Practical issues in the release of Retention money

With respect to the timing for the release of Retention money, although in theory the release of retention money provisions appear to set out clear provisions, practical application reveals that Clause 2, Article 28 of Decree No. 06/2021/ND-CP (“Decree 06/2021”) still leaves room for significant debate.

Specifically, Clause 2, Article 28 of Decree 06/2021 imposes two conditions that a contractor must meet in order to be entitled to the release of retention money:

- First, the defects liability period has expired; and

- Second, the Employer has confirmed that the contractor has fulfilled its defect liability obligations.

However, in practice, issues related to deduction, retention, and release of retention money can be very complicated, which makes the provisions of Decree 06/2021 seem unable to foresee all possible scenarios. One of the most contentious matters is determining the exact timing for the release of retention money.

Download the PDF file here: CNC Newsletter_Practical issues in the release of Retention money

Legal framework for Retention money

What is Retention money?

For clarification, to determine when the Employer must release the contractor’s retention money, it is first necessary to define what retention money is.

Neither the Law on Construction 2014 nor Decree 06/2021 on quality management, construction, and maintenance defines “retention money.” In practice, retention money can be understood as a percentage or sum withheld by the Employer for a set period to ensure that: (i) The works performed by the contractor meet the contractual requirements and technical standards; and (ii) The contractor remains responsible for rectifying defects during the defects liability period after the works have been put into operation.

In effect, retention money is a financial safeguard for the Employer in case the contractor fails to comply with contractual obligations.

Retention money may take various forms, including:

- Cash (withheld by the Employer at the final payment stage);

- Bank guarantee;

- Security assets;

- …

Various forms of retention money

While parties are generally free to agree on the withheld retention percentage, public investment projects or projects using state funds are subject to minimum retention rates of:

- 3% of the contract value for special-grade and grade I construction works;

- 5% of the contract value for construction works at the remaining grade.[1]

Typically, the Employer withholds these amounts in the following forms: (i) progressively from each interim payment, ranging from 5% to 10%; or (ii) from the final payment.

