International Financial Center in Vietnam – Opportunity or Challenge?

On 27/06/2025, the National Assembly of Vietnam officially adopt Resolution No. 222/2025/QH15 (“Resolution 222”), thus establishing the legal foundation for the creation of International Financial Centers (IFC) in Vietnam—a “controlled exception” institutional model with no previous precedent.

With Ho Chi Minh City and Da Nang chosen as the starting points, Vietnam is ready to enter a playing field that has traditionally dominated by “giants” such as Singapore, Dubai, Hong Kong or London. This is a strategic move not only to attract foreign capital, but also to redefine Vietnam’s position in the global financial map.

What is International Financial Center?

According to clause 1 Article 3 Resolution 222, an International Financial Center is an area with a defined geographical boundary established by the Government, focusing on a diverse ecosystem including financial services and support services, and applying mechanisms and policies as mandated by the laws.

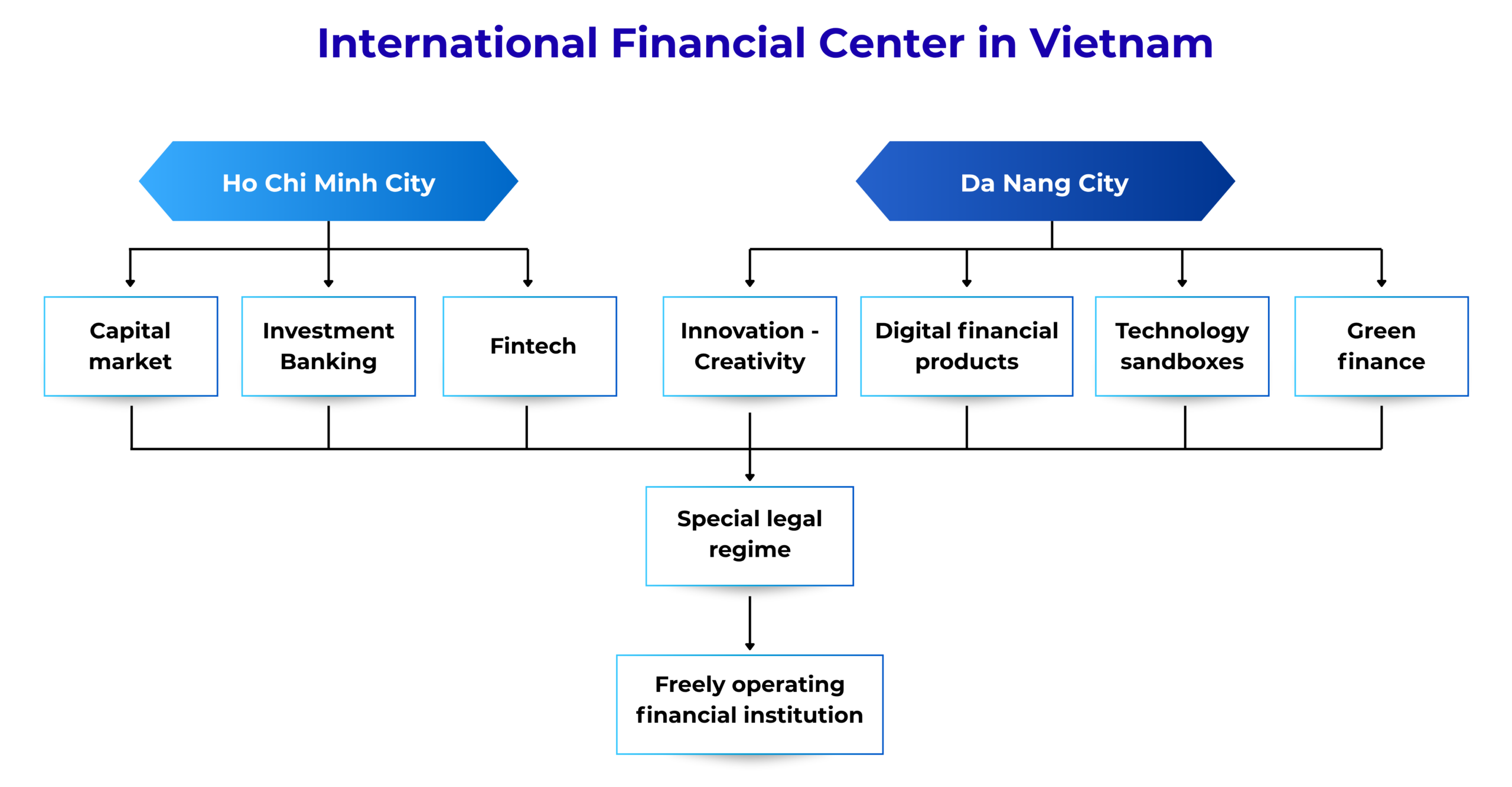

According to Resolution No. 222/2025/QH15, the National Assembly of Vietnam decided to establish IFC at two locations:

- Ho Chi Minh City – considered the largest economic and financial center in Vietnam, focusing on capital market, investment banking, and fintech.

- Da Nang City – a hub of innovation and the gateway to the central region, designated for piloting digital financial products, technology sandboxes, and green finance.

International Financial Center in Vietnam

Each center shall be developed in its own distinct direction, optimizing the advantages of the local area while maintaining interconnectedness and mutual support. These two areas will have their exclusive legal regime and policies, thereby facilitating domestic and foreign financial institutions to operate freely per the international standards.

Operation Objective

Vietnam has set five strategic objectives for the establishment and operation of IFC in Vietnam, aiming to create a regional-class ecosystem that serves as a new launching pad for national economic-financial growth, rather than merely developing a financial zone.

First, develop separate products, capitalize on the strength of each city; ensure fairness, uphold mutual support, strive for the goal of becoming a leading international financial institution, elevate Vietnam’s standing within the global financial network in tandem with economic growth drivers.

Second, promote sustainable finance, encourage the development of green finance products and mobilize resources for energy conversion and green conversion projects, contribute to the sustainable socioeconomic development. IFC shall serve a pivotal role in the capital mobilization for green conversion – including clean energy, sustainable infrastructure, low-carbon urban development projects. This is the incorporation of sustainable development goals (SDGs) into the financial policies. Green finance is not only a global trend, but also a prerequisite to access to international concessional finance sources (such as WB, ADB, Green Climate Fund, etc), IFC shall be the “launching pad” for the development of green bond, green investment fund, or carbon credit mechanisms – all of which are currently lacking in the current financial market of Vietnam

Third, IFC shall operate in accordance with the advanced international standards, connecting with major global financial markets and centers, and facilitating the association of domestic and international exchange platforms. IFC shall ensure that all financial activities, transactions, supervision, and governance, etc, are designed in line with current international norms, ensuring compatibility and connectivity with leading financial hubs such as Singapore, Hong Kong, Tokyo, and London.

