FIDIC Pink Book 2010

FIDIC Pink Book 2010 stands for FIDIC Conditions of Contract for Construction works designed by Employer, a Harmonized version of the Multilateral Development Bank 2010 [1].

The birth of the FIDIC Pink Book Contract 2010 is based on the cooperation between the Head of Procurement Department of FIDIC and the Multilateral Development Bank in harmonizing the provisions of Construction Contracts published by FIDIC, especially FIDIC Red Book 1999 and capital financing issues that Multilateral Development Banks are often concerned about [2].

Prior to the current increasing usage of FIDIC Pink Book 2010, tFIDIC and the Multilateral Development Bank first introduced the FIDIC Pink Book in May 2005, and the modified version in March 2006.

Multilateral Development Bank

The term “Multilateral Development Bank” means banks and large financial institutions in the world, which were established by countries and territories that have strong financial potential for the social and economic development of developing countries [3].

Initially, the term “Multilateral Development Bank” was often used to refer to financial institutions such as the World Bank – WB (World Bank), Asian Development Bank -ADB (Asian Development Bank), African Development Bank -AfDB (African Development Bank), European Investment Bank – EIB (European Investment Bank), European Bank for Reconstruction and Development – EBRD (European Bank for Reconstruction and Development).

However, the term “Multilateral Development Bank” has now been interpreted to even include financial institutions such as (the list below only points out some examples for illustration purposes and does not include all cases):

- Black Sea Trade and Development Bank – BSTDB

- Caribbean Development Bank – CDB

- Central American Bank for Economic Integration – CABEI

- Corporación Andina de Fomento – CAF

- East African Development Bank – EADB

- West African Development Bank -– WADB

Or other financial institutions with restrictions on number of participating and sponsoring members for particular/ certain projects, such as:

- European Commission -EC

- European Investment Bank – EIB

- International Fund for Agricultural Development – IFAD

- Islamic Development Bank – ISDB

- Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V.

- Nordic Investment Bank – NIB

- OPEC Fund for International Development Bank

Comparison with FIDIC Red Book 1999 Contract

As mentioned above, the FIDIC Pink Book 2010 Contract was created on the basis of the FIDC Red Book 1999 Contract.

Accordingly, FIDIC Pink Book 2010 shall be appropriate for projects where the Employer is responsible for designing and setting out Technical Specifications for the Construction/ Project.

Meanwhile, the Contractor shall be responsible for the implementation of the Construction/ Project, following the Drawings and Technical Specifications of that Construction/Project.

The Contractor shall also partake in the design (to a limited extent), but only for parts specified in the contract [4].

Normally, Contract Prices are determined via the unit price specified in the contract or another reasonable unit price along with the volume of work done confirmed [5]. Of course, there are also exceptions where the Employer and Contractor enter into the contract with the lump-sum price as the basis.

On that general foundation, many of the provisions of FIDIC Red Book 1999 could be found in FIDIC Pink Book 2010.

The main similarities between Pink Book 2010 and FIDIC Red Book 1999 contract include:

Common points of FIDIC Pink Book 2010 and FIDIC Red Book 1999

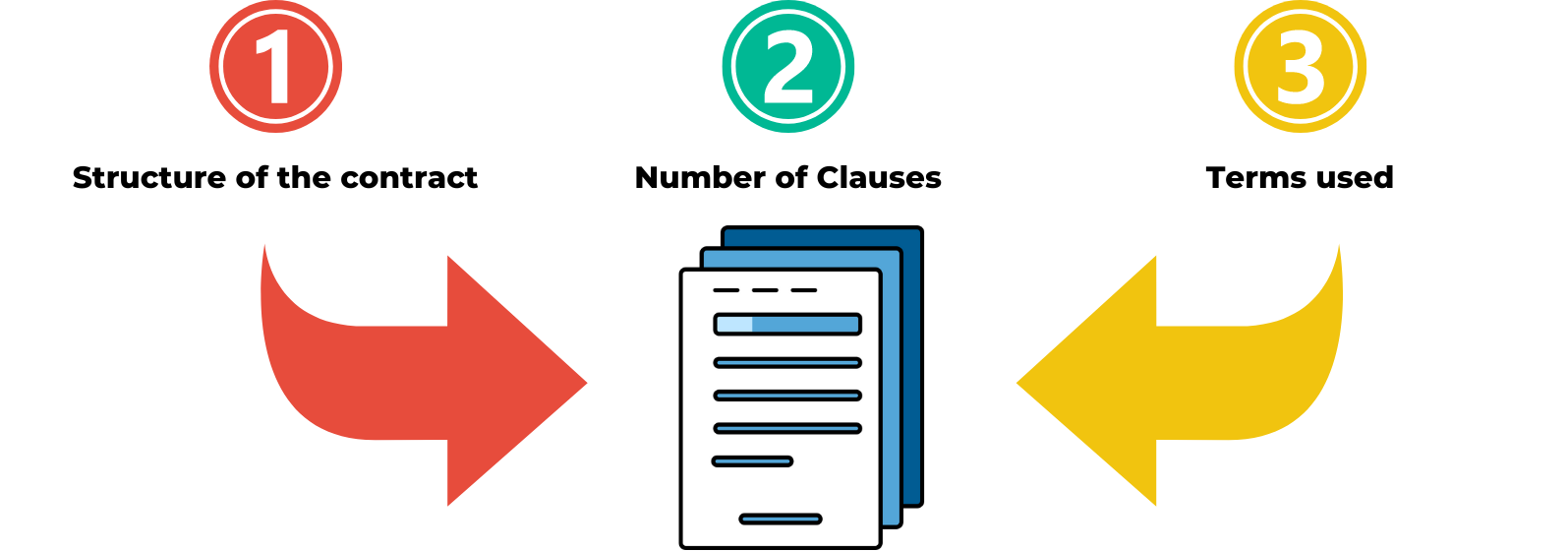

Firstly, FIDIC Pink Book 2010 essentially retains the structure of FIDIC Red Book 1999 and there are no significant changes or shuffles.

Accordingly, the structural arrangement of the FIDIC Pink Book 2010 Contract still follows the same structural arrangement:

Sorting Orders of FIDIC Pink Book 2010

Even in provisions on definitions, FIDIC Pink Book 2010 retains the same structural arrangement, prioritizing sorting by topic instead of by alphabetical order, the method established in the FIDIC Subcontract 2011 (trial version 2009), Design, Build, and Operation Contract 2008 (FIDIC DBO 2008).

Secondly, FIDIC Pink Book 2010 also has a total of 20 Clauses, the same number as FIDIC Red Book 1999.

Compared to FIDIC Red Book 1987 with 72 Clauses, the introduction of the 1999 FIDIC Contracts including FIDIC Red Book 1999 with only 20 Articles marked a milestone and was a revolution in the process of perfecting the construction contract template.

Therefore, it is not surprising that the FIDIC Pink Book 2010 also follows the 20 Clauses structure, established in the FIDIC Red Book 1999. This is also one of the major reasons for the recommendation to use the FIDIC Conditions of Subcontract 2011 for Subcontractors and Nominated Subcontractors along with FIDIC Red Book 1999 and FIDIC 2010.

Thirdly, FIDIC Pink Book 2010 and FIDIC Red Book 1999 use similar terms.

Aside from the two terms “Banks” and “Lessee” from the lists of definitions on the topic of Parties, FIDIC Pink Book only adds one more definition on “Notice of Dissatisfaction” in Clause 1.1.6.10

This demonstrates that FIDIC Pink Book 2010 tries to keep the changes to FIDIC Red Book 1999 to the bare minimum so as not to disrupt the established integrity and consistency.

