Amendments to the Law on Enterprises: 4 Key Changes Not to Be Missed

In need of transparency in corporate governance and prevention of financial fraud amid Vietnam’s deepening integration into the global economy, the Law Amending and Supplementing Certain Articles of the Law on Enterprises (the “Amended LOE”), effective from July 1, 2025, introduces several significant new provisions.

The Amended LOE is not merely a technical legal adjustment, but a clear demonstration of Vietnam’s commitment to modernizing its corporate legal framework. The new provisions aim to safeguard the interests of investors, the market, and businesses themselves by imposing higher standards for ownership transparency, legal accountability, and financial safety.

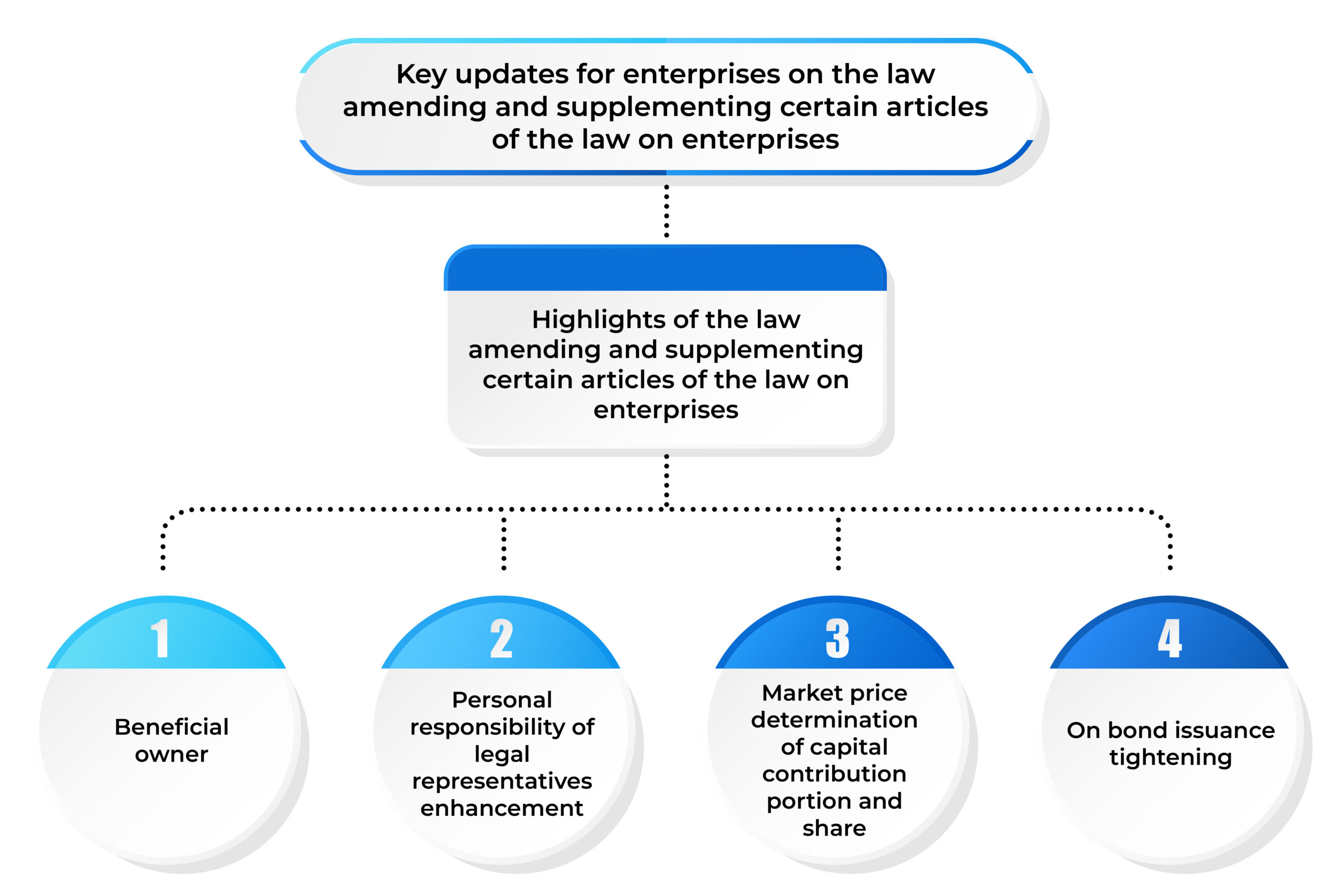

Below are 4 overriding changes that all enterprises operating under Vietnamese law should carefully consider and proactively prepare for:

04 overriding changes of the Amended LOE

First-Ever Legal Recognition of “Beneficial Owner”

Although the concept of a “beneficial owner” has long been familiar in business practice, this is the first time the term is formally recognized in Vietnam’s corporate legal system as a mandatory disclosure obligation.

By definition, a beneficial owner of an enterprise having legal entity status is “an individual who has actual ownership of charter capital or the right to control that enterprise.” In essence, this refers to individuals who truly own or control an enterprise, regardless of whether their names appear on official documents. This aims to close legal loopholes that have allowed anonymous individuals/shareholders to manipulate businesses, evade taxes, or launder money.

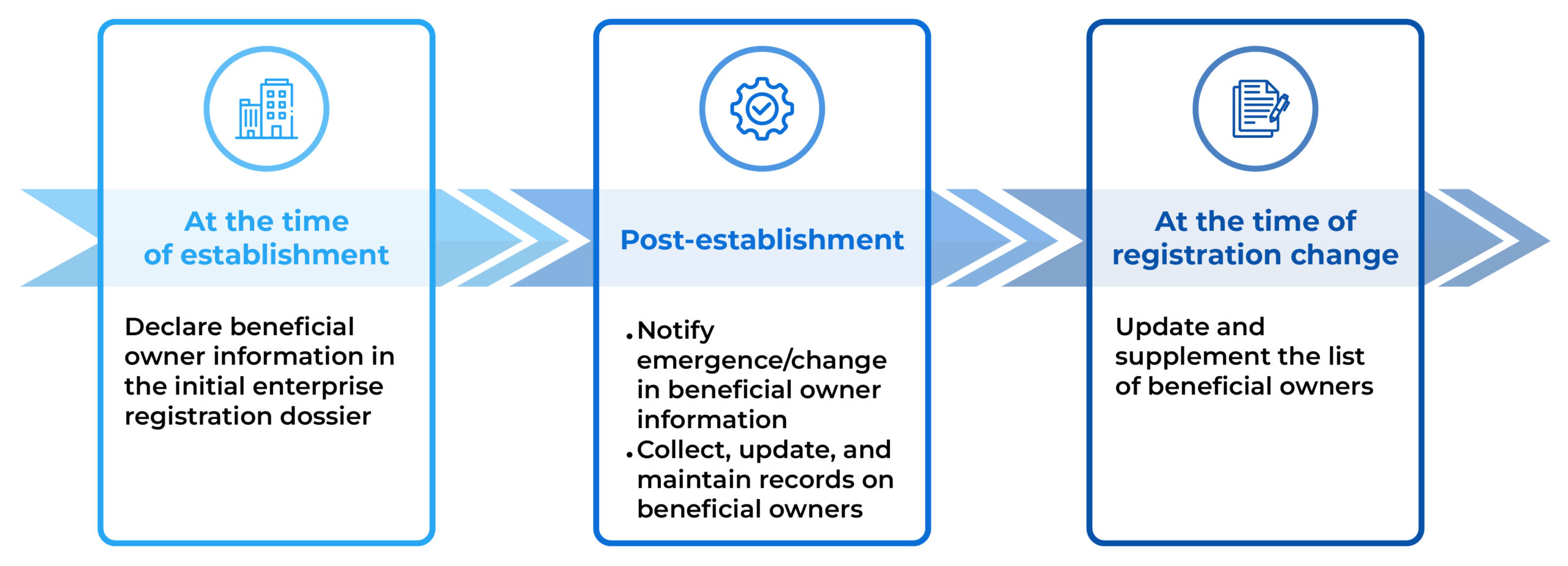

Under the Amended Law, enterprises are now subject to mandatory and systematic regulations for declaring, updating and recording beneficial ownership information, as follows:

- At the time of establishment: Declare beneficial owner information in the initial business registration dossier;

- Post-establishment: Notify the business registration authority of any emergence or change in beneficial owner information; collect, update, and maintain records on beneficial owners;

- Provide information to competent state authorities to identify beneficial owners upon request.