Fourth, attract and develop a high-quality workforce, including both domestic and international financial experts. IFC cannot thrive without highly qualified operators. This goal emphasizes attracting global talent and building a comprehensive human capital ecosystem that encompasses education, professional practice, and livelihood. At the same time, IFC will drive demand for the development of international schools, international hospitals, and high-quality living infrastructure, thereby creating a sustainable environment for investment and working. This objective also implicitly encourages reforms in the legal framework governing international financial, accounting, and legal professions in Vietnam.

Fifth, the development of IFC shall be placed within the framework of ensuring the harmonization of benefits among the State, investors, and the public, while maintaining financial safety, economic security, politic and social order stability throughout its operation. This is the principle of “brake” — meaning that while Vietnam expands financial liberalization, it must simultaneously uphold macrostability and economic and political security, ensuring that the IFC does not become “cluster policies” that threaten the entire system.

Strategic Objective of IFC in Vietnam

Management structure of IFC in Vietnam

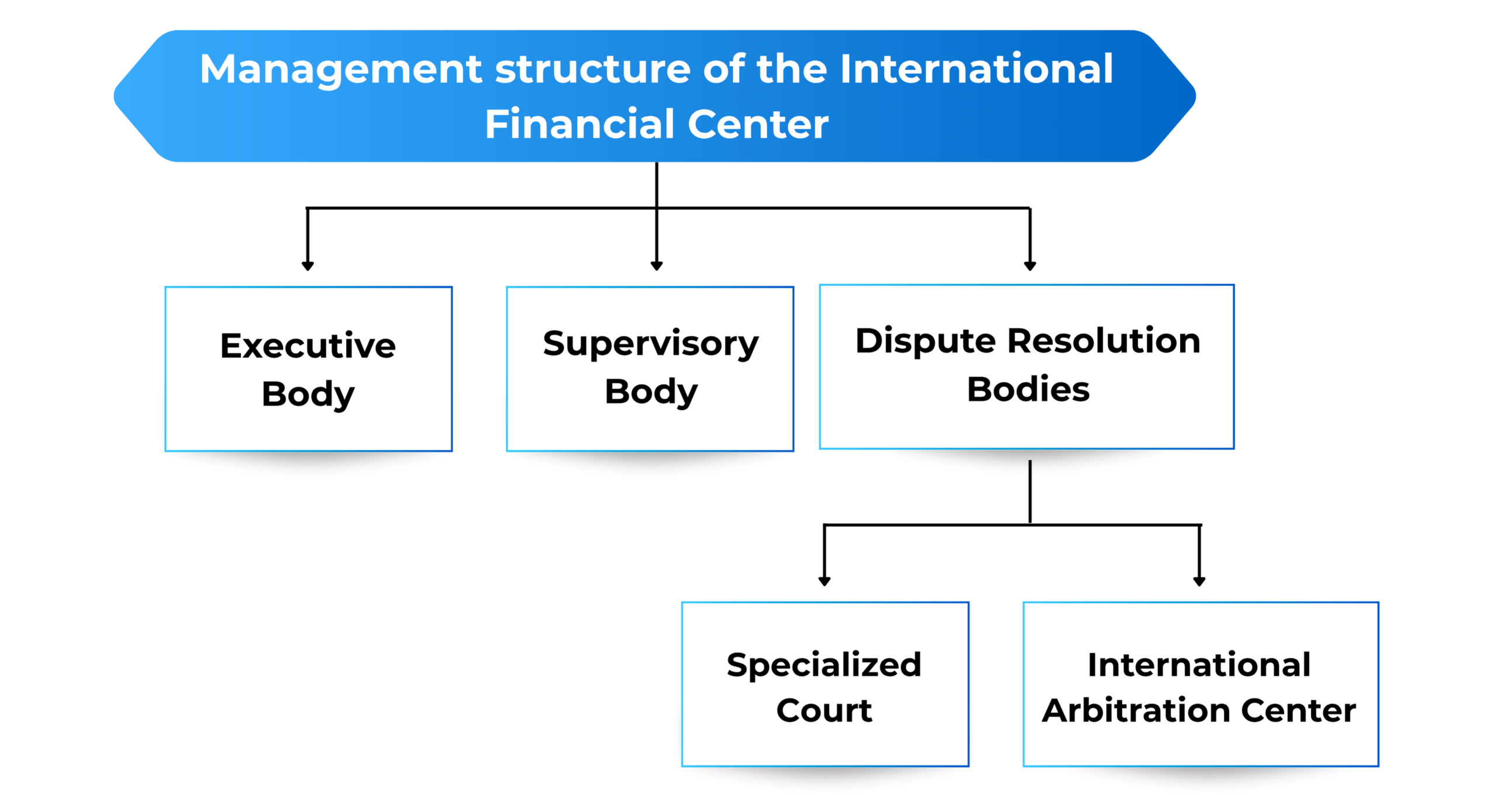

The management bodies of IFC are organized as follows:

- Executive body has the function of directly managing and administering all activities at IFC. The executive body has the power to issue Operation Regulations or equivalent regulations to provide detailed stipulations on the establishment and operation of the IFC.

- Supervisory body has the function of supervising, inspecting, examining, preventing and handling violations in financial activities at IFC.

- Dispute Resolution bodies at IFC:

- Specialized court or

- International arbitration center of the IFC.

Management structure of the International Financial Center

Specially-armed IFC in Vietnam:

