Choosing the Right Business Structure in Vietnam

#1. Why Choosing the Right Business Structure in Vietnam Matters

Choosing the right business structure in Vietnam is one of the most critical decisions every foreign investor must make. Before asking “where to invest” or “how much capital to commit”, investors should first determine “how to enter the Vietnamese market” — that is, through which business structure or investment vehicle.

Vietnam’s legal framework allows a diverse range of business structures and investment channels, each designed for specific commercial purposes and levels of control. Foreign investors can participate through the following main forms:

- Equity investment – buying shares or contributing capital in existing Vietnamese companies (including listed firms on HOSE, HNX, UPCoM).

- Direct establishment – setting up new entities such as LLCs, JSCs, branches, or representative offices.

- Contractual or hybrid models – Business Cooperation Contracts (BCCs) and Public-Private Partnerships (PPPs) for infrastructure or energy projects.

- Other investment vehicles – venture-capital funds, franchise systems, and indirect portfolio investments through licensed managers.

A wide range of business structure in Vietnam

Each business structure in Vietnam follows its own regulatory framework, licensing procedure, and governance requirements. Selecting the right form of business entity directly affects your control, compliance obligations, and ability to repatriate profits.

This article focuses specifically on business structures in Vietnam that allow investors to conduct business operations directly – that is, entities through which foreign investors can carry out commercial activities, hire employees, sign contracts, and generate revenue.

Other investment methods – such as portfolio investment through the Vietnam stock market, public–private partnership (PPP) projects – will be covered in a separate feature in CNC Insights’ Investing in Vietnam series.

At CNC, we approach this strategically: What do you want to achieve in Vietnam — and which business structure gets you there fastest, safest, and most profitably?

#2. How Urgent Is Your Market Entry?

Once you’ve determined that generating profit in Vietnam is essential, the next question is how soon you must begin – and which business structure in Vietnam best enables you to do so lawfully and efficiently. If you plan to earn revenue, sign contracts, or hire, forming a foreign-invested company in Vietnam becomes essential, and timing becomes decisive.

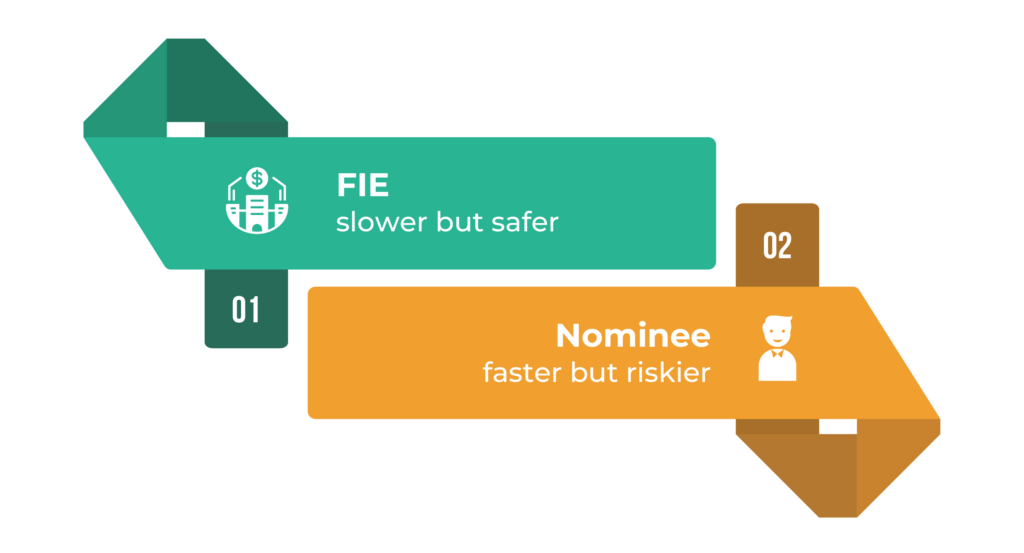

Two Pathways to Establish a Company

Two pathways to incorporate a company in Vietnam

Direct Establishment by the Foreign Investor

- Apply for both Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC).

