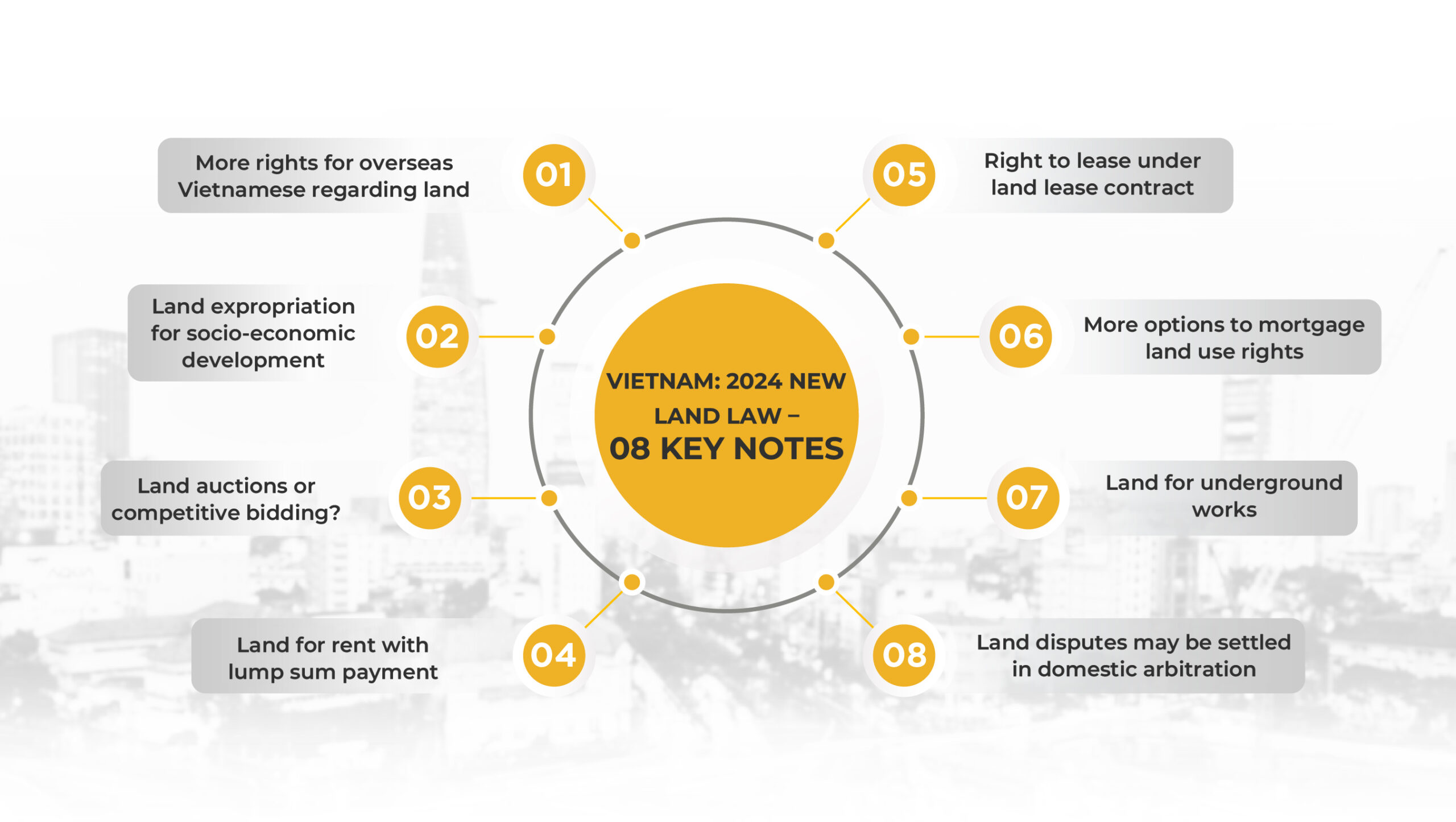

Vietnam: 2024 New Land Law – 8 key notes

Land Law No. 31/2024/QH15 dated 18 January 2024 (“2024 Land Law ”) was approved by the National Assembly of Vietnam and will take effect as of 01 January 2025 (with the exception that some of the provisions will take effect sooner).

Recently, the Government proposed to the National Assembly that this Law will take effect from 01 August 2024 with the expectation of recovering the domestic real estate market.[1]

Not only the changes based on Resolution No. 18-NQ/TW dated 16 June 2022 issued by the Central Committee of the Communist Party of Vietnam, but also other notable changes are found in this new Law with the expectation of addressing the shortcomings of the Land Law No. 45/2013/QH13 dated 29 November 2013 (“2013 Land Law ”).