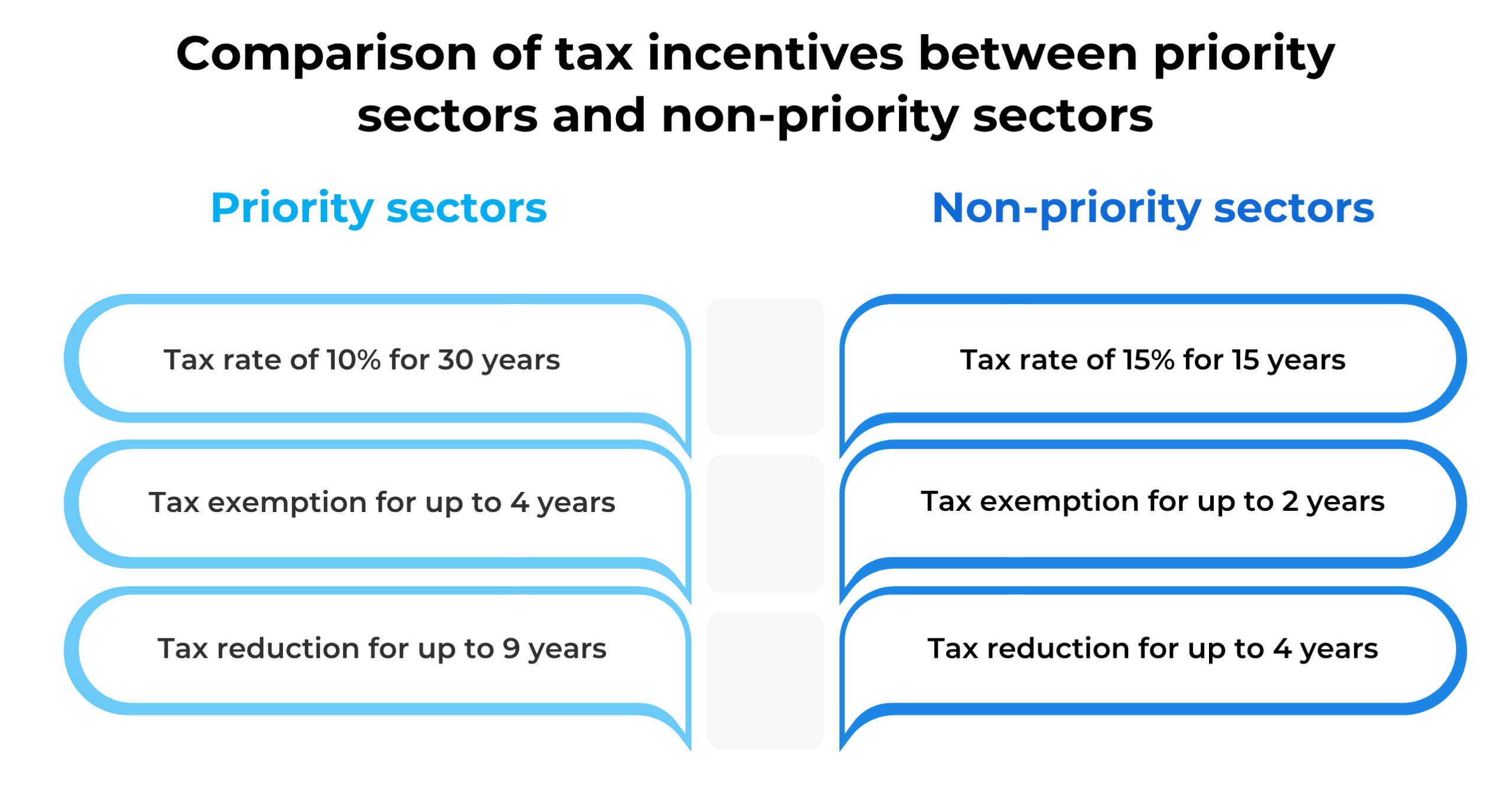

Unprecedented tax incentives:

- Corporate income tax applicable to enterprises operating in priority sectors in the IFC shall be at the rate of 10% for 30 years, shall be exempted up to 4 years, and shall be reduced by 50% of the payable tax amount for the next 9 years.

- Corporate income tax applicable to enterprises not operating in priority sectors shall be at the rate of 15% for 15 years, shall be exempted up to 2 years, and shall be reduced by 50% of the payable tax amount for the next 4 years.

Comparison of tax incentives between priority sectors and non-priority sectors

Freedom of Foreign Exchange Transactions:

Enterprises inside IFC are given more rights in relation to the use of foreign currency in comparison to enterprises outside IFC

|

Content |

Enterprises inside IFC |

Enterprises outside IFC |

|

Use of foreign currency for payment, listing, or quotation |

The use of foreign currencies is permitted for all transactions between IFC members and with foreign organizations/individuals; only transactions with domestic organizations/individuals who are IFC non-members shall comply with general regulations. | Within the territory of Vietnam, the payment, listing, advertising, quotation, etc, must be in VND, except for a few exceptions allowed by the SBV. |

|

Foreign loans in foreign currency |

Members are allowed to borrow foreign currency from foreign organizations/individuals; only required to declare and report such transactions | Resident enterprises that want to borrow from abroad must register the loan with the SBV and comply with the permitted purposes and borrowing limits. |

|

Domestic borrowing of foreign currency |

It is permitted to borrow foreign currency from credit institutions/foreign bank branches that are IFC members. | Loans are only allowed for very limited needs (imports, special projects) and reselling foreign currency to banks as soon as disbursement is usual. |

|

Domestic loaning of foreign currency |

IFC members are permitted to loan foreign currency to domestic organizations (IFC non-members). | Banks are entitled to lend foreign currency only if the borrower can demonstrate a source of foreign currency revenues. |

|

Capital Inflows/Outflows & Repatriation |

No limitation: members are free to transfer money. In the case of 100% foreign-owned enterprises, they are exempt from foreign exchange procedures when investing abroad (with the only obligations to open an account and to report). | Remittance of capital and profits abroad must carry out procedures for registration/notification to the SBV, subject to the limit of purpose and duration. |

|

Digital Asset/ FinTech |

“Sandbox” testing of fintech services — including digital assets — under specific management. | Cryptos are not recognized as a means of payment; transactions are still in the legal “gray zone”, not yet officially licensed. |

|

Foreign Ownership Cap in Banks |

Foreign ownership may be increased to up to 49% of charter capital in private banks operating in the IFC. | The total foreign ownership in Vietnamese commercial banks is capped at 30%, with exceptions allowing up to 49% only for certain specially restructured banks. |

|

Mandatory Use of VND |

No mandatory requirement to use VND for internal transactions within the IFC → favorable conditions for international investors. | Domestic transactions must be conducted in VND (except for cases where the SBV allows). |

English is the primary language

- English (or English + Vietnamese translation) is the official primary language in transactions, administration, adjudication, supervision, and technical documentation at IFC.

- All regulations, internal rules, financial documents, and records shall be bilingual or in English per the international standard.