- Duration ≈ 45–90 days (longer for conditional sectors).

- Pros: transparent, compliant, direct ownership from day one.

- Cons: slower, administratively heavier.

Indirect Establishment via Local Nominee

- A trusted Vietnamese party first sets up a domestic company; later shares are transferred to the foreign investor.

- Pros: fast (≈ 2–3 weeks), immediate operations.

- Cons: legal risk if undocumented, extra transfer costs and FX steps.

Nominee Timeline and Costs

- Incorporation (2–3 weeks) – nominee registers company and signs Founders/Nominee Agreement with security mechanisms.

- Operation & Preparation (1–2 months) – initial activities; foreign investor opens capital account and prepares fund remittance.

- Transfer & Conversion (3–6 weeks) – share transfer, new IRC/ERC, and re-registration.

The full transition to foreign ownership ≈ 2½–3 months and incurs dual costs.

Treat the nominee model as a bridge, not a shortcut — secure it with escrow and legal protections.

> Insight: Direct setup offers clarity and compliance; nominee routes offer speed but require strong safeguards and timely capital planning.

#3. How Much Control Do You Need — and Which Corporate Form Fits Best?

As investment objectives become clearer, attention naturally shifts to selecting the appropriate business structure in Vietnam.

The Law on Enterprises 2020 (as amended) defines several types of business structures in Vietnam, from single-member and multiple-member limited liability companies to joint stock companies and partnerships. For foreign-invested companies in Vietnam, recognising these structural differences is key to balancing efficiency, governance, and legal certainty before investing.

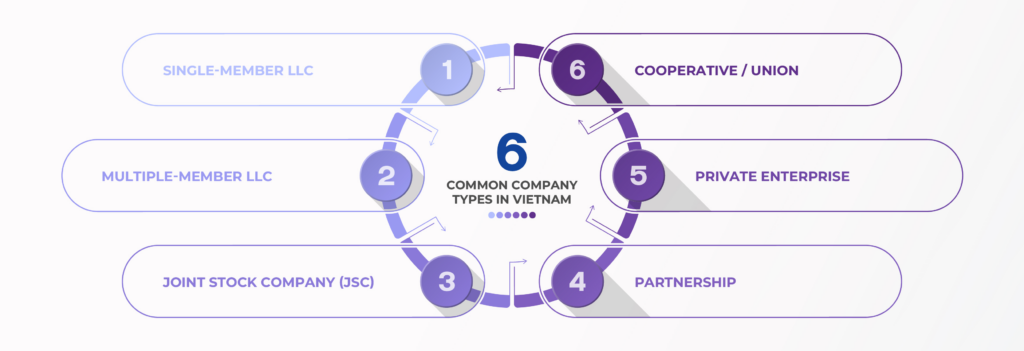

6 common company types in Vietnam

The Corporate Landscape in Vietnam

| Enterprise Type | Legal Personality | Ownership Structure | Eligible for Foreign Investors | Key Features |

| Single-Member LLC | ✅ | One owner (individual or organisation) | ✅ Common for 100 % FDI | Simple governance, sole control. |

| Multiple-Member LLC | ✅ | 2–50 members | ✅ | Joint-venture flexibility; restricted transfer rights. |

| Joint Stock Company (JSC) | ✅ | ≥ 3 shareholders | ✅ | Share issuance & capital mobility; preferred for M&A. |

| Partnership | ✅ | ≥ 2 general partners + limited partners | ⚠️ Rare for FDI | Unlimited liability for general partners. |

| Private Enterprise | ❌ | One individual | ❌ (Vietnamese only) | Owner personally liable. |

| Cooperative / Union | ✅ | Collective members | ⚠️ Restricted | Mutual-benefit entity; limited foreign participation. |

Among these, LLCs and JSCs dominate foreign investment activity. They are the standard vehicles for most commercial operations – from manufacturing and trading to services and technology.