Noted: Enterprises established before July 1, 2025 are also required to update such information when carrying out any registration change procedures after this date.

Liability of enterprises with beneficial owners

Enhanced Personal Liability of the Legal Representative

- In the past, it was common for legal representatives to serve as mere nominees without actual management roles, posing significant risks. The Amended Law affirms that the responsibility of the legal representative is personal and non-transferable.

- The Amended Law emphasizes that a legal representative shall be personally liable for any damage caused to the enterprise if they breach their obligations, provide false information during enterprise registration, or fail to contribute the committed charter capital.

- Furthermore, the Amended Law tightens the requirements for truthful declarations in registration dossiers. Overstatement of charter capital shall be strictly sanctioned.

- This is a major step forward in enhancing transparency, accountability, and professionalism in enterprise governance.

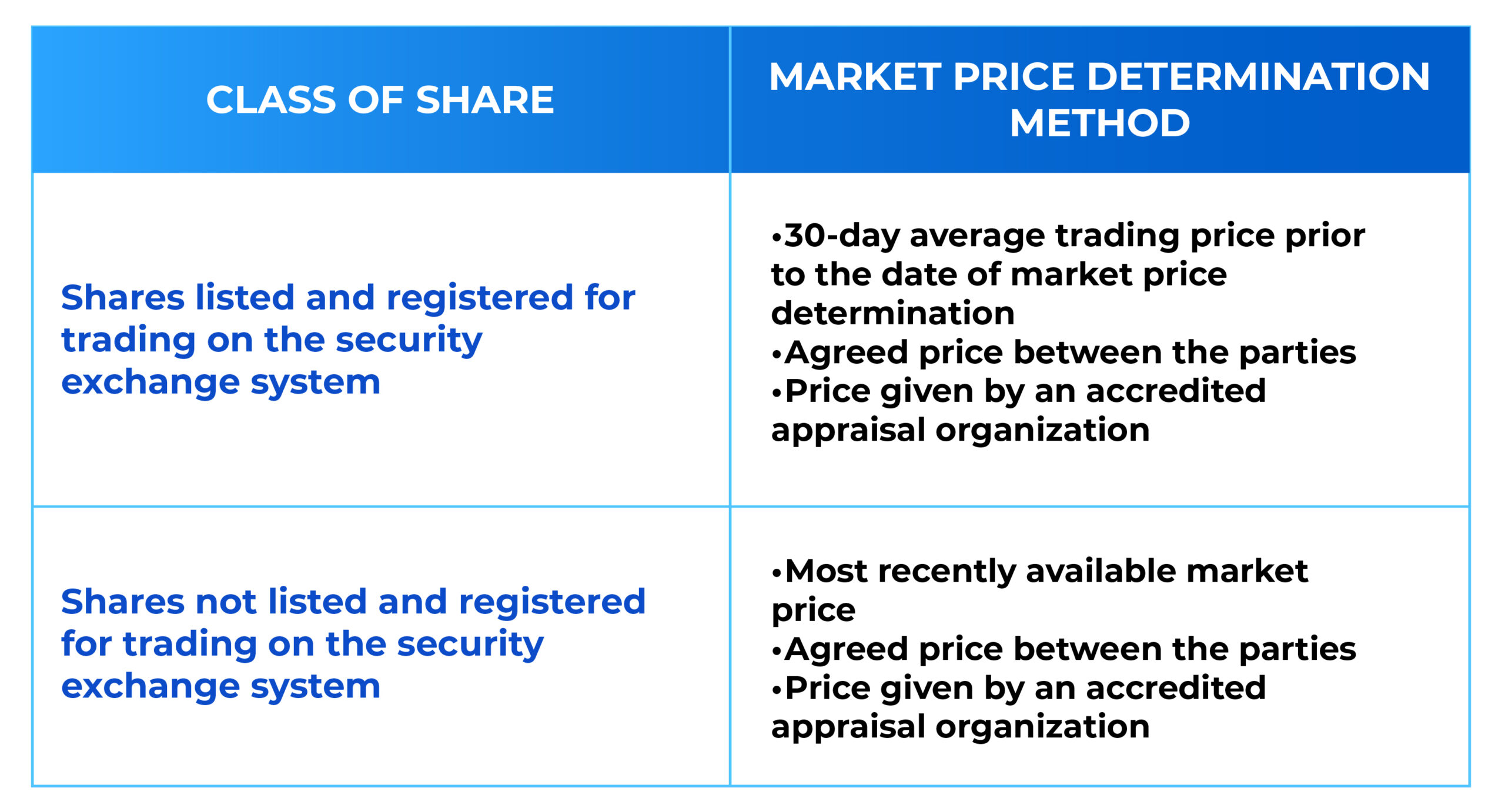

Determination of Market Price for Capital Contributions and Shares

While not as groundbreaking as the definition of beneficial owner, the introduction of a clear definition for the market price of shares listed and registered for trading on the security exchange system helps clarify many existing flaws in transactions pertaining to such shares. As for unlisted shares, the methods for the determination of their market price remain mostly unchanged.

Determination of market price for shares

Private Placement Of Bonds Rules: Debt Control for Financial Safety

Given the situation where some enterprises issued bonds far beyond their financial capacity, thus creating risks for investors and the market, the Amended LOE introduces a mandatory financial condition for private bond issuance.

The Amended LOE limits the total liabilities based on the owner’s equity, which serve as a condition for the issuance of private bonds. Specifically, joint stock companies that are not publicly listed companies must satisfy the condition of “Due debt (including the value of to-be-issued bonds) shall be at no more than 05 times the owner’s equity based on the audited financial statement of the year preceding issuance” (unless otherwise provided by the law). This replaces the previous regime that only imposed three basic conditions.