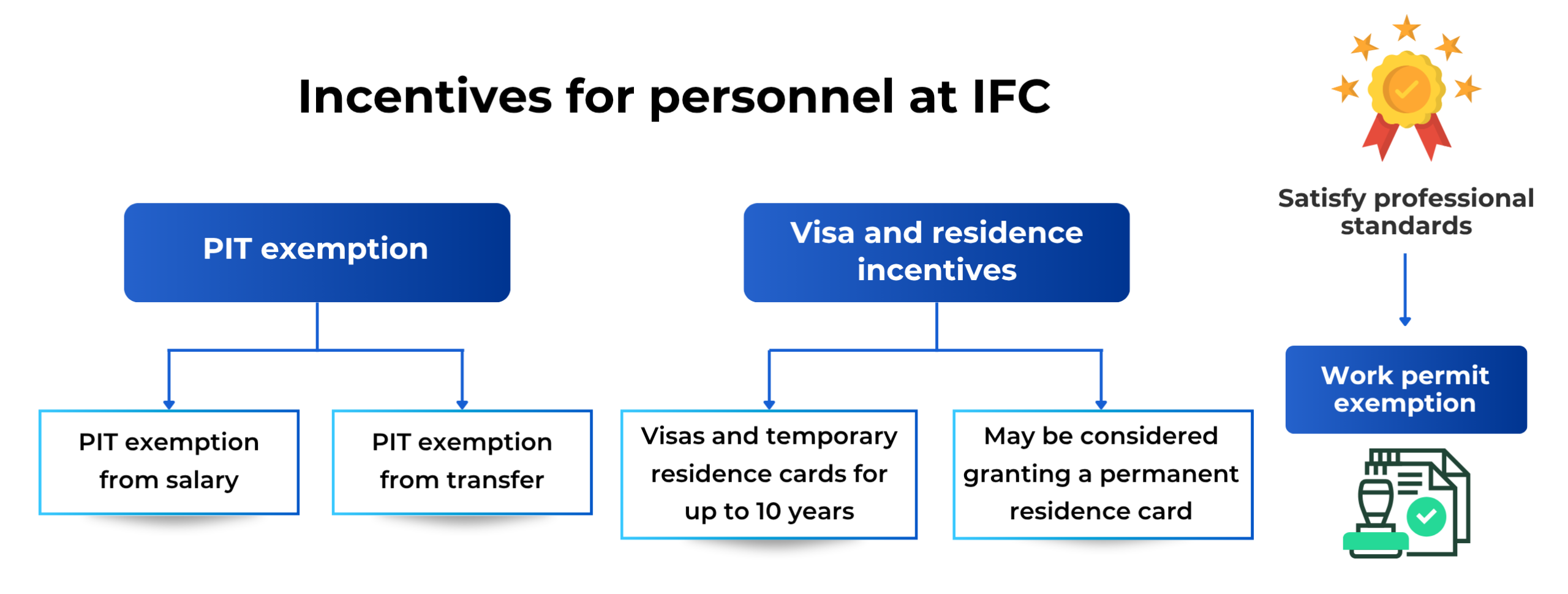

Incentives for foreign experts:

Personal Income Tax exemptions:

- Personal Income Tax (PIT) on salaries and wages earned by experts, managers, and scientists working at IFC is exempt until the end of 2030.

- Personal Income Tax on gains from the transfer of shares, capital contribution, or the right to contribute capital in members is exempt until the end of 2030.

Visa and residence incentives:

- Visa – residence: Foreign nationals who are key investors, experts, managers, or highly qualified employees will be granted visas and temporary residence cards (type UD1). Their accompanying family members shall be eligible for visas and residence cards (type UD2), both with a validity of up to 10 years.

- Permanent Residence Card: Foreign nationals who are key investors, experts, managers, individuals with exceptional talents, or senior executives working long-term at the IFC could be granted permanent residence cards at the request by Body of the IFC.

Additionally, foreigners working at the IFC are exempt from work permit requirements if they meet the professional qualifications specified by the Government or the Executive Body without being limited by the cases in the labor law as before.

Incentives for personnel at IFC

Land Use Right Extended:

- One of the most anticipated aspects for foreign enterprises and investors is undoubtedly the preferential land policies. The State has demonstrated its priority to IFC through regulations on the allocation of clean land funds to implement projects.

- However, the most notable concession in land policy is the allowance for land use rights and assets attached to land to be mortgaged at foreign credit institutions to secure investment loans. Given that land use rights in Vietnam, when establishing relationships with foreign entities, are always a sensitive issue, so this should be considered a major step forward in policy making.

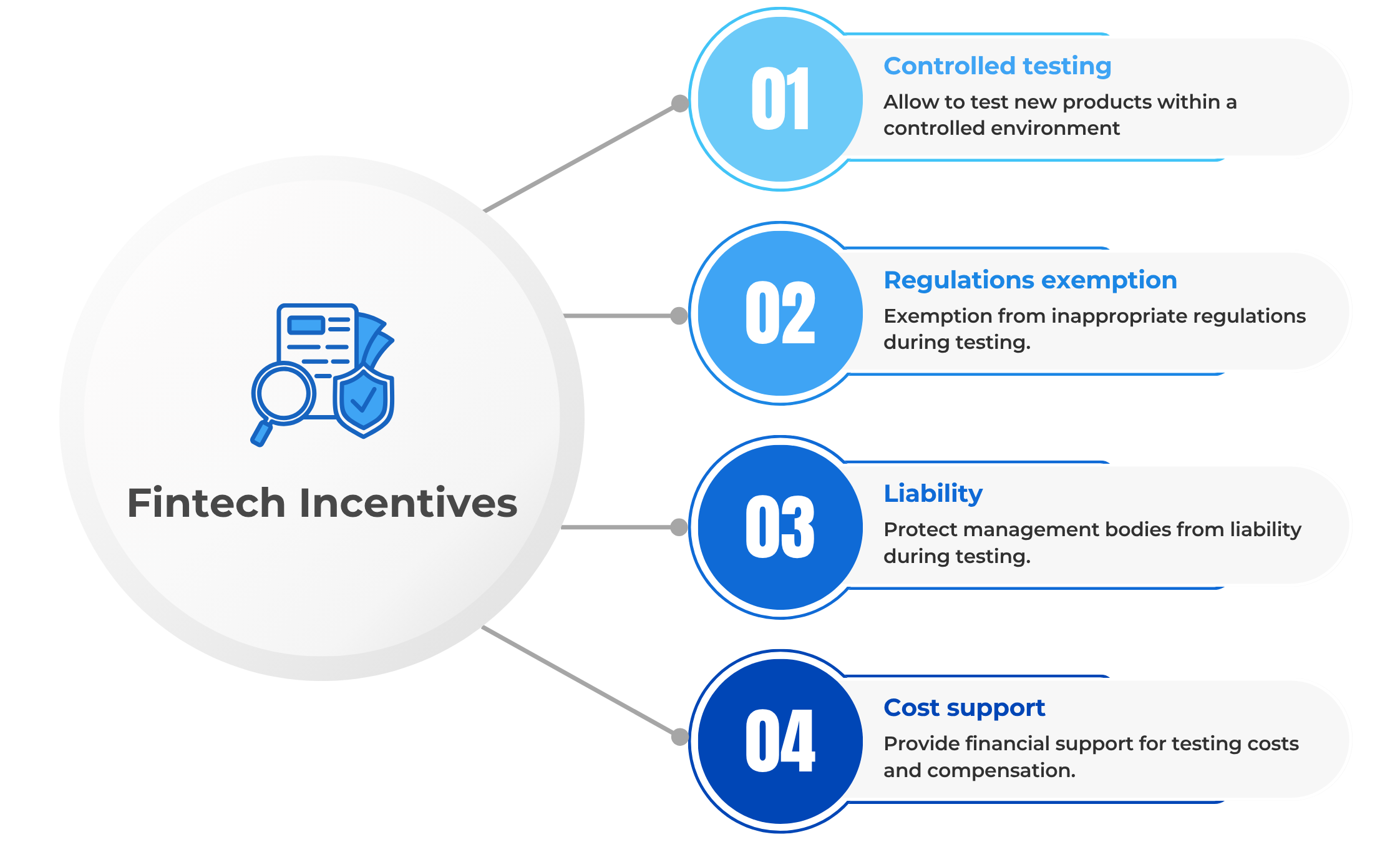

Fintech Incentives:

Financial Technology (FinTech) is regarded as a strategic pillar of the IFC. To promote this sector, the State has introduced several noteworthy preferential policies aimed at enabling controlled testing:

- Controlled testing (sandbox): Allowing FinTech to test new products and technologies within a specified timeframe, even in the absence of existing legal regulations.

- Exemptions from certain legal regulations: During the testing process, enterprises may be exempt from specific business conditions, technical standards, or licensing procedures that are not compatible with the innovative nature.