Comparing the Main Corporate Forms for Foreign Investors

| Aspect | LLC (Single / Multiple) | Joint Stock Company (JSC) |

|---|---|---|

| Minimum Owners | 1 or 2–50 members | ≥ 3 shareholders |

| Capital Contribution | In kind / cash within 90 days after ERC | Same, but can issue shares publicly or privately |

| Governance | Owner(s) → Director → (Optionally) Members’ Council | Shareholders’ Meeting → Board → Director |

| Transfer of Equity | Requires approval of existing members | Freer transfer; subject to pre-emption rights |

| Fund-Raising Flexibility | Limited (capital increase by members) | High (share issuance, convertible notes, IPO) |

| Typical Uses | Wholly foreign-owned subsidiaries, JVs, SMEs | Large or scalable ventures, fund-raising projects |

| Compliance Burden | Lower | Higher (board meetings, audit, disclosure) |

Insight: LLCs deliver simplicity and tight control; JSCs offer growth and liquidity. Choose the right business structure based on whether your priority is management control or capital mobility.

Which Business Structures in Vietnam Are Most Common for Foreign Investors?

-

Wholly Foreign-Owned LLC (Single-Member) – by far the most prevalent. Ideal for investors seeking full control and a straightforward governance model.

-

Joint Venture LLC (Multiple-Member) – chosen when a Vietnamese partner is required by law (e.g., advertising, logistics) or provides strategic market access.

-

Joint Stock Company (JSC) – popular for medium-to-large investments, especially when future capital raising or M&A is planned. Many foreign investors convert an LLC into a JSC once operations scale up.

Other structures – Partnerships, Private Enterprises, and Cooperatives – exist but are rarely used by foreign investors because of liability exposure or participation limits.

Control Considerations

Control flows from both ownership structure and governance rights:

-

LLCs concentrate control in a single owner or a small group, with decisions usually made by written resolution — suitable for subsidiaries or small ventures.

-

JSCs distribute power among the shareholders’ meeting and a board of directors — more complex but enabling external investors and share options.

-

JVs within either form require precise drafting of the charter and joint-venture agreement to allocate voting thresholds, veto rights, and reserved matters.

Key Insight

In Vietnam, “control” isn’t defined by share percentage alone — it’s embedded in the company’s charter, governance design, and exit rights.

LLCs deliver simplicity and control; JSCs offer growth and liquidity.

The right choice depends on whether your priority is tight management or scalable expansion.

#4. Do You Need a Local Partner or Government Link?

In industries such as infrastructure, energy, and utilities, investors often turn to a Business Cooperation Contract (BCC) or Joint Venture Agreement — collaborative business structures in Vietnam that permit joint participation without establishing a new legal entity. These arrangements are widely applied in PPP projects and other public–private ventures where each party retains its own legal status.

- Pros: No incorporation; rapid deployment.

- Cons: Complex taxation, accounting, and exit mechanisms.

Such business structures in Vietnam are best suited when partnering with state-owned enterprises or local entities holding specific sectoral licences.