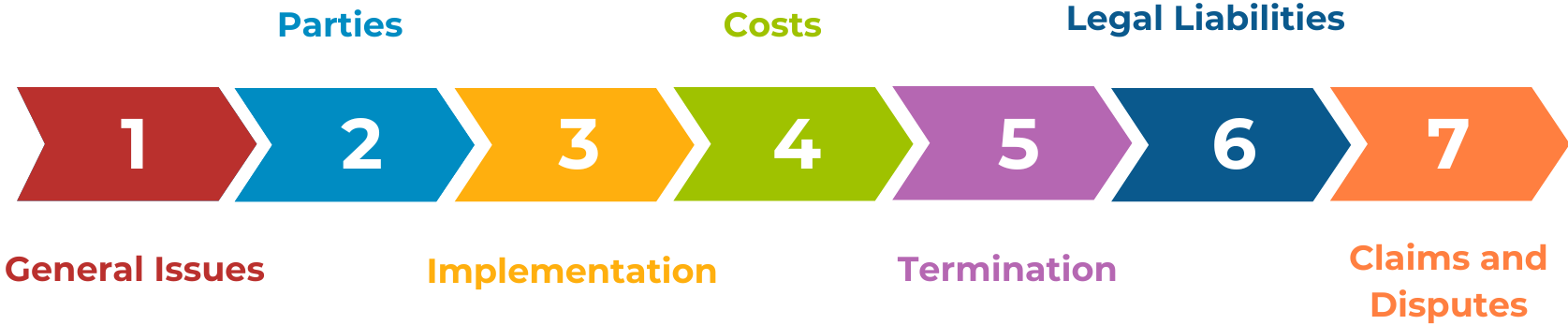

However, the differences between FIDIC Pink Book 2020 and FIDIC Red Book 1999 are also significant. Here are 12 main differences:

First, the definition of “reasonable profits” is clarified as 5% of Costs (Clause 1.2)

Second, the term “Appendices to Bidding Documents” is changed to “Part A – Contract Data” and considered as part of Conditions of Particular Conditions.

Third, financial issues, disbursement, and loans are added to the corresponding provisions such as Clause 2.4 [Financial Arrangement of the Employer], Clause 8.1 [Commencement of construction], Clause 14.7 [Payment], Clause 15.6 [Corruption] Clause 16.1 [Suspension and Termination of the Contract by the Contractor].

Fourth, stipulations on foreign workers, customs, etc are added to ensure the stable development of involved parties during the implementation of the project (From Clause 6.12 [Foreign workers] to Clause 6.24 [Non-discrimination and Equal Opportunities]).

Fifth, adjustments are made to rates used for the calculation of unit price in the Contract (Clauses 12.3 (i), and Clauses 12.3 (ii)).

Sixth, adjustments are made so that favorable mechanisms for advance payment are added (Clauses 14.2)

Seventh, adjustments are made to the consequences of the Employer’s risks (Clause 17.3).

Eighth, the inconsistency in Clauses 17.6 on Limitation of Liability in FIDIC Red Book 1999 is clarified.

Ninth, stipulations on the use of Employer’s Accommodation/ Facilities in Clause 17.7 are added

Tenth, issues in relation to Insurance are adjusted

Eleventh, some aspects of Force Majeure are adjusted for clarification in the application

Twelfth, the name of the Dispute Adjudication Board is adjusted

Details of the aforementioned changes are shown in Attachment 1: Comparison between FIDIC Red Book 1999 and FIDIC Pink Book 2010

Application of FIDIC Pink Book 2010 in Vietnam

Throughout the years, the Asian Development Bank, the World Bank, and the Japan International Cooperation Agency have been the major sponsors of the projects [6].

In particular, projects related to Transport (infrastructure for transportation and urban areas), Environment (water environment improvement, wastewater treatment), Energy and Industry (electricity), Agriculture and Rural Development always account for the highest proportion [7].

As such, it is no coincidence that FIDIC Pink Book 2010 is commonly used in the aforementioned funded projects.

However, the current application of FIDIC Pink Book 2010 in Vietnam also raises many concerns. Many of these difficulties and problems cannot be effectively solved in a short time or simply by an administrative decision. For example:

Firstly, the conformity of the FIDIC Pink Book 2010 to domestic laws

Nowadays, it is not uncommon to come across projects or packages of a funded project that require the Contractor to be responsible for the design. In such cases, the FIDIC Pink Book 2010 is not a suitable option.

This is because FIDIC Pink Book 2010 is meant to be used in projects whose designs are assumed by the Employer and the Contractor is only required to perform design works (if any) to a certain extent that are explicitly specified in the Contract.