- Exemption from administrative, disciplinary & civil liability to the management bodies: If damages occur due to objective reasons and experimental procedures are faithfully adhered to, the testing organization and supervisor involved shall not be held liable. However, enterprises must still compensate third parties for any harm caused as mandated by the law, albeit partial compensation may be supported by the IFC’s budget, depending on the extent of the damage and financial capacity.

- Support for experiment and compensation costs: FinTech enterprises may be considered for non-refundable financial support or partial compensation support, funded by the local budgets of Ho Chi Minh City and Da Nang City, depending on the resources of each local area.

Fintech Incentives

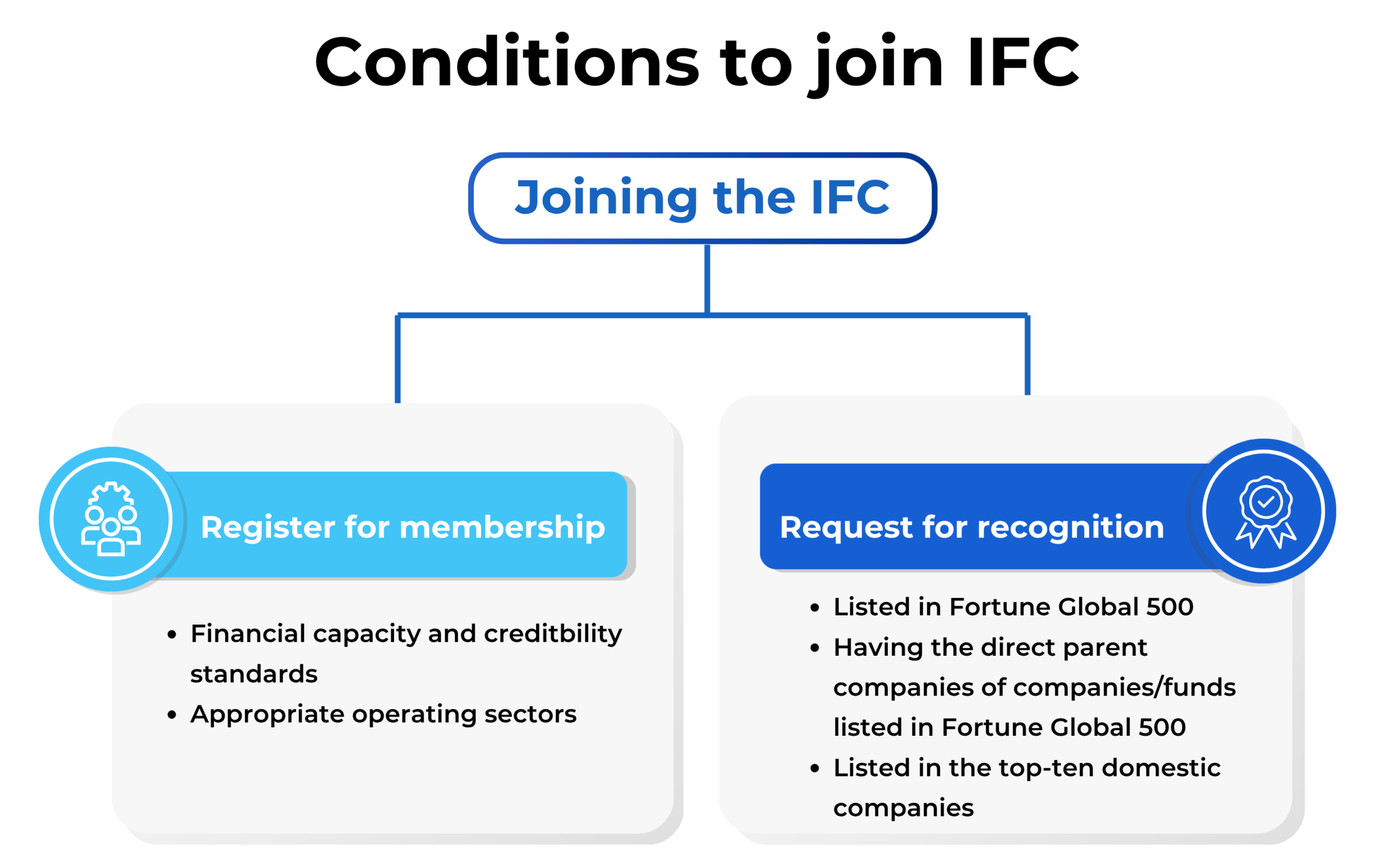

Become IFC Members

Joining the IFC[1]

- Organizations and enterprises are eligible to register as IFC Members if they satisfy:

- Financial capacity and credibility standards; and

- Requirements of operating sectors align with the development direction of the IFC.

Entities that already have a presence in the IFC may request recognition as Members without registration procedures if they are:

- Financial institutions, investment funds, enterprises or their direct parent companies are listed in the Fortune Magazine at the time of registration, excluding those operating in banking, securities, and insurance sectors

- Financial institutions ranked as one of the top ten domestic enterprises in terms of charter capital in each respective field, except for banking, securities, and insurance

