrowing |

Direct investment account

|

Each foreign loan shall be allowed to open its account at only 01 account service provider. Except medium-term and long-term foreign direct investment enterprises, Borrowers may own 1 account for 1 or multiple foreign loans.

|

|

Short-term foreign borrowing |

An account for direct investment or an account for foreign borrowing and repayment (distinct from the account for direct investment) |

|||

| 2 |

Indirect/non-direct foreign-invested enterprise borrowers |

All loans |

must open a foreign borrowing and foreign debt repayment account at an account service provider in order to perform money transfers relating to foreign loans (including disbursements, fund withdrawals, principal and interest payments). |

Disbursements, Fund Withdrawals, and Money Transfers for Foreign Loan Arrangement

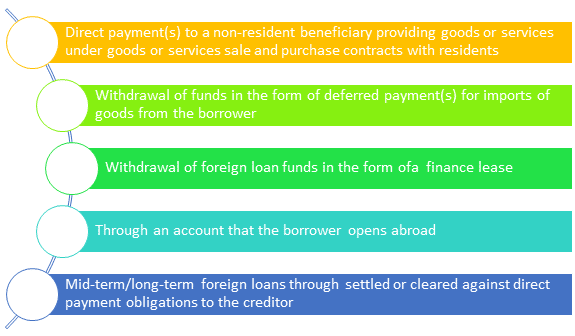

Borrowers that are not a commercial bank or foreign bank branch, must perform every money transfer (disbursements, fund withdrawals or debt repayments) relating to foreign loans through foreign borrowing and foreign debt repayment accounts of the borrower, except in the following situation:

A fund withdrawal is not carried out through foreign borrowing and foreign debt repayment accounts, including:

Article 34.1, Circular No. 03/2016/TT-NHNN

Notes when transferring money for effecting of foreign loan:

Borrowers of foreign loans subject to registration with the State Bank of Vietnam can withdraw funds and repay debts (principal and interest) of foreign loans, only after registration for such loans is certified by the State Bank of Vietnam, except when the withdrawal funds or payment of a part of principal or interest occurs within the first year of a mid-term or long-term loan.

Borrowers are only allowed to receive disbursed loans and transfer money to pay debts (principal and interest) through the account of the creditor, representative for the creditor, or bank payment agents for the creditors.

When disbursement and transfer of funds are carried out through the account of the non-resident third party that not related to these subjects, this content must be clearly defined in the loan and/or loan change agreements. When foreign loans are subject to registration with the State Bank of Vietnam, this content must be confirmed in the statement on confirmation of registration or registration for changes of foreign loans.

Reporting Regulations

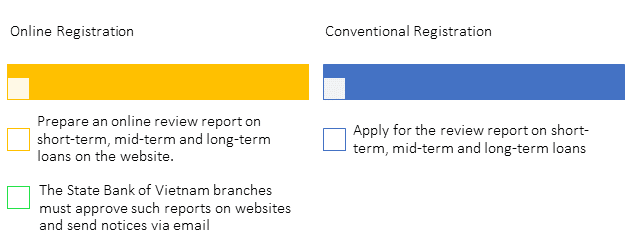

Time: On a quarterly basis, no later than the 5th day of the month and immediately after the reporting period.

Article 39 and Article 40, Circular No. 03/2016/TT-NHNN

Ad-hoc reporting

Upon the request of The State Bank of Vietnam, borrowers or the account service providers must submit reports.

Support:

CNC is honored to receive and respond to any and all inquiries to support effective and efficient registration of your foreign loans in Vietnam.

Requests can be made by email or phone according to the information below:

Lawyer Nguyen Thi Kim Ngan | Senior Associate

T: (+84-28) 6276 9900

Nguyen Thi Hong Tra | Associate

T: (+84-28) 6276 9900

CNC© | A Boutique Property Law Firm

63B Calmette St., Nguyen Thai Binh Ward, District 1, Ho Chi Minh, Vietnam

T: (+84-28) 6276 9900 | F: (+84-28) 2220 0913

cnccounsel.com | contact@cnccounsel.com

Disclaimers:

The content herein does not reflect any legal perspective of CNC or any of its partners in the past, present or future. This newsletter is not considered to be accurate and/or suitable for legal issues encountered by clients. In no way does this newsletter constitute a service agreement between CNC and client. CNC objects all liability arising from or relating to client’s quoting any content of this newsletter to apply to their own issues. Clients are encouraged to ask for legal advice for each specified circumstance they encounter.

Like!! I blog quite often and I genuinely thank you for your information. The article has truly peaked my interest.