Therefore, the demand for another contract template to adjust to the new relationship between the Employer, the Contractor, and the sponsor is inevitable. Unfortunately, to date, the Multilateral Development Bank and FIDIC have yet to introduce any such template

To rectify this situation, the Employer and Engineer often choose one of the following three options.

The first option is to still rely on the provisions of the FIDIC Pink Book 2010 and make adjustments accordingly.

The second option is to adopt another form of contract introduced by FIDIC, such as the 1999 FIDIC Yellow Book.

The third option is to combine the FIDIC Pink Book 2010 with the 1999 FIDIC Yellow Book with the addition of some amendments based on the agreement between parties.

Which FIDIC template is appropriate?

Which FIDIC template is appropriate?

In practice, the second and third options are considered difficult to implement. This is because these options require a huge change in the opinion of the Parties, especially the Employer (usually enterprises with state capital, owned by the state, or using state budget) and sponsors.

Regarding the second option in particular, Multilateral Development Banks would likely encounter hardships in terms of regulations, regulations on lending, disbursement, and capital sources.

Because the main function of the Multilateral Development Bank is to participate in supporting developing countries (including Vietnam) to develop infrastructure and utilities to promote social development, the change of regulations and regulations on procurement and therefore disbursement procedures, capital allocation, supervision, etc. is a matter of concern to the Multilateral Development Bank and should be exercised with caution.

Similarly, the option to apply FIDIC Yellow Book 1999 – i.e. empower the Contractor with the ability to design, offer their own solutions, and propose costs on a lump-sum basis, which causes the Employer (those using loans, state budget) to have difficulties in explaining the detail and basis of the value paid to the Contractor.

The question of transparency and clarity in paying the Contractor the lump-sum price (without considering the construction volume in detail) has yet to be addressed by the domestic laws

Therefore, the most feasible option and also the one that receives the most support from FIDIC is the use of the FIDIC Pink Book 2010 accompanied by guidelines on amending contract terms with conditions of particular application.

In late 2009, FIDIC introduced official guidelines for drafting conditions of particular applications [8]. This is considered a handbook and is the most practical and detailed guide compared to any other tutorial on drafting conditions of particular applications.

In its guidance on drafting conditions of particular conditions for construction contracts designed by the Contractor and financed by the Multilateral Development Bank, FIDIC has specified details of each section, giving specific examples to demonstrate the usage to parties.

However, this option is not universally chosen, and conditions of particular conditions vary from project to project.

The most exemplary evidence is that major urban transportation infrastructure projects in Vietnam still choose to combine FIDIC Pink Book 2010 and FIDIC Yellow Book 1999.

In such cases, it’s almost infeasible to set the priority for contract documents since the provisions in the contract are different, contradictory, and highly heterogeneous.

Secondly, the issue of capital financing, capital overruns, and dangerous consequences

There is no denying the positive effects that have been demonstrated in the development of important infrastructure and transportation projects in Vietnam funded by the Multilateral Development Bank.

However, capital overruns in projects using loans from multilateral development banks have always been a matter of great concern, and an appropriate remedy is required.

The reasons leading to capital overruns still require further analysis from many aspects and angles, including legal and technical perspectives. However, it could be seen that intervention (through traps utilizing interest rates or techniques) by the Multilateral Development Bank might be one of the indirect reasons affecting this increase in capital.

Specifically, at the time of writing, although the bidding of many important packages and projects is held openly and transparently and based on specific criteria, the bid winners are mostly either international contractors or those with close connections with the winning Multilateral Development Bank. Meanwhile, those directly implementing those bidding packages/projects are domestic contractors.

In reality, there are many questions that need to be answered, especially the destination of capital sources sponsored by the Multilateral Development Bank.