Conditions to join IFC

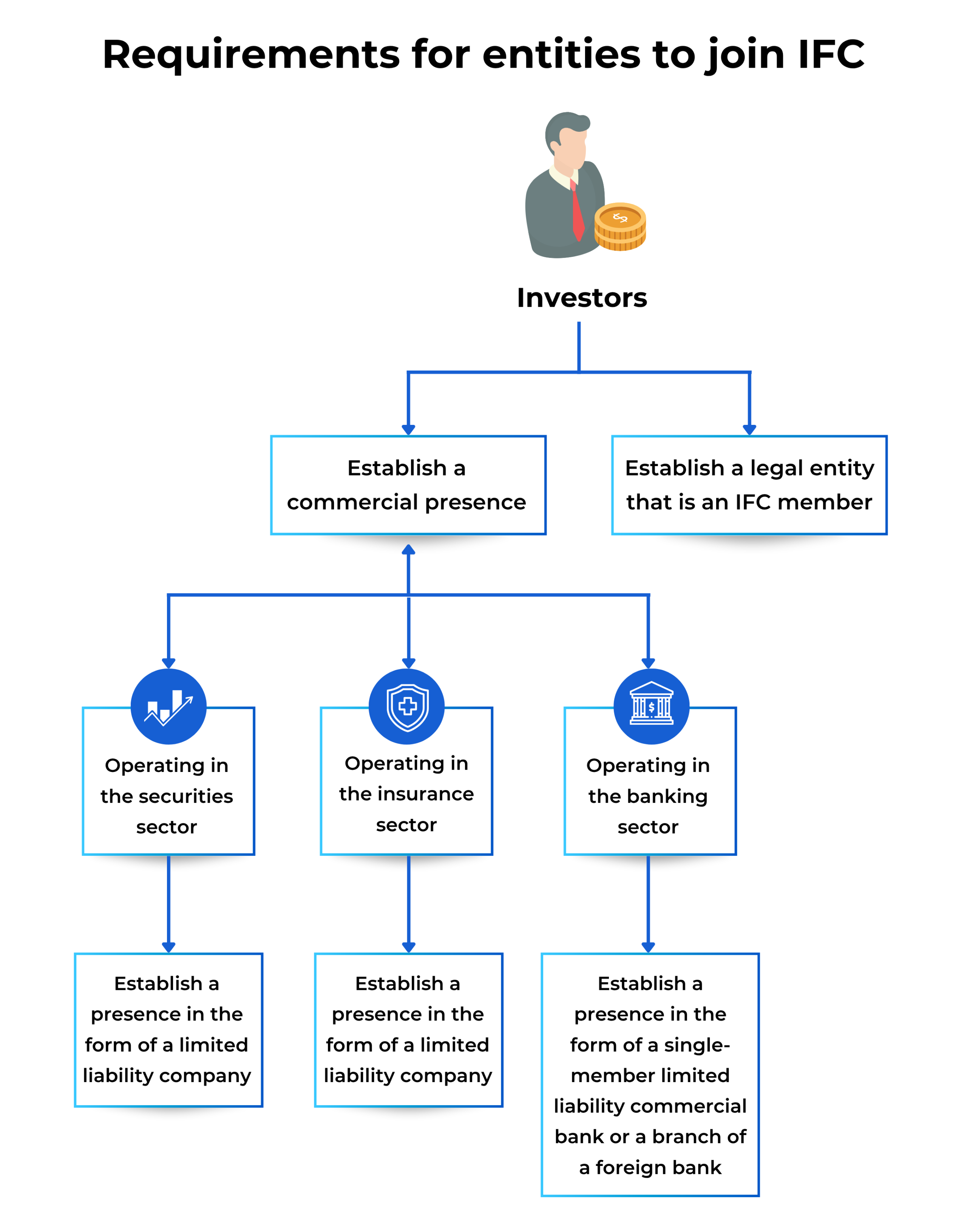

- Except for investors that are foreign banks or domestic commercial banks, all other investors that must establish a legal entity are members of the IFC.

Special entities for which presence in the IFC is required:

- Investors being foreign banks and domestic commercial banks must establish a commercial presence in the form of a single-member limited liability commercial bank or a branch of a foreign bank in Vietnam;

- Investors operating in the securities sector must establish a presence in the form of a limited liability company licensed by the State Securities Commission;

- Investors operating in the insurance sector must establish a presence in the form of a limited liability company licensed by the Ministry of Finance.

Requirements for entities to join IFC

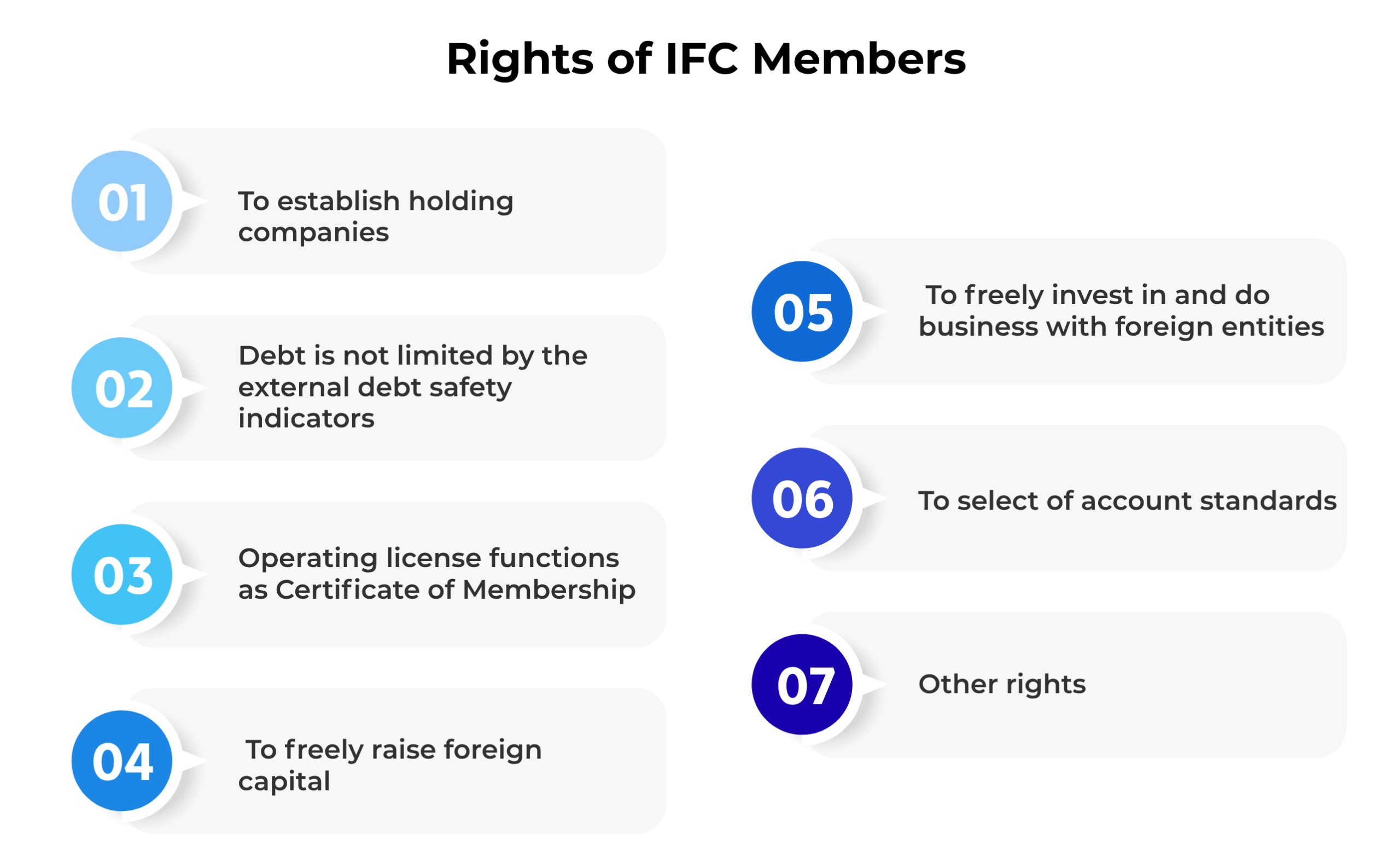

Rights of members [2]

The rights of members serve as the opening to a series of exclusive privileges established specifically for Members under Resolution 222. Aside from offering highly attractive benefits that aim to draw significant international investment, these rights also lay the foundation for unprecedented preferential policies in Vietnam.

General rights of IFC members

- To establish holding companies for capital mobilization and investment management (excluding commercial banks);

- To freely raise foreign capital without prior approval, only required to report in accordance with regulations;

- Members’ foreign debts will not be considered as part of the national external debt for the purpose of management and monitoring of external debt safety indicators;

- To freely invest and do business with organizations and individuals outside Vietnam’s territory or with other Members;

- For financial institutions and banks licensed to operate in the International Financial Center, the operating license also serves as the Certificate of Membership;

- To choose and apply international account standards (IFRS/IASC) or generally accepted accounting principles of other countries (e.g., UK, US, Japan, South Korea, etc). Once applied, reporting under the Vietnamese standard would no longer be required;

- Other rights as specified in the Resolution and its guidelines.

