When there are signs of real estate transactions thriving, again, post social distancing, insiders, especially land buyers, are subject to encountering several types of land sale scams.

In an effort to help insiders avoid legal disputes, CNC has classified some “typical” scenarios in which sellers and buyers encounter within the Covid-19 era.

Scenario 1: Land sale announcement under the cover of a loan with a short repayment period

Using this tactic, a seller usually pretends to underestimate a piece of land’s market value and expects the buyer to lend him/her a specific amount of money in advance (30% of the land’s value, for example), then promises a period of repayment with an attractive interest rate. If the seller defaults on the loan’s repayment within the repayment period, the buyer will allow the seller to notarize and transfer the land to the buyer.

Carrot and stick theory

In this scenario, the seller made use of benefits to take advantage of the buyer into agreeing to the transaction. Two benefits the seller offers are: (1) underestimating the practical value of the parcel of land, and (2) offering a more attractive interest rate than the market interest rate.

Accordingly, soon after being announced, the buyer will diligently research land prices in the area (through brokers, listings on the Internet, or acquaintances) and discover “it is true that the land price in the seller’s announcement is lower than the market price.”

For the buyer, this is explicitly an incomparable investment opportunity, because if the buyer cannot buy that parcel of land, they will still benefit from the interest rates which are far higher than interest rates for bank deposit.

Are there any risks to consider?

In the aforementioned scenario, the benefit of consulting a lawyer would reveal potentially suspicious activity or activities to be avoided and/or resolved. Without a lawyer, one might be subject to deception. Specifically:

First, why doesn’t the seller sell the land at the market price and make a profit as opposed to borrowing from the buyer?

Second, at this time, it is quite a challenge for people to invest with high rates of interest. Succinctly, why would a seller agree to repayment under such unusually high rates of interest?

Third, in the event a seller defaults on repayment (of the loan), what recourse do buyers have to recover their money (the money they loaned to the seller)?

Legal Inquiries

Succinctly, the implicit legal risks that any buyer may face upon entering into these types of transactions are:

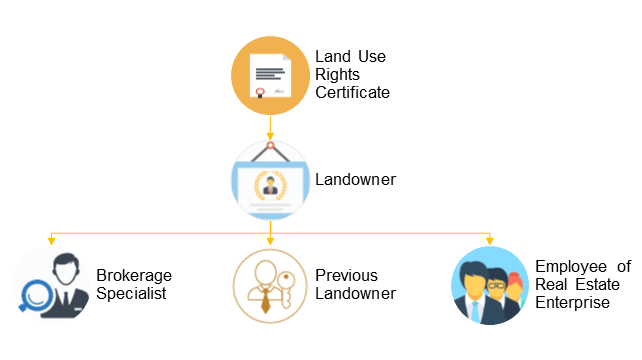

When a seller does not have legal status to make such a transaction

In practice, there are several reasons in which Land Use Rights Certificates are falsified, and used for inappropriate purposes as well as being used to deceive buyers in real estate transactions.

Illustratively, in the situation above, a seller may be the previous landowner, but retains an identical copy of the Land Use Rights Certificate, or the seller may be a broker who obtained the Land Use Rights Certificate from the landowner, or the seller may be an employee of a real estate enterprise to whom the enterprise transfers land parcels split in real estate projects.

In such situations, there are risks of losing the entire loan.