In this newsletter, CNC introduces some key notes of 2024 Land Law in comparison with 2013 Land Law undertaken by Mr. Tran Pham Hoang Tung – Senior Associate and Mr. Pham Nguyen Tan Trung – Legal Assistant.

Download PDF here: Vietnam: 2024 New Land Law – 8 key notes

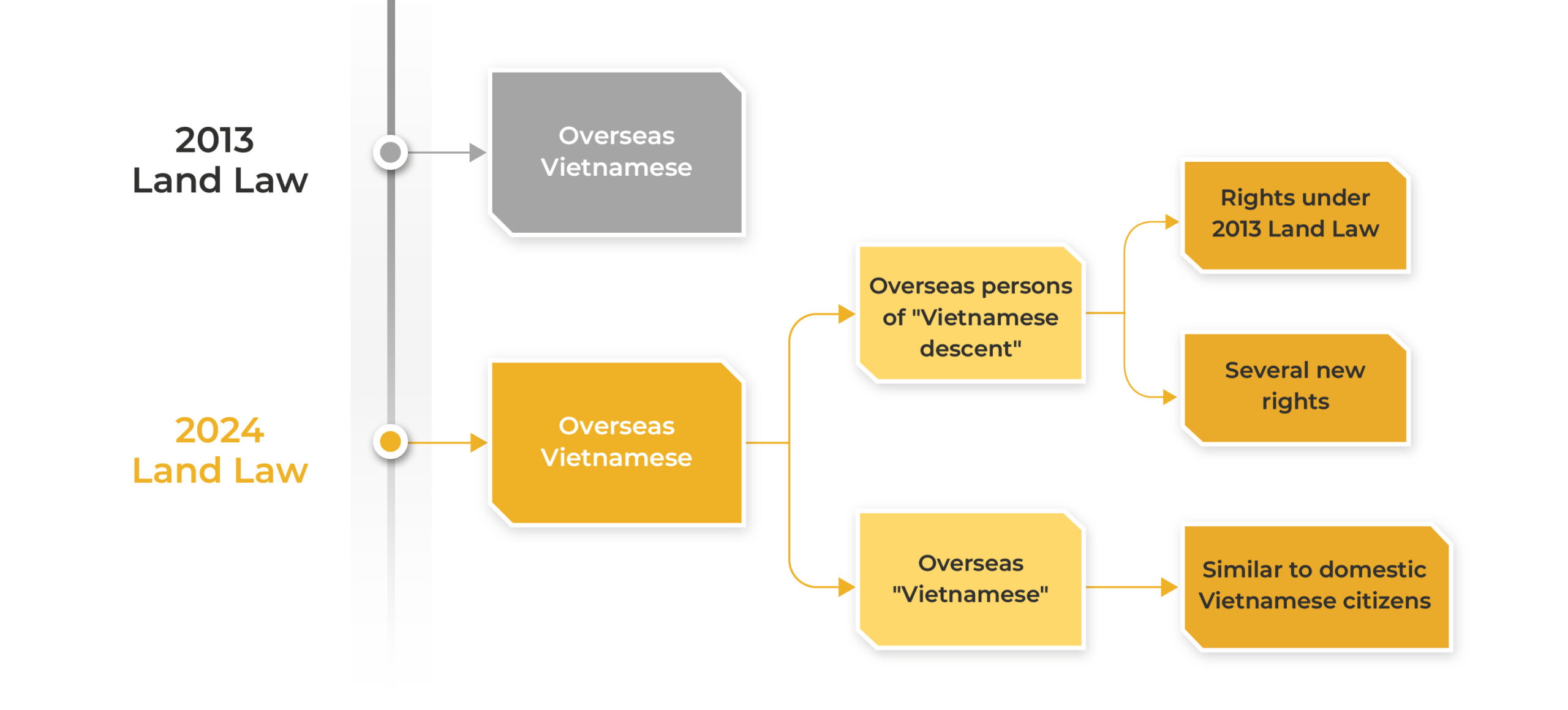

More rights for overseas Vietnamese regarding land

The Constitution of Vietnam 2013 states that the overseas Vietnamese make up an inseparable part of the Vietnamese national community. The State encourages and creates conditions for Vietnamese living abroad to preserve the Vietnamese cultural identity, maintain familial relationships, and contribute to the construction of their native land and the nation (Article 18). Remittances to Vietnam, over the years, exhibit the desires of overseas Vietnamese to maintain close ties with their families and the native land,[2] and such remittances have become a force that contributes to domestic economic growth. Therefore, the laws are necessary to facilitate the promotion of remittances, especially through the real estate market.