Rights of IFC Members

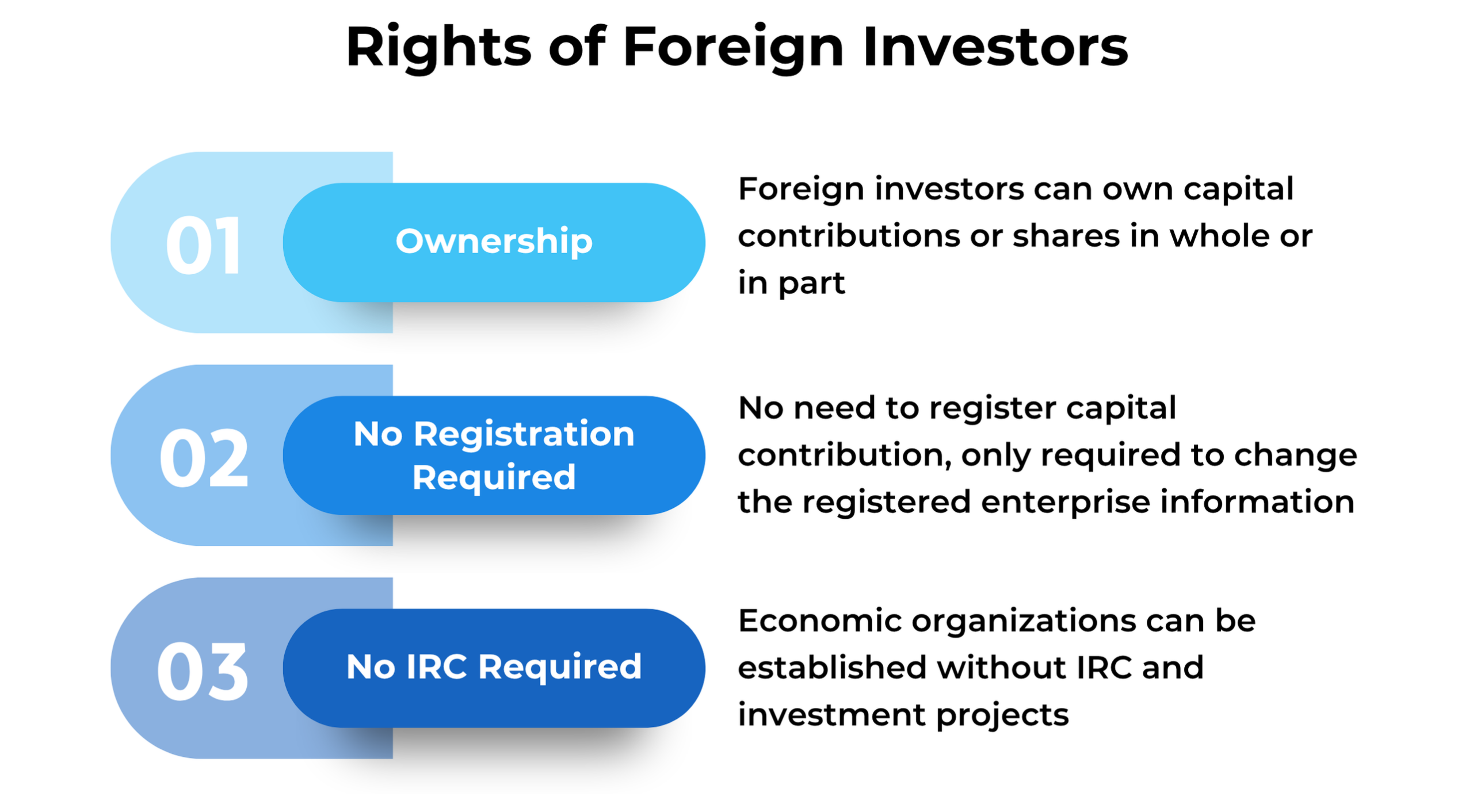

Rights of Foreign investors:

- To own whole or partial shares or capital contributions in IFC Members.

- To establish economic organizations in the IFC without an investment project or an investment registration certificate.

- To not register capital contribution/share purchases – only required to give notice of changes to registered enterprise information (not applicable to banks)

Rights of Foreign Investors

Compared to the exceptional benefits enjoyed by Members, the obligations of Members are fundamental to ensure compliance with the minimum obligations necessary for conducting business activities.

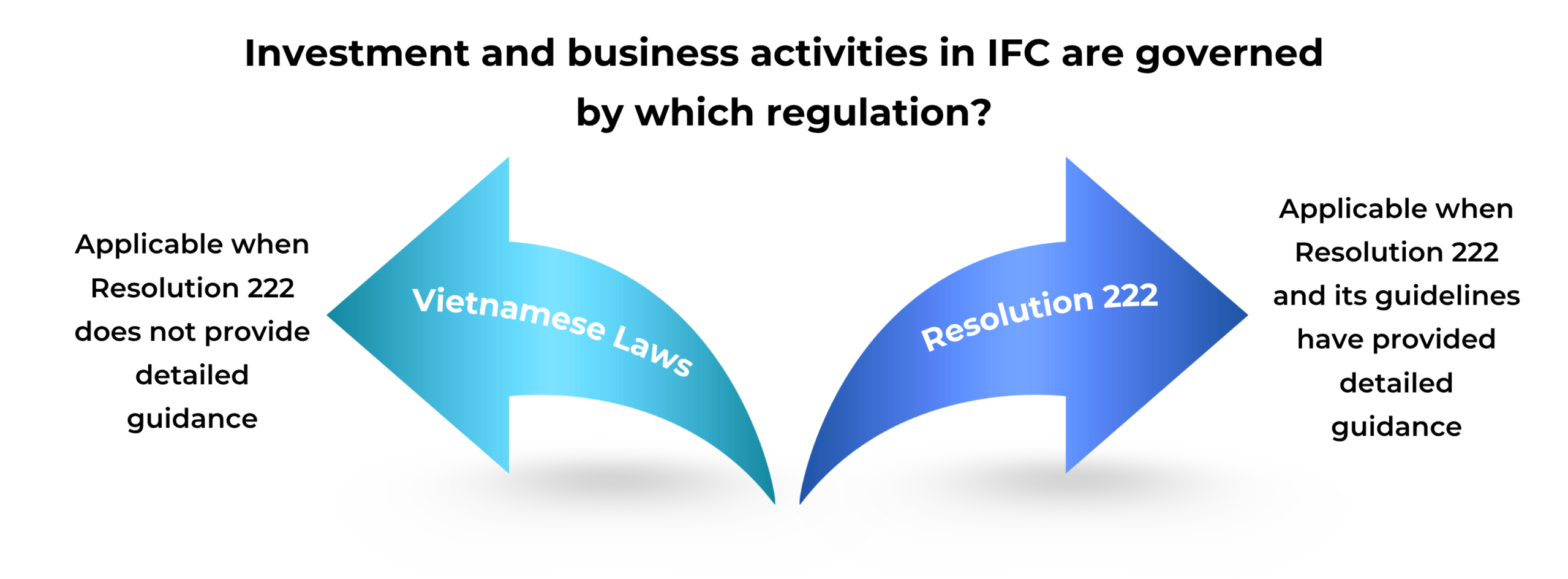

Applicable Law[3]

- For investment and business activities in IFC governed by:

- Resolution 222 and its detailed guidelines for implementation; or

- Vietnamese Law, if not covered by Resolution 222 and its detailed guidelines for implementation.