Not everyone who possesses a Land Use Rights Certificate is a landowner

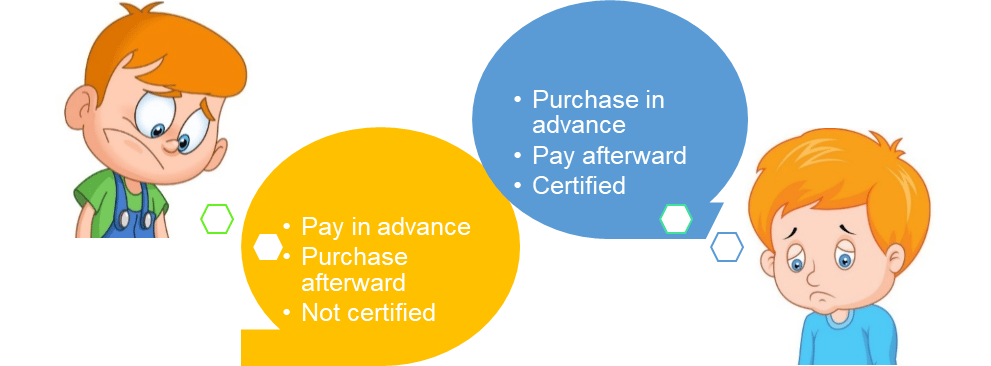

Risks involved when one parcel of land is sold to many buyers

In our experience, when a seller refuses or provides various excuses for NOT providing the origin of the Land Use Rights Certificate, or declines to use the Land Use Rights Certificate for a transaction guarantee, it means that the seller is deceptively hiding something from the buyer.

When a buyer compromises or allows the seller to retain the Land Use Rights Certificate for an indefinite period of time, the seller has time to use the Land Use Rights Certificate in other transactions with other buyers. It isn’t until the buyers realize they’ve been deceived that they understand they have entered into a righteous transaction, so they must share the remaining value (if any) from the resolution of the seller’s assets under respective percentages.

How to determinate a buyer’s interests?

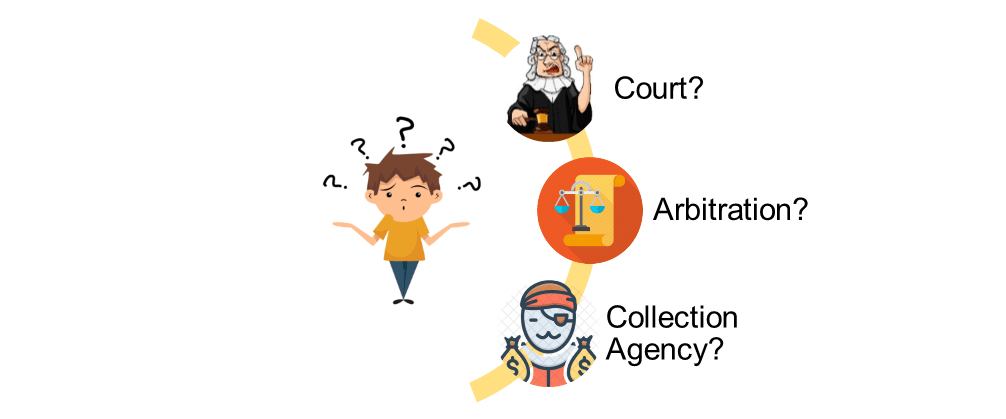

Risks involved when taking costly and prolonged measures to recover the loan

Initiating a lawsuit against the seller in Court or Arbitration or employing other measures to recover the loan with costly or prolonged procedures ARE NOT smart solutions.

According to the statistics of Vietnam International Arbitration Center (VIAC)[1], despite considerable advances in reducing dispute resolution procedures at VIAC, the average amount of time to resolve a dispute is 152 days/case. In comparison with the timeframe of approximately 400 days/case in a court of law, this is definitely time, needlessly spent, that any buyer does not anticipate when reclaiming a disbursed loan.

Additionally, the buyer will have to pay a huge sum of money if they hire a collection agency and possibly subject themselves to legal problems if the collection agency neglects to follow professional rules and ethics and accusationsby the seller.

Which method of loan recovery should be chosen?

Risks involved when engaging in the crime of Obtaining Property by Deception

In practice, when the truth is revealed, the buyer will promptly construe it as deception and submit reports and letters of denunciation to the police investigators. However, the settlement results of complaint and denunciation often does not meet the buyer’s expectations. Because:

First, the 2015 Criminal Code, amended in 2017, has a clear and convincing provision regarding Obtaining Property by Deception in Article 174[2], however, the police investigators tend to consider it a civil matter among the parties. The police investigators action can be methodically explained that any decision on filing charges against crimes or suspects must be approved by the Procuracy[3]. Incorrectly filing charges against crimes and suspects can lead to compensation liabilities for the accused persons. Relevant persons may encounter difficult and complicated legal consequences.

Second, implementation of the law on the crime of Obtaining Property by Deception has not been practically consistent. There are a great number of opinions about implementing the regulations of this crime, meanwhile circumstances arising in each transaction are complicated and different. Hence, in many cases, the police investigators will regard it as a civil matter.