However, the existing laws on land impede the involvement of overseas Vietnamese in the real estate market. Explicitly, 2013 Land Law only permits overseas Vietnamese (regardless of Vietnamese citizenship) to receive land use rights for “residential land” in the form of purchase, hire-purchase, receipt of inheritance, receipt of gifts being residential housing attached to such land use rights, or to receive the land use rights for “residential land involving projects on development of residential housing”.[3]

2024 Land Law facilitates overseas Vietnamese in comparison to 2013 Land Law when dividing this group of Vietnamese into two separate groups by nationality, there are: (1) overseas Vietnamese (with Vietnamese citizenship), and (2) overseas persons of Vietnamese descent (without Vietnamese citizenship).

Specifically, group (1) has full rights regarding land – all the same as domestic Vietnamese citizens,[4] and group (2) maintains the rights regarding land of “overseas Vietnamese” of 2013 Land Law which supplements several new rights. In other words, group (2) has rights as follows:[5]

- Receiving land use rights for “residential land” in the form of purchase, hire-purchase, receipt of inheritance, receipt of gifts being residential housing attached to such land use rights;

- Receiving the land use rights for “residential land in projects on development of residential housing”;

- Receiving inheritance of land use rights for “residential land and other types of land” within the same land lot with residential housing under civil laws;

- Receiving gifts being residential housing attached to land use rights of heirs under civil laws.

These new rights are expected to facilitate the involvement of overseas Vietnamese in the real estate market and the growth of remittances for economic growth.