Investment and business activities in IFC are governed by which regulation?

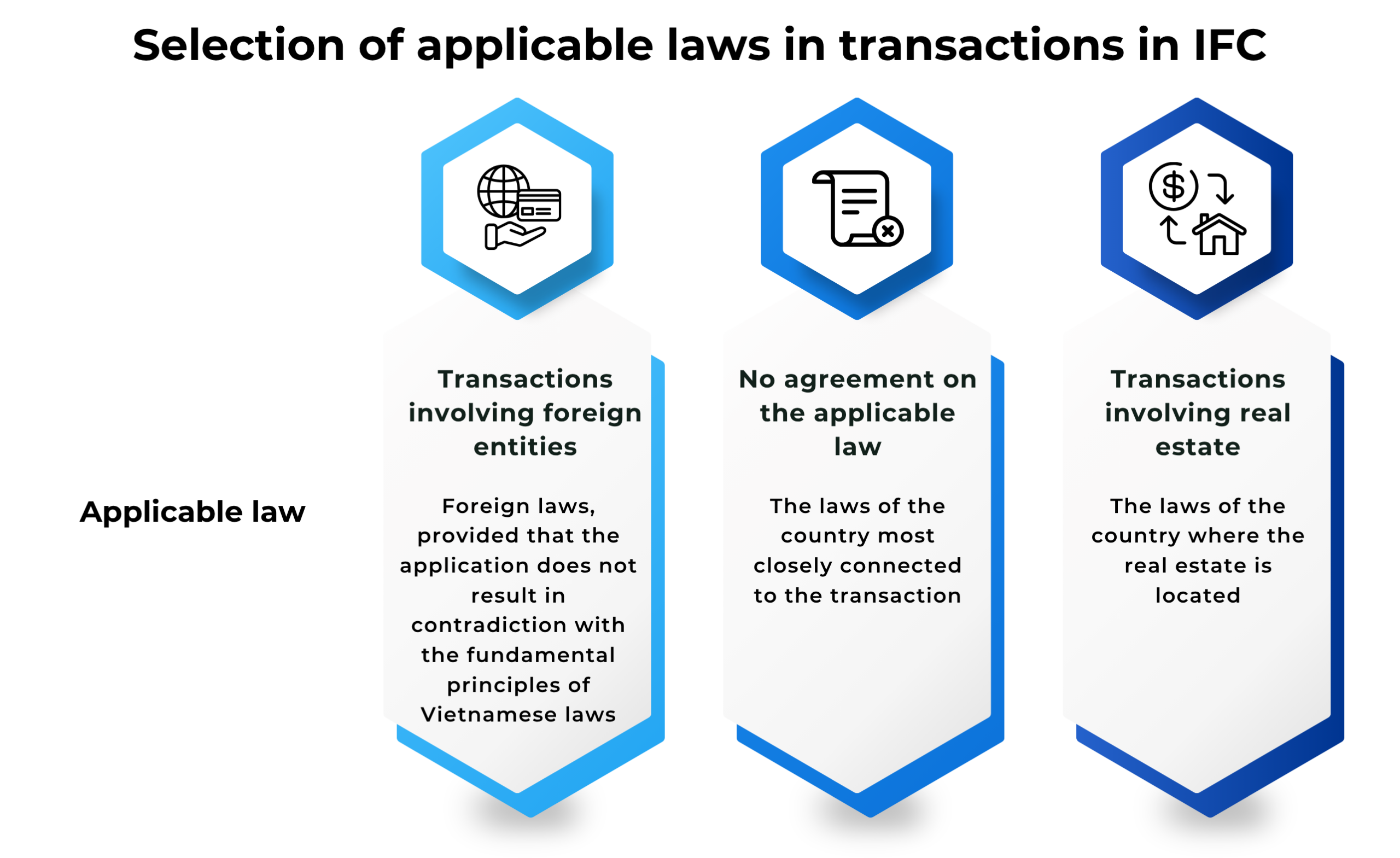

- Selection of foreign laws as applicable laws in investment and business transactions in IFC:

- For transactions involving at least one foreign individual or organization, the parties may agree to apply foreign laws to the transaction, provided that such applications do not result in contradiction with the fundamental principles of Vietnamese laws.

- In cases where the parties have no agreement on the applicable law, the laws of the country most closely connected to the transaction shall apply.

- For transactions related to ownership and other rights over real estate, the lease of real estate, or the use of real estate as collateral, the laws of the country where the real estate is located shall apply.

Selection of applicable laws in transactions in IFC

Conclusion

The adoption of Resolution 222 is a major breakthrough in Vietnam’s financial institutional reform. However, opportunity will only truly translate into benefits if the policies are implemented consistently, with strong enforceability and effective coordination across all levels of governance. IFC, if operated in the right direction, will not only serve as a catalyst for attracting international capital but also as a major test of Vietnam’s institutional, legal, and administrative capacity in the global arena, where the line between opportunities and challenges is always closely intertwined.

Contact Us:

For further information, please contact:

CNC Vietnam Law Firm

Address: The Sun Avenue, 28 Mai Chi Tho, Binh Trung Ward, Ho Chi Minh City, Vietnam

Phone : 028 6276 9900

Hotline: 0916 545 618

Email: contact@cnccounsel.com

Website: cnccounsel

We would be delighted to welcome you at CNC’s office, where you’ll have the opportunity to consult with the lawyer best suited to your circumstances. Of course, if you are unable to meet in person, simply email us via contact@cnccounsel.com or call us via (+84-28) 6276 9900.

It would be a pleasure for CNC’s lawyers to help you build a solid legal foundation, thus ensuring the success and sustainable development of your project!

Managed by

|

Tran Pham HoangTung | Partner

Phone: (84) 901 334 192 Email: tung.tran@cnccounsel.com |

|

Tran Thi Hanh Nhan | Associate

Phone: (84) 916 545 618 Email: nhan.tran@cnccounsel.com |

|

Tran Anh Thy | Junior Associate

Phone: (84) 28 6276-9900 |

[1] Article 10, Resolution 222.

[2] Clause 1 Articles 11, 12 Resolution 222.

[3] Clauses 1-5, Article 6, Resolution 222.

Disclaimers:

This article has been prepared and published for the purpose of introducing or informing our Clients and potential clients on information pertaining to legal issues, opinions and/or developments in Vietnam. Information presented in this article does not constitute legal advice of any form and may be adjusted without advance notice.