Accordingly, to issue bonds, enterprises must satisfy the following conditions:

- The company has paid in full for the principal and interest on bonds already offered for sale which are due for payment or has paid in full all due debts for three consecutive years prior to the bond placement tranche (if any), except for bond placement to creditors being selected financial institutions

- It has audited annual financial statements for the year immediately preceding the year of issuance

- It satisfies the conditions on financial safety ratios and prudential ratios during operation as prescribed by law

>>> 4. Due debt (including value of the to-be-issued bonds) shall be at no more thn 05 times the owner’s equity based on the audited financial statement of the year preceding issuance.

What Should Enterprises Do Now?

To ensure compliance with the Amended Law and mitigate legal and financial risks before the Law comes into effect on July 1, 2025, enterprises are advised to take the following actions immediately:

- Review & update information on “beneficial owners”

- Identify individuals who truly control or substantially benefit from the enterprise (including those holding indirect or proxy ownership);

- Compile a list of beneficial owners according to the statutory definition;

- Prepare templates, data systems, and internal procedures to monitor and update information upon any changes (e.g. share transfers or capital sales).

- Review the qualification and liability of the legal representative

- Reassess the competence, credibility, and legal responsibility of the current legal representative;

- If the current representative does not actively manage the company or only serves as a nominee, consider replacing them to avoid uncontrollable personal liabilities;

- Clearly define internal regulations on responsibilities, authority, and sanctions applicable to legal representatives in legal and financial decisions.

- Update price determination methods for contributed capital/share and control the debt-to-equity ratio before issuing bonds.

Managed by

|

Tran Thi Hanh Nhan | Associate

Phone: (84) 32 703 0033 Email: nhan.tran@cnccounsel.com |

|

Tran Anh Thy | Junior Associate

Phone: (84) 28 6276-9900 |