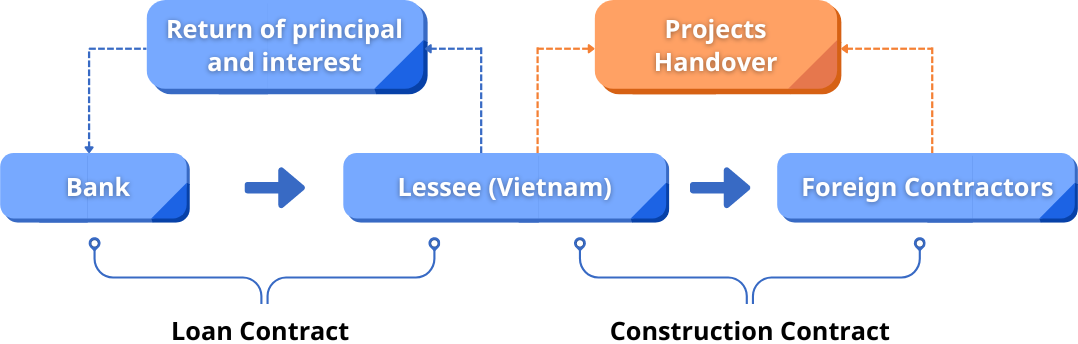

The following flow chart will show why the use of loans from the Multilateral Development Bank should be limited.

Where do loan funds go?

In this simplified flowchart, as a Lessee, Vietnam faces many risks, including the risk of using the loan effectively, exchange rate differences, interest rate increases, and increases in construction investment costs.

The longer the project lasts, the more limited the use of loan capital becomes. Similarly, the responsibility to pay costs arising from delay (including costs due to price inflation and changes in laws, costs arising from extension of time) would also increase.

Furthermore, when the Employer or the Executing Agency is not entitled to take the initiative or be given autonomy to resolve legal issues that arise during the implementation of construction contracts, the chances of disputes and conflicts with the Contractors would increase.

Meanwhile, against the technical barriers (capacity/experience requirements, revenue, management human resources, and access to capital), domestic contractors have little opportunity to participate in the project as main contractor/general contractor.

Therefore, after being awarded the contract, it is a common sight that many foreign contractors assign domestic subcontractors to directly perform parts of the work at low cost and with limited management ability.

Along with the difficulties and complexities in the classification of construction investment management, classification and allocation of medium and long-term investment, classification and decentralization of the Employer/Executing Agency’s power. With the current situation, the trends of prolongation and increase in capital for projects utilizing loans in particular and projects utilizing state budget in general show no sign of stopping in the near future.

Support:

CNC is pleased to receive and respond to any and all inquiries regarding drafting and reviewing construction contracts effectively and efficiently.

Inquiries may be submitted via email or phone – contact information provided below:

Le The Hung | Managing Partner

Điện thoại: (84) 916 545 618

Email: hung.le@cnccounsel.com

Hoặc

Nguyen Thi Kim Ngan | Partner

Điện thoại: (84) 919 639 093

Email: ngan.nguyen@cnccounsel.com

CNC© | A Boutique Property Law Firm

The Sun Avenue, 28 Mai Chi Tho, An Phu Ward, District 2,

Ho Chi Minh city, Vietnam.

T: (+84-28) 6276 9900 | F: (+84-28) 2220 0913

cnccounsel.com | contact@cnccounsel.com

Disclaimers:

This newsletter has been prepared and provided for the purpose of introducing and updating customers about issues and/or the developments of legal statutes in Vietnam. The information presented in this newsletter does not constitute advice of any kind and is subject to change without notice.

[1] Translation of Conditions of Contract for Construction for Building and Engineering Works Designed by the Employer, Multilateral Development Bank Harmonised Edition, June 2010

[2] See more: https://fidic.org/MDB_Harmonised_Construction_Contract

[3] See more: https://www.investopedia.com/terms/m/multilateral_development_bank.asp

[4] Sub-Clause 4.1 [Contractor’s General Obligations], FIDIC Pink Book 2010

[5] Sub-Clause 14.1 [The Contract Price], 12.3 [Evaluation], FIDIC Pink Book 2010

[6] Figure 1: Structure of ODA and concessional loans by sponsors during 2011-2015, enclosed with Decision No. 251/QD-TTg dated February 17th,2016 of the Prime Minister

[7] Table 1: ODA by Sectors during 2011 -2015, enclosed with Decision No. 251/QD-TTg dated February 17th,2016 of the Prime Minister

[8] Attachment 2: FIDIC Guidelines for the Drafting of Particular Conditions of FIDIC Design-Build MDBs