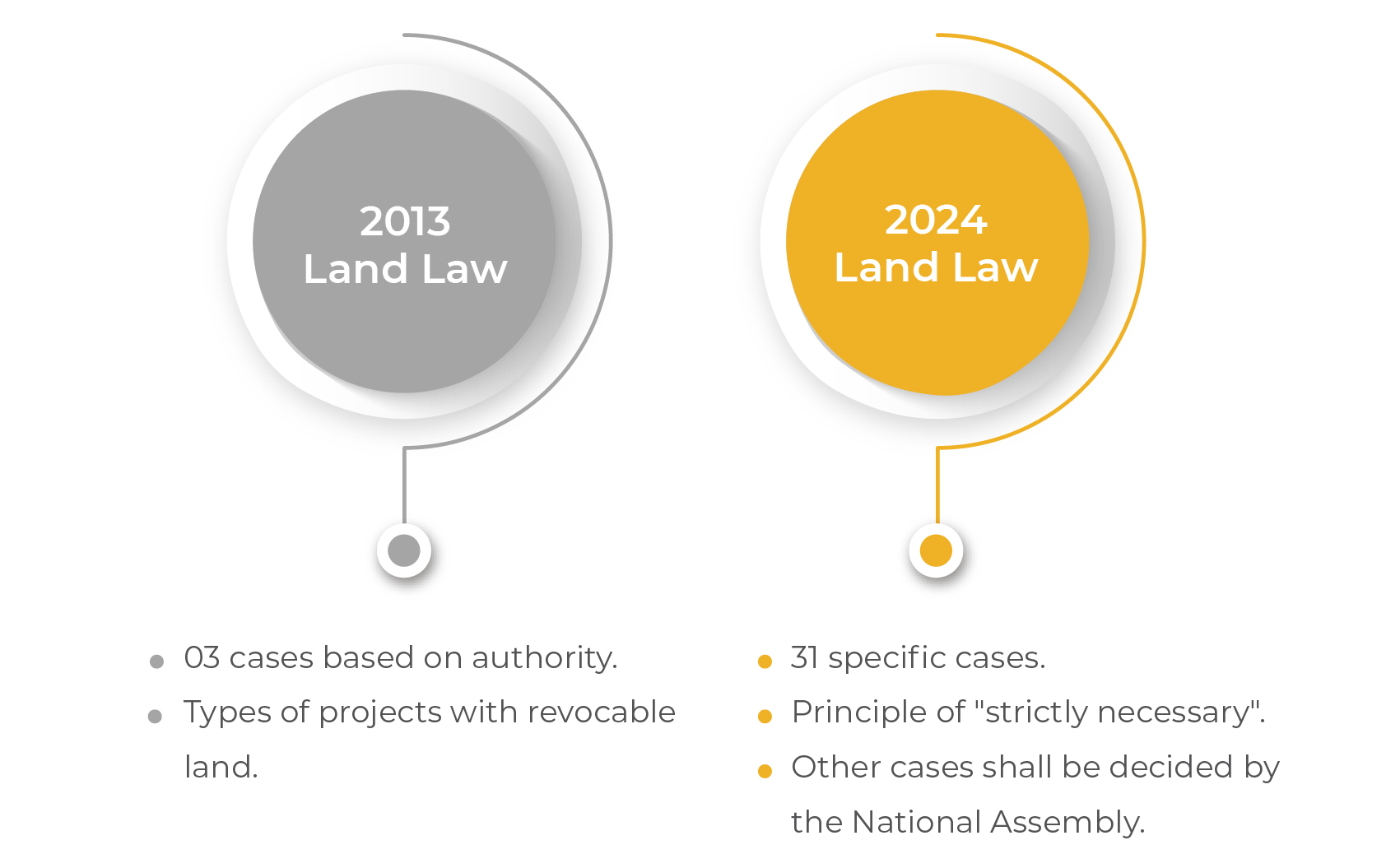

Land expropriation for socio-economic development

Article 62 of 2013 Land Law classifies the cases of land expropriation for socio-economic development in the national and public interests based on the classification of the decision-making bodies including: (i) the National Assembly, (ii) the Prime Minister, (iii) the provincial People’s Committee. Futhermore, (ii) and (iii) provide the types of projects with revocable land.

However, in practice, such regulation in 2013 Land Law creates the challenge that there are many different interpretations by local authorities, which leads to a myriad of inappropriate cases of land expropriation and causing the law suits and claims against administrative authorities.

Based on the rule of “ensuring fairness and transparency”, under Resolution 18/NQ-TW, 2024 Land Law provides 31 “specific” cases of land expropriation for socio-economic development in the national and public interests in Article 79 of this Law.

Additionally, this Article “foresees” that there may be cases of land expropriation for socio-economic development other than the 31 mentioned cases. Thus, this Article further provides that such cases shall be decided upon by the National Assembly through an “abridged procedure” and shall ensure the principle of “strictly necessary” of the 2013 Constitution of Vietnam.[6]

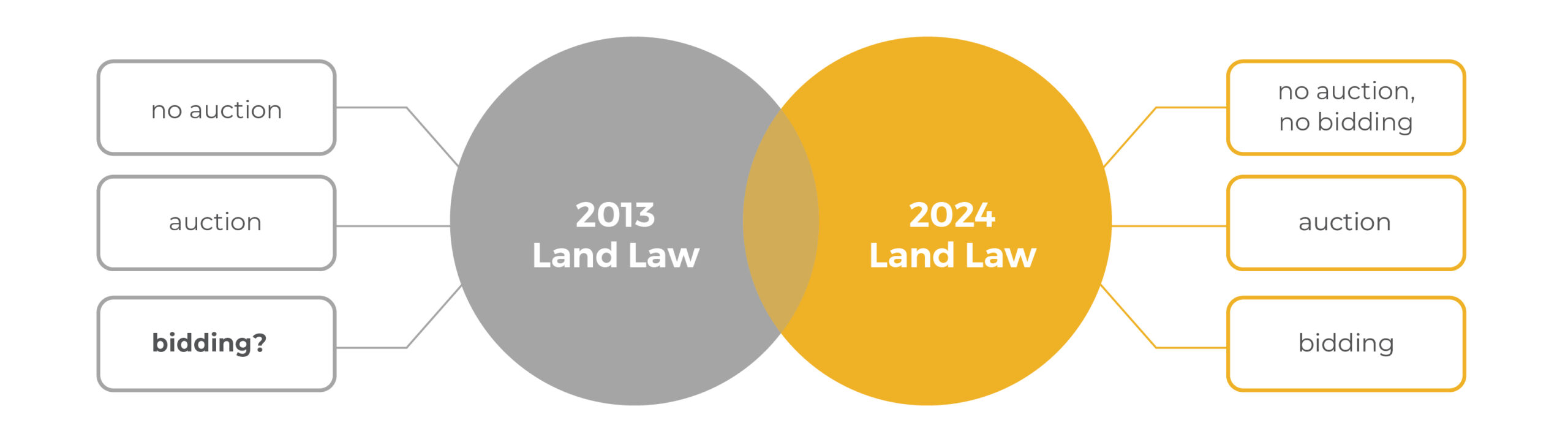

Land auctions or competitive bidding?

Granting land use rights through land auctions or competitive bidding has become a challenging problem for enterprises and local authorities – for a long time – due to the contradiction among the laws.

In detail, Article 118 of 2013 Land Law provides specific methods of land allocation and land lease: (i) through land auction, and (ii) without land auction. Beyond such cases, 2013 Land Law does not provide any case of land allocation and land lease through competitive bidding.

However, Decree No. 25/2020/ND-CP dated 28 February 2020 of the Government detailing the implementation of several provisions in the Law on Bidding regarding investor selection and Decree No. 31/2021/ND-CP dated 26 March 2021 of the Government detailing and guiding the implementation of several provisions in the Law on Investment provide for cases of granting land without land auction under land laws to selected investors through competitive bidding. It creates a contradiction among the laws, including: the law on land, the law on bidding, and the law on investment. Additionally, cases of granting land to the selected investor through competitive bidding do not match any case of granting land without land auction under Article 118 of 2013 Land Law.

For a long time, this contradiction creates challenges for enterprises and local authorities to choose appropriate methods of land allocation and lease to implement projects involving land, thereby affecting project implementation.

2024 Land Law acknowledges and addresses such contradiction by providing three specific methods of land allocation and lease, including: (i) without land auction and competitive bidding (Article 124); (ii) through land auction (Article 125); (iii) through competitive bidding (Article 126).

Methods of land allocation and land lease

Land for rent with lump sum payment

Under Article 56 of 2013 Land Law, the party who rents land from the State is entitled to choose one of two payment methods, including: lump sum payment or annual payment. In practice, many local authorities encourage enterprises to make lump sum payments due to advantages of pre-estimating the input costs to prepare the business plan for enterprises, and an immediate and large income for the local budget.[7]

Conversely, the annual rental payments also present advantages, in which the national income is steady by such payments, and the input costs for business operations shall be decreased due to a decrease in land rental payments (paid per year). Based on this advantage, Resolution 18/NQ-TW states to complete the mission regarding land for rent that: “Basically conducting the payment method of land for rent in which annual payments shall be made and prescribing a certain number of cases in which a lump sum payment shall be made, ensuring the consistency with the nature and purpose of using land, the sustainable income and avoiding the loss of the state budget”.

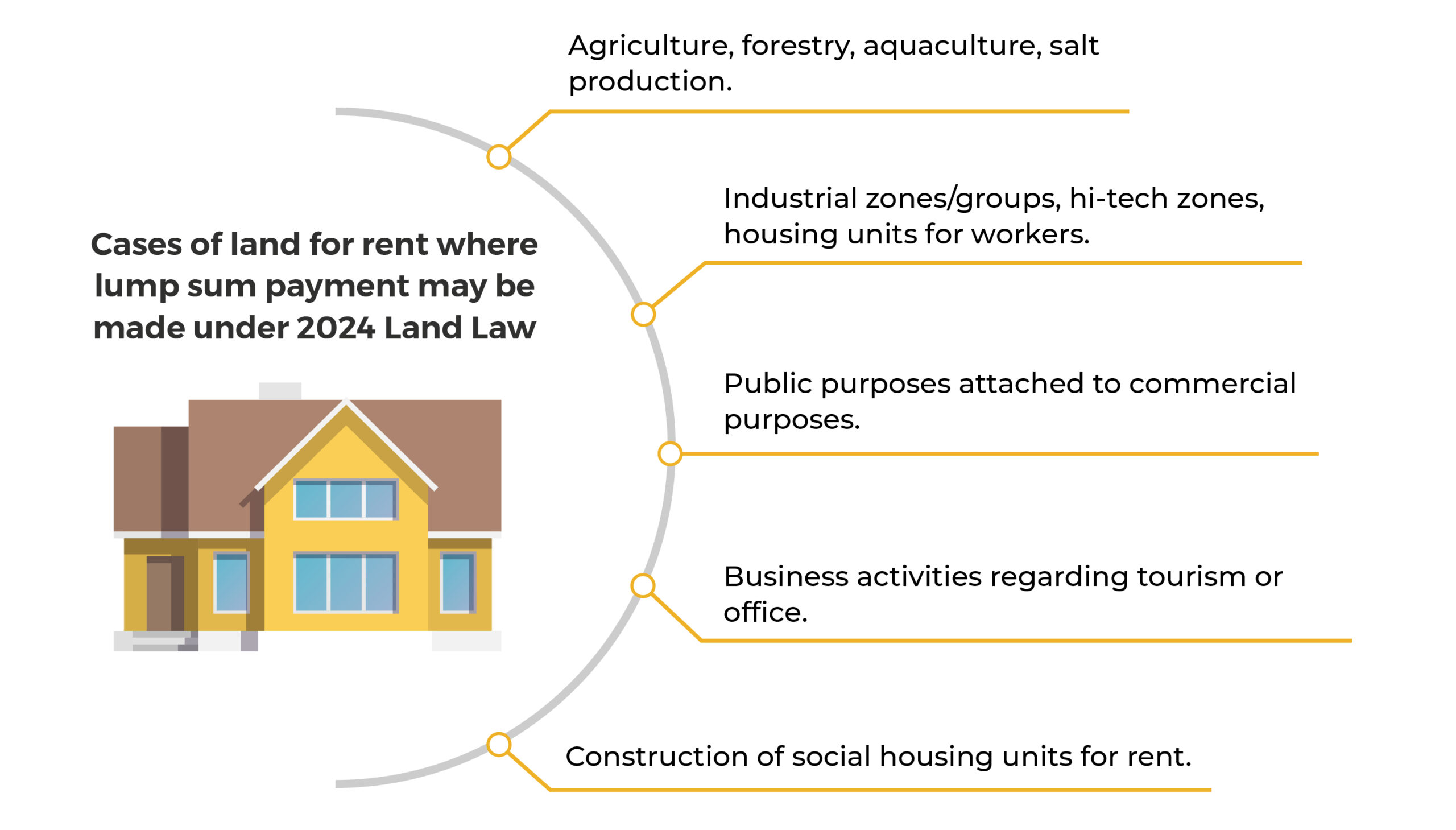

On this basis, 2024 Land Law provides for a certain number of cases of land for rent in which a lump sum payment may be made under Article 120 of this Law, including:

- Using land for projects of agriculture, forestry, aquaculture, and salt production;

- Using land of industrial zones, industrial groups, hi-tech zones, housing units for workers in industrial zones; using land for public purposes attached to commercial purposes; and using commercial land for business activities regarding tourism or office;

- Using land for construction of social housing units for rent under the laws on housing.

The above cases may be considered as the real estate segments facilitated by the State due to the crucial impact on the economy (agriculture, industry, social housing) or the significant contribution on the national budget (land for business activities regarding tourism or office). Therefore, these real estate segments are listed as cases of land for rent in which lump sum payments may be made. It helps enterprises to pre-estimate the total rental payment which shall be made for the entire life of the project to decide the business operation.

Additionally, it is more favorable for these enterprises to mobilize capital in which such enterprises are entitled to mortgage such land to get bank loans. It is noteworthy that the party who rents such land has another option in which annual payments may be made.

Other than the above cases, annual payments shall be made in the remaining cases.

Right to rent under land lease contract

The practice in Vietnam illustrates that the regulations regarding land for rent with annual payments under 2013 Land Law causes several disadvantages regarding the land use rights market. Additionally, it also causes the loss of the state budget during the privatization of state-owned enterprises, because the value of such land shall not be included in the enterprise value.[8]

To address the above concerns, 2024 Land Law provides a new right of “right to rent under land lease contract” for investors who make annual rental payments. This new right makes the transactions of land use rights more flexible, thereby promoting the land use rights market, and thus, the state budget income will increase through the transfer of taxes and fees transactions regarding this right.

For enterprises, this new right is expected to encourage the lessor-investors to make annual payments under Resolution No. 18-NQ/TW, and to address the concerns of the investors who wish to transfer their projects to other investors in an effort to deduct their losses during their investment process.

However, the transaction of “right to rent under land lease contract” is only valid if:

Firstly, the land user made advance payment of land compensation, support, and resettlement which had not been fully deducted from the rental payment.[9]

Secondly, the land user shall not transfer, lease, sublease, bequeath, or donate the “right to rent under land lease contract” without properties attached to the relevant land,[10] except the land user who is an individual sub-lessor.[11]

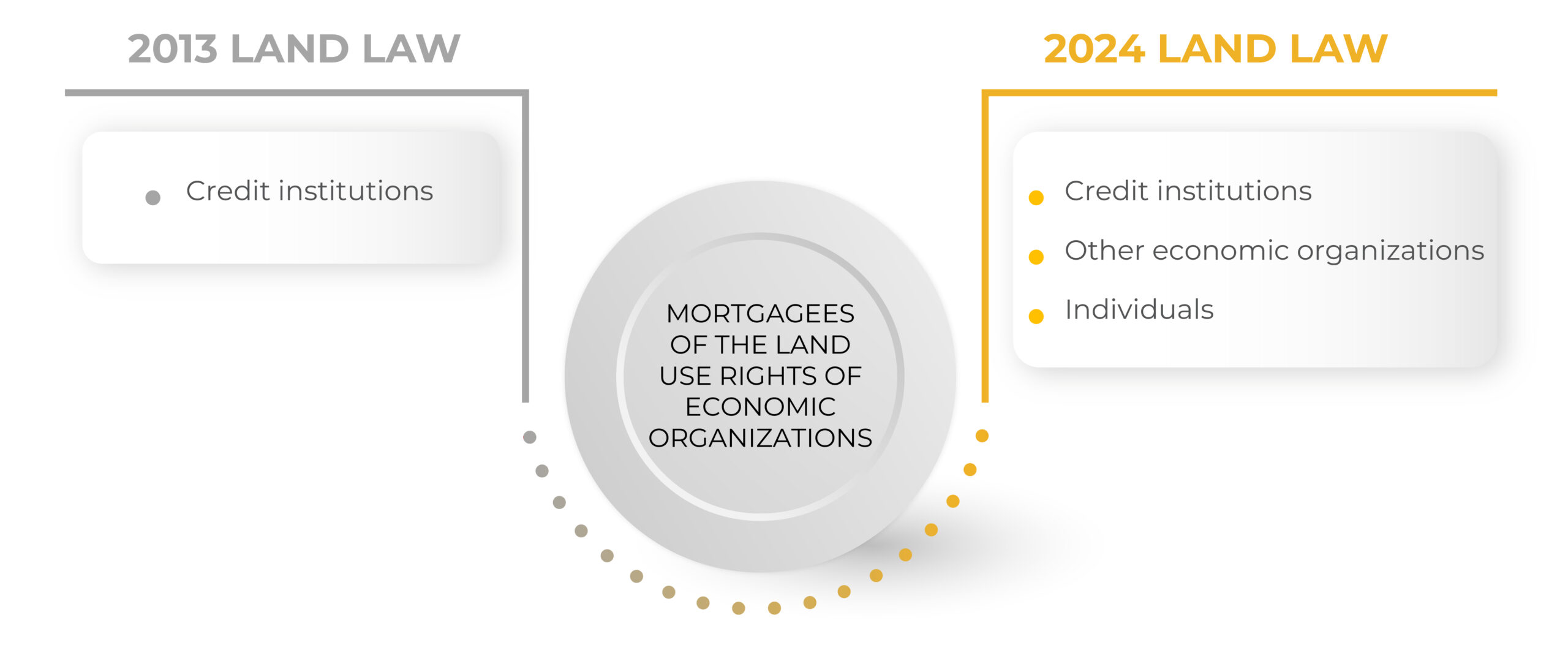

More options to mortgage land use rights

2013 Land Law does not mention any mortgagee (other than credit institutions) of land use rights of economic organizations[12], though the 2015 Civil Code and other laws do not prohibit it.

It raises a problem of concern for such mortgagees, because many notary organizations do not accept notarization of mortgage contracts. Furthermore, many land registry offices only receive the land documents of credit institutions.[13]

Additionally, the capital flows into the real estate market in Vietnam has significantly depended on commercial bank loans.[14] The promotion of capital sources other than traditional loans from credit institutions will help enterprises more flexibly in preparing their financial plan. The bond issuance market thereby becomes more sustainable.

On this basis, 2024 Land Law affirms that mortgagees of land use rights of domestic economic organizations shall include not only credit institutions, but also individuals and other domestic economic organizations.[15] This affirmation is consistent with the 2015 Civil Code and other related laws.

It is noteworthy that 2024 Land Law continues to reject the branches of foreign banks as mortgagees, because the drafting committee argues that it remains to be a legal and national security risk on this issue, and thus, further research and policy experimentation should be conducted.

Land for underground works

By Article 8.5 of 2024 Land Law, the practice of “development of underground works” has been mentioned in the land law as an incentive policy regarding land investment for the first time. This is a leap forward when the land lots are shrinking in urban areas, thus, the development of underground spaces becomes more and more important, especially in the megacities such as Hanoi and Ho Chi Minh City.

Moreover, 2024 Land Law basically addresses significant concerns regarding land for construction of underground works according to 2013 Land Law and the relevant laws. In detail, the 2013 Land Law prescribes the utilization of land for construction of underground works and of works on the ground’s surface shall be consistent with the construction plans, the land use plans, and other relevant plans approved by the competent authorities; the land use regime for each type of land; rights and obligations of land users who utilize land for construction of works.

However, 2013 Land Law lacks many regulations such as: requirements for land for construction of underground works, issuance of certificates for underground works, financial obligations regarding the utilization of land for construction of underground works, thereby causing many difficulties in implementation.

Furthermore, although the 2015 Civil Code prescribes the “surface rights” governing the legal relationship between the land users and the persons who utilize the underground space, the lack of specific regulations regarding land for construction of underground works in 2013 Land Law causes difficulties in the implementation of the clause of “surface rights” in the 2015 Civil Code.

In 2024 Land Law, there are several specific provisions addressing the mentioned shortcomings and encouraging the development of underground works, as follows:

- Issuing a certificate “for ground’s surface areas” for construction of works assisting the operation, utilization and use of underground works, and “for underground works below that surface” (Article 216.6);

- The user of ground’s surface for underground works is entitled to transfer, lease or sublease underground space, after such space is determined by the State under laws (Article 216.2);

- The construction of works on the ground’s surface assisting the operation, utilization, and use of underground works is considered a case allowing land expropriation for socio-economic development in the national and public interests (Article 79.30);

- Registration for changes if there are “changes in land use rights of a ground’s surface” for construction of works assisting the operation, utilization and use of underground works and “changes in ownership of underground works” (Article 133.1);

- Policy of exemption from and reduction of land use and land rent fees for cases of using a ground’s surface for construction of works assisting the operation, utilization and use of underground works (Article 157.1(dd));

- Distinguishing the ground’s surface for construction of works assisting the operation, utilization and use of underground works for “commercial purposes” (land for rent with annual payment), and such ground’s surface for “non-commercial purpose” (land for rent with exemption from land use fees) (Article 216.5).

These changes in 2024 Land Law are consistent with the reality of Vietnam and the relevant laws such as the Civil Code (surface rights), the Law on Planning (urban plans, rural plans), the Law on Construction (underground works).

Land disputes may be settled in domestic arbitration

2024 Land Law expressly affirms that any dispute arising from commercial activities related to land may be settled in Vietnam’s commercial arbitration.

This affirmation is considered a leap forward in dispute resolution related to land, especially including foreign elements. That’s because the 2015 Civil Procedure Code provides in Article 470 that Vietnam’s courts have exclusive jurisdiction over civil cases including foreign elements related to the rights over real estate on the territory of Vietnam.

In practice, there are many interpretations of this regulation, including:

- Only excluding the jurisdiction of the foreign courts;

- Only excluding the jurisdiction of the foreign courts and foreign arbitration;

- Excluding the jurisdiction of the foreign courts and all types of arbitration (domestic and foreign arbitration).

In the explanation report No. 631/BC-KHXX dated 31 December 2014 and issued by the Institute of Judging Science of the Supreme People’s Court, the Supreme Court stated that there shall be no exclusion of the jurisdiction of Vietnam’s arbitration over the exclusive jurisdiction of Vietnam’s courts. However, due to the lack of express regulation, the arbitral institutions in Vietnam have struggled with the problem of whether to receive cases related to land including foreign elements or not.[16]

Therefore, this affirmation in 2024 Land Law provides a clear basis for the arbitral institutions in Vietnam to receive cases arising from commercial activities related to land and including foreign elements, where the involvement of foreign investors becomes increasingly visible in Vietnam’s real estate market. It is expected to contribute significantly to Vietnam’s arbitration which has growth potential.

Written by:

|

Senior Associate Tran Pham Hoang Tung

Phone: (84) 901 334 192 Email: tung.tran@cnccounsel.com |

|

Legal Assistant – Pham Nguyen Tan Trung

Phone: (84) 347 924 900 Email: trung.pham@cnccounsel.com |

[1] https://vnexpress.net/de-xuat-sua-doi-de-3-luat-lien-quan-bat-dong-san-co-hieu-luc-som-4751283.html

[2] https://baochinhphu.vn/luong-kieu-hoi-giai-doan-1993-2022-sanh-ngang-luong-von-fdi-giai-ngan-102231227123006785.htm

[3] Article 169.1(dd) Land Law 2013.

[4] Article 4.3 Land Law 2024.

[5] Article 28.1(h) Land Law 2024.

[6] Article 54.3 Constitution of Vietnam 2013.

[7] https://daibieunhandan.vn/chinh-sach-va-cuoc-song/hoa-giai-rui-ro-thue-dat-tra-tien-hang-nam-i318699/

[8] https://xaydungchinhsach.chinhphu.vn/se-tach-qua-trinh-sap-xep-xu-ly-nha-dat-ra-khoi-qua-trinh-co-phan-hoa-119220930144230409.htm

[9] Article 46.2(b) Land Law 2024.

[10] Article 34.1 and 34.2, Article 37.2, Article 41.2 Land Law 2024.

[11] Article 37.2(d) Land Law 2024.

[12] Article 174.2(d) and Article 175.1(b) Land Law 2013.

[13] https://baochinhphu.vn/to-chuc-ca-nhan-co-duoc-nhan-the-chap-quyen-su-dung-dat-102245528.htm

[14] https://laodong.vn/bat-dong-san/mat-xich-day-doanh-nghiep-bat-dong-san-phat-trien-trong-nam-2023-1134240.ldo

[15] Article 33.1(dd) and Article 34.1(b) Land Law 2024.

[16] https://thanhnien.vn/trong-tai-thuong-mai-se-giai-quyet-tranh-chap-lien-quan-dat-dai-185230302101306294.htm

Pingback: Vietnam: Pilot policies addressing challenges of commercial housing projects – CNC | Công ty Luật TNHH CNC Việt Nam

Pingback: Vietnam: 2023 New Real Estate Business Law – 08 key notes – CNC | Công ty Luật TNHH CNC Việt Nam