Timing for the release of Retention money

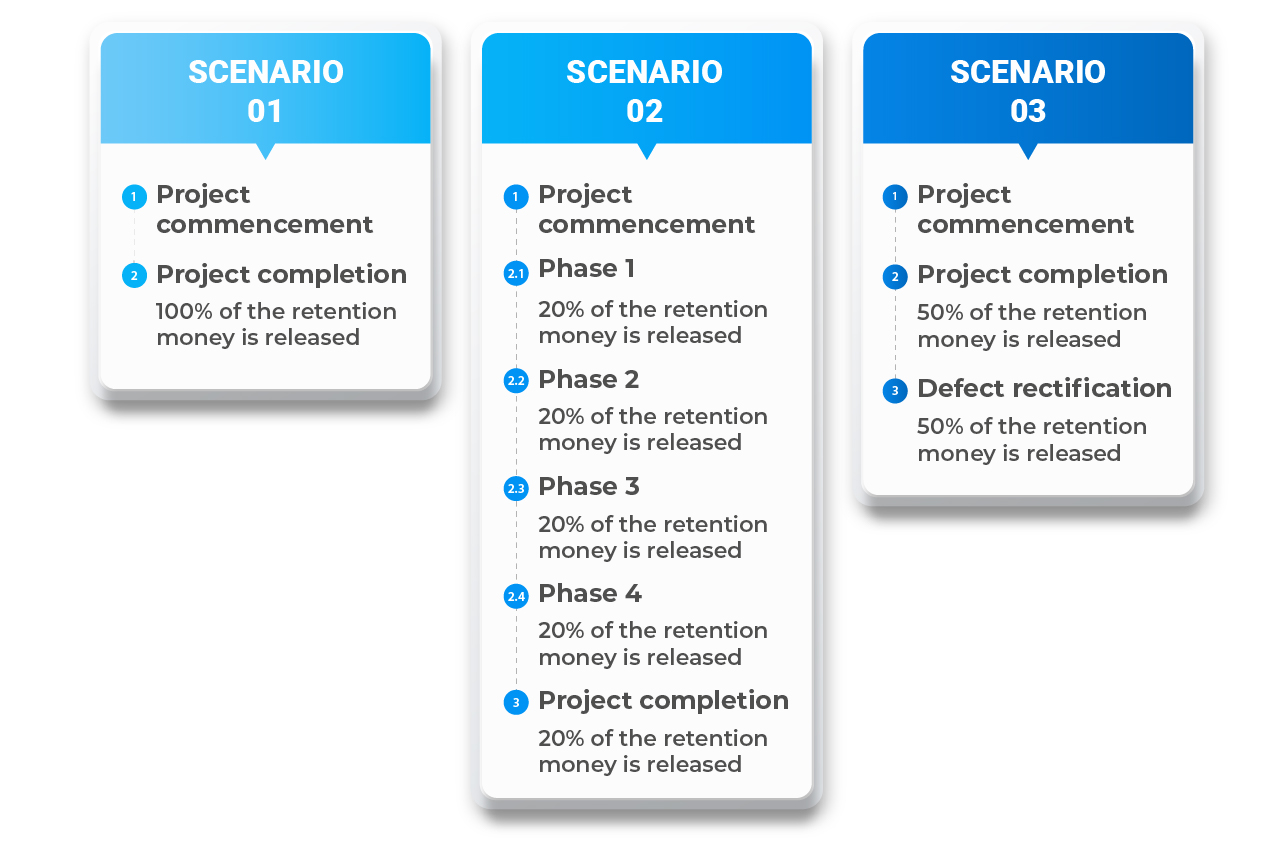

As with retention rates, the timing and conditions for the release of retention money are generally subject to contractual agreement. For example, the Employer may agree to release 100% upon project completion or to release progressively upon partial acceptance.

Payment scenarios for retention money

On the other hand, from a legal perspective, Clause 2, Article 28 of Decree 06/2021 states that retention money shall only be released after the defects liability period has expired, and the Employer has confirmed that the Contractor has fulfilled its defect liability obligations. While, in theory, the provisions on the timing for the release of retention money appear clear, their practical application reveals several controversial issues under Clause 2, Article 28 of Decree 06/2021.

Specifically, Clause 2, Article 28 of Decree 06/2021 sets out two conditions that the Contractor must satisfy to be eligible for the release of the retention money:

- First, the defects liability period has expired; and

- Secondly, the Employer has confirmed that the Contractor has fulfilled its defects liability obligations;

Thus, it is clear that, in addition to the second condition requiring the Employer’s confirmation, the timing for the release of the retention money depends entirely on the project’s defects liability period.

Determining the commencement of the defects liability period in special cases

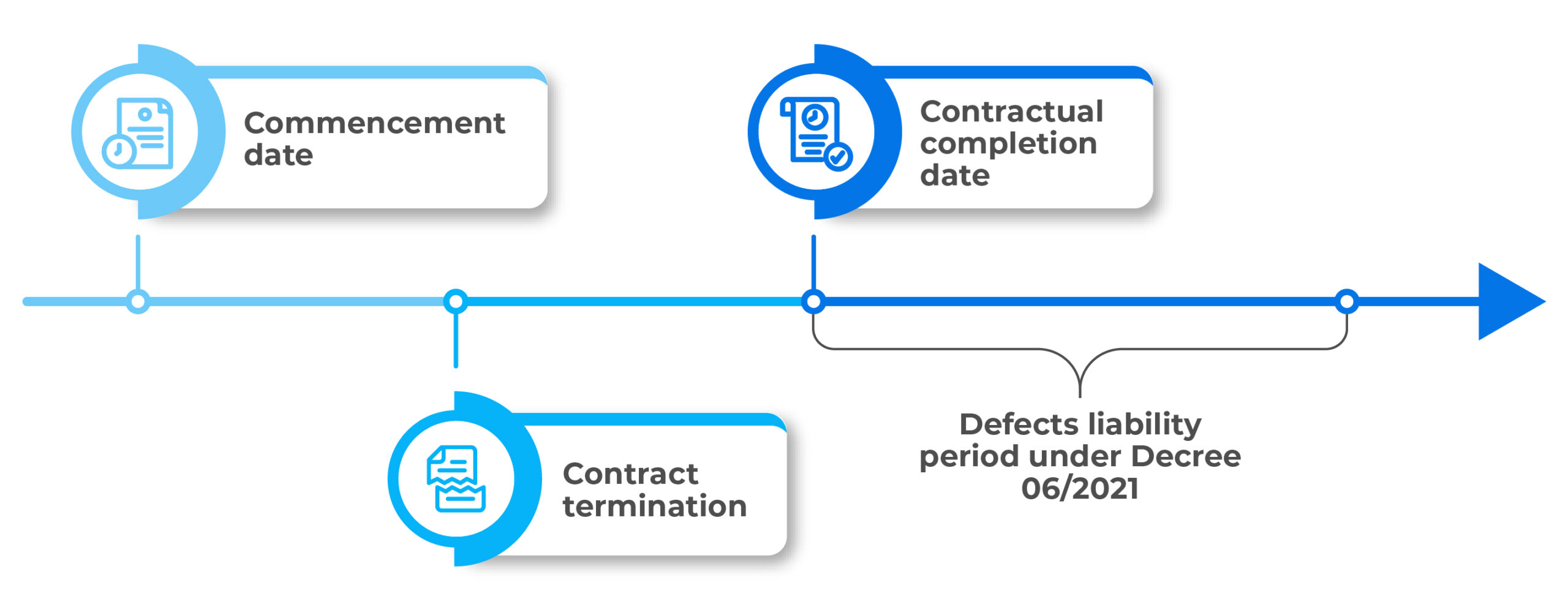

Under current law, the defects liability period is calculated from the date the work or work item is accepted by the Employer.[2] In practice, this acceptance for calculating the defects liability period refers to the acceptance of project completion for use, not acceptance for payment or interim acceptance.

The commencement of the defects liability period

This provision, when compared with the practical execution of contracts, raises the question: When does the defects liability period begin if the work or work item has not been formally accepted by the Employer, or if the contract is terminated early?

Divergent Court Approaches

Arising from these regulations, a review of case law reveals that different courts have adopted varying interpretations when approaching this issue.

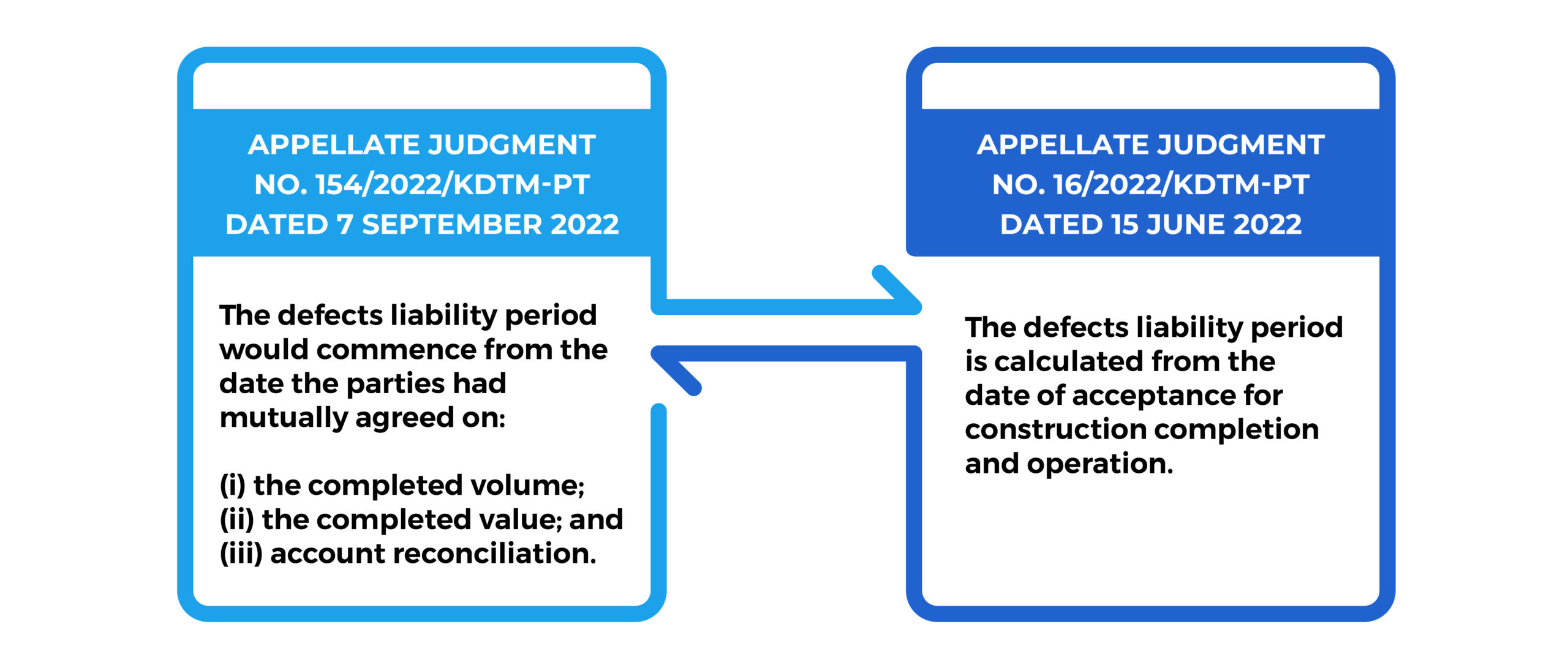

For example, in Appellate Judgment No. 154/2022/KDTM-PT dated 7 September 2022, the Hanoi People’s Court interpreted a contractual clause stating that the defects liability period was 24 months “from the date the parties sign the Minute of acceptance for construction completion and operation”. The Court held that, even without such a Minute of acceptance for construction completion and operation, if the parties had mutually agreed on: (i) the completed volume; (ii) the completed value; and (iii) account reconciliation, the works were deemed to have been completed. Therefore, the defects liability period would commence from this date, regardless of whether the parties had signed the acceptance certificate.

This approach by the Hanoi People’s Court demonstrates a flexible interpretation and application of contractual provisions in a practical context. This is because it is inappropriate for an Employer or a main Contractor to claim that the defects liability period has not commenced simply because a completion certificate has not been issued, even though the works have been completed and confirmed by the Employer or main Contractor.

By contrast, the Da Nang People’s Court, in its Appellate Judgment No. 16/2022/KDTM-PT dated 15 June 2022, took a different view, giving maximum respect to the parties’ contractual agreements.

Specifically, the parties had agreed that the retention money, equivalent to 2.5% of the final settlement value, would be released by the Defendant to the Plaintiff one year after the date of acceptance for use. Therefore, the Da Nang People’s Court ruled that if “the parties have agreed that the defects liability period is calculated from the date of acceptance for construction completion and operation, then the defects liability period has not yet begun if the parties have not signed the acceptance minute”.

The Courts’ approaches to the commencement of the defects liability period

However, both of the Courts’ approaches present problems:

Firstly, if the defects liability period is considered to begin when the parties agree on the completed volume, value, and account reconciliation, this would render the final settlement process unnecessary for determining these figures. This is because all matters related to volume, value, and account reconciliation are already clearly recorded in the interim payment documents. Consequently, the agreement or reconciliation of these matters has no bearing or intrinsic link to the commencement of the defects liability period.

Secondly, the Da Nang Court’s approach, which holds that the defects liability period has not yet commenced because an acceptance minute has not been signed, places the Contractor at an extreme disadvantage. Although the Law on Construction stipulates that the Employer has an obligation to accept completed works, it does not specify a remedy if the Employer intentionally delays this acceptance. Thus, by following the Da Nang Court’s ruling, a Contractor could be held indefinitely liable for defects until the Employer agrees to an acceptance and signs the certificate.

Furthermore, in the specific context of Appellate Judgment No. 16/2022/KDTM-PT dated 15 June 2022, the Defendant had already issued a notice to suspend the contract. Therefore, the Da Nang People’s Court’s requirement for an acceptance minute to commence the defects liability period was not in line with the actual performance of the contract.

International Perspective

Disputes related to the release of retention money are a common concern, not only in Vietnam’s construction market but also in other jurisdictions.

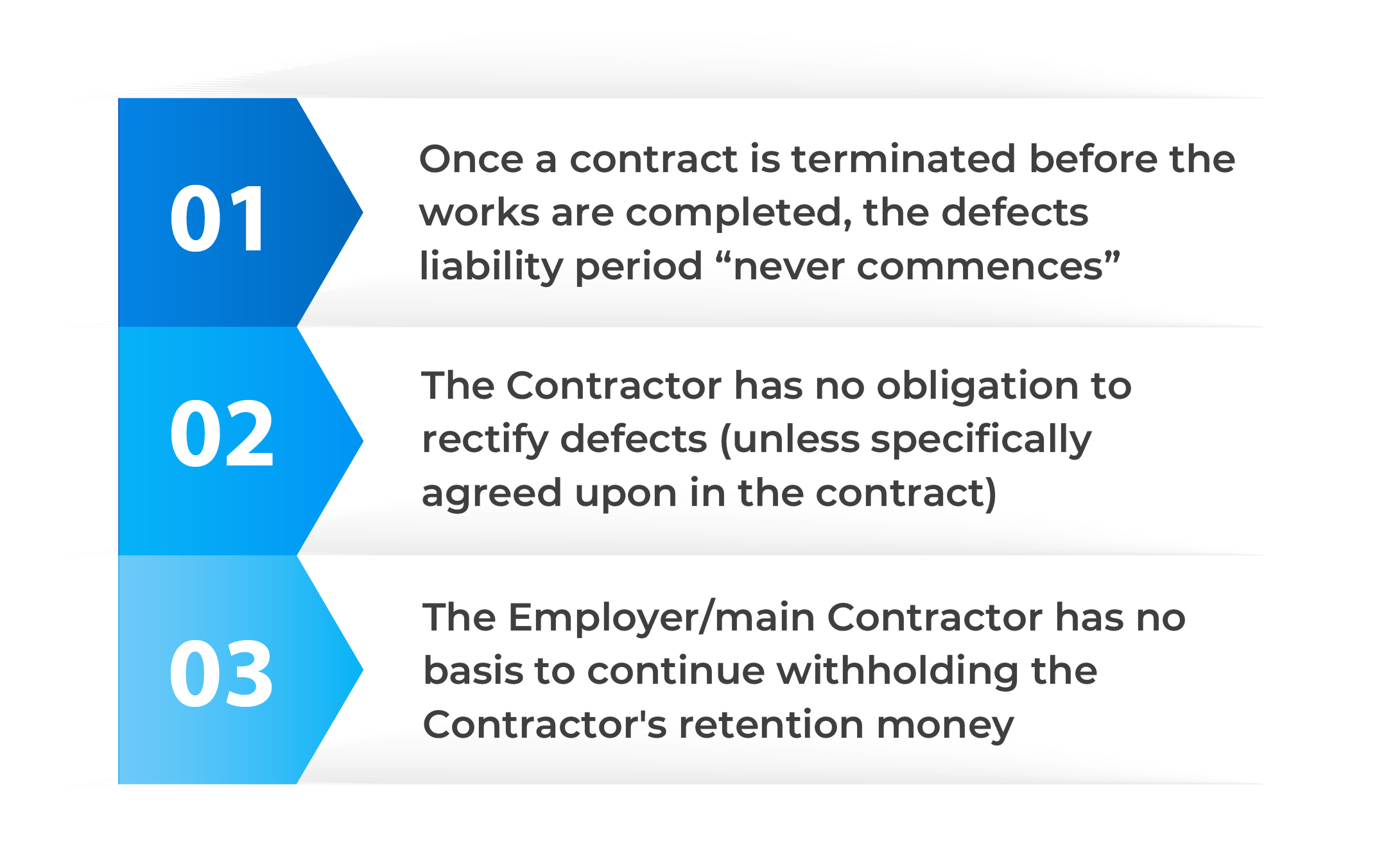

In the case of Harji Engineering Works Private Limited v. Punjab and Sind Bank & Anr, the High Court of New Delhi, India, when examining the Defects Notification Period (DNP), concurred with Dr. George’s view that once a contract is terminated prematurely, the provision regarding the defects liability period cannot be applied.

“…the defect liability period by its very nature begins after the work is completed. However, in the present case, the work having been terminated, there is no question of the expiry of the defect liability period for invocation of the BGs.

Similarly, in the case of Harvinder Singh & Co. (supra), this Court has inter-alia held that when a construction contract is terminated much prior to the completion of the work, the defect liability period would not have begun to run.”

From this, the New Delhi High Court highlighted three relatively important points concerning defects liability in the context of a prematurely terminated contract:

- Once a contract is terminated before the works are completed, the defects liability period “never commences”.

- Consequently, the Contractor has no obligation to rectify defects (unless specifically agreed upon in the contract).

- Simultaneously, the Employer/main Contractor has no basis to continue withholding the Contractor’s retention money.

Three key points from the New Delhi High Court regarding defects liability in the context of a prematurely terminated contract

Our View and recommendation

From our experience in construction disputes, we believe that when works are complete in practice but have not been formally accepted, the start of the defects liability period should be treated similarly to the date of acceptance. In such cases, this date should be the date on which the contract is officially terminated.

At that point:

- The contractor has withdrawn from the project;

- The executed volume is final, with no further works to be performed;

- Ownership of the works reverts to the Employer.

However, this approach is only viable where one party has formally terminated the contract. If the contract is still ongoing, it is difficult to identify another date equivalent in nature to formal completion and handover, leaving the contractor exposed to greater risk.

Conclusion

The issue of release of retention money is just one example of the many complex, technical disputes that can arise in the construction sector. The absence of detailed, clear legal provisions makes it challenging for contracting parties to find common ground when disputes occur.

Written by

|

Le The Hung | Managing Partner

Tel: 0916 545 618 Email: hung.le@cnccounsel.com |

|

Kieu Nu My Hao | Associate

Tel: (84) 28 6276 9900 Email: hao.kieu@cnccounsel.com |

|

Nguyen Le Anh Thu | Legal Assistant

Tel: (84) 932 705 676 Email: thu.nguyen@cnccounsel.com |

[1] Clause 7, Article 28 of Decree 06/2021.

[2] Clause 5, Article 28 of Decree 06/2021.

Disclaimers:

This article has been prepared and published for the purpose of introducing or informing our Clients and potential clients on information pertaining to legal issues, opinions and/or developments in Vietnam. Information presented in this article does not constitute legal advice of any form and may be adjusted without advance notice.

Pingback: FIDIC Contract Training Course at CC1 – CNC | Công ty Luật TNHH CNC Việt Nam