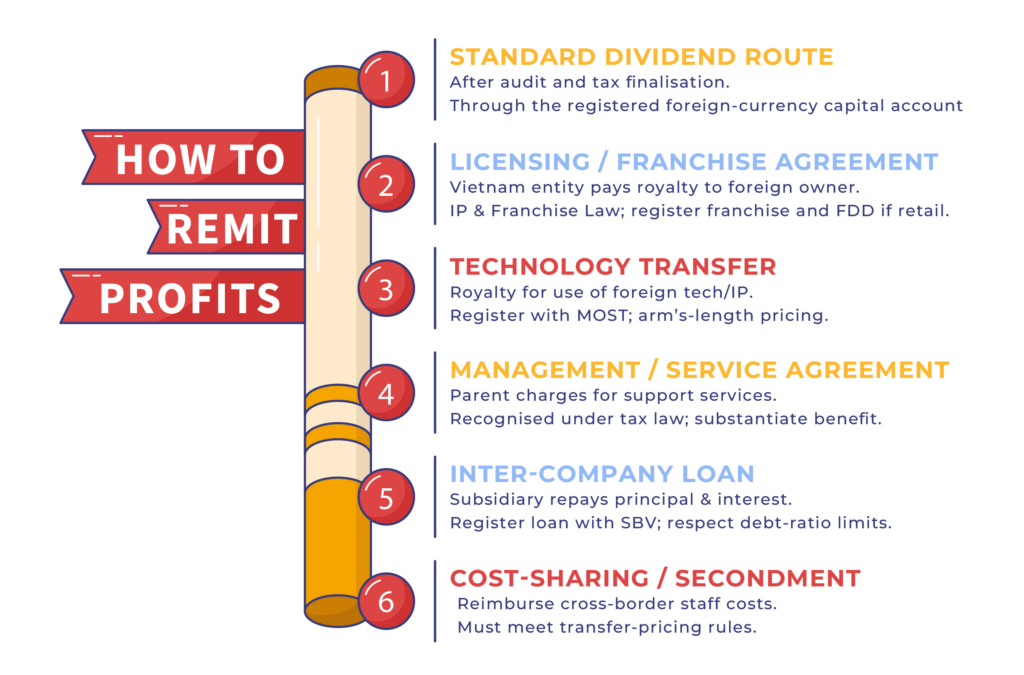

#5. How to Remit Profits Safely — and Build Lawful Alternatives

Profit repatriation is not optional — it is the end goal. In practice, the ease of transferring profits abroad is determined by the business structure in Vietnam you establish, and how well it aligns with investment licensing, tax, and foreign-exchange regulations.

Effective profit repatriation depends on the underlying business structure in Vietnam

Standard Dividend Route

- Allowed for FIEs and branches after audit and tax finalisation.

- Funds must flow through the registered foreign-currency capital account.

- Delays often stem from documentation errors or unregistered ownership (in nominee cases).

When Direct Repatriation Is Blocked

- Nominee company still domestic — outward transfer illegal.

- Funds introduced informally — no proof of capital origin.

- Licensing updates pending — profits frozen temporarily.

Lawful Alternative Mechanisms

| Mechanism | How It Works | Legal Basis / Notes |

| Licensing / Franchise Agreement | Vietnam entity pays royalty to foreign owner. | IP & Franchise Law; register franchise and FDD if retail. |

| Technology Transfer | Royalty for use of foreign tech/IP. | Register with MOST; arm’s-length pricing. |

| Management / Service Agreement | Parent charges for support services. | Recognised under tax law; substantiate benefit. |

| Inter-Company Loan | Subsidiary repays principal & interest. | Register loan with SBV; respect debt-ratio limits. |

| Cost-Sharing / Secondment | Reimburse cross-border staff costs. | Must meet transfer-pricing rules. |

Safeguards

- Plan early: Map payment flows before incorporation.

- Register: Capital accounts, loans, IP contracts.

- Substance: Real services or IP, not disguised dividends.

- Regularise: Formalise foreign ownership promptly.

Takeaway: Design multiple compliant channels for value return — dividends, royalties, service fees, and interest — so cash can flow even if one route faces delay.

#6. What’s Your Exit Plan?

Plan your exit before entry.

| Structure | Exit Flexibility | Notes |

| LLC/JSC | ✅ High | Share transfer or M&A sale. |

| Branch | ⚖️ Moderate | Simple closure; no equity value. |

| RO | ❌ None | Administrative presence only. |

| BCC | ⚖️ Project-based | Ends on completion; no resale. |

JSCs suit future fund-raising and exit through share sales or IPO.

#7. Comparing Business Structures in Vietnam — A Practical Overview

Vietnam’s legal framework offers several types of business structures in Vietnam, from representative offices and branches