For example, the case between Nguyen Van Ch. and Hoang Thi Y. published by The Supreme People’s Procuracy of Vietnam on November 11th, 2019, titled “Notice about experience from the case “Obtaining Property by Deception” being dismissed to reset investigations” poses many controversial issues. According to The Supreme People’s Procuracy of Vietnam[4], “The Loan Agreement between Nguyen Van Ch. and Hoang Thi Y. on September 21st, 2015 and December 10th, 2015 was replaced by another contract agreed upon by the parties on November 6th, 2017 as totally voluntary, in adherence to the law. Prior to this, on November 11th, 2017, the Office of Police Investigation Agency – K. Province Police published Notice no. 778/PC-44 responding to the letter of denunciation on September 12th, 2017 and instructing Mrs.Y to start a lawsuit in court because this is a civil matter.”

However, the process of this case poses 2 vitally important questions: (1) what is the foundation (motive) for Nguyen Van Ch. to continue meeting Mrs.Hoang Thi Y. to loan her 150.000.000 VND on December 10th, 2015; and (2) did Nguyen Van Ch. receive the money from Mrs.Y. after saying “he needed the money for bank maturity” and promising that after the maturity, he would repay Mrs.Y the total amount of 620.000.000 VND?

It is clear that in the aforementioned case, Nguyen Van Ch. used various tactics, including consistently providing Mrs.Y misleading information to obtain the 620.000.000 VND. In an effort to continue obtaining Mrs.Y’s property, Nguyen Van Ch. repeated the same schemes with promises to reimburse Mrs.Y on schedule. The amount of money that Nguyen Van Ch. repaid emphasized his deviousness. It really is a shame that The Supreme People’s Procuracy of Vietnam considered this a typical case from which to learn from.

Third, not everyone chooses to denounce crime.

Anyone who applies the provision in Article 23, 2018 Denunciation Law must consider the relevant legal issues. In many cases, denouncing crime IS NOT the final choice.

There are several reasons for this decision, including:

- Difficulty in determining the competent authority to receive letters of denunciation

- Concern over committing crimes of slander

- Difficulty in determining the crime or crimes

- Prolonged responses and denunciation settlement letters

- Uncertainty concerning the results of denunciation letters

Risks involved when negotiating with the seller

Successfully persuading the seller to repay the loan is pleasant satisfaction for the buyer. For that purpose, the buyer may be willing to relinquish the interest and accept a extended repayment schedule. As to the aforesaid case, the seller may have received money from various sources and the buyers unaware they were misled, or being misled, until the seller neglected to repay or until the buyers realized legal problems.

Therefore, it is evident that the buyer is subject to a plethora of risks can and will result in the loss of property.

Extra consultation

Considering the above-mentioned cases, CNC encourages insiders to learn valuable lessons to prevent similar circumstantial situations.

It is our honor to companionably support clients during the COVID-19 era to manage issues presenting themselves resulting from the purchase or transfer of land use. Responses to client requests can and will be delivered via email or voice, using the contact information provided below:

Nguyen Thi Kim Ngan | Senior Associate

T: (+84-28) 6276 9900

CNC© | Business and Commerce Law Firm

The Sun Avenue, 28 Mai Chi Tho Boulevard, An Phu Ward, Distric 2,

Ho Chi Minh City, Vietnam

T: (+84-28) 6276 9900 | H/L: (+84) 916 545 618

cnccounsel.com | contact@cnccounsel.com

Dispensation:

This newsletter has been prepared and published for the purpose of introducing or informing Clients on information about legal issues, opinions and/or developments in Vietnam. Information presented in this newsletter does not constitute any form of legal advice and may be amended without further or advance notice.

[1] See more at: https://www.viac.vn/tin-tuc-su-kien/tinh-uu-viet-cua-trong-tai-khi-xay-ra-tranh-chap-thuong-mai-n494.html

[2] A person who uses deception to obtain another person’s property which is assessed at from VND 2,000,000 to under VND 50,000,000 … shall face a penalty of up to 03 years’ community sentence or 06 months to 03 years’ imprisonment.

[3] See Article 153, Article 154 Criminal Procedure Code 2015.

[4] See more at: https://vksndtc.gov.vn/tin-chi-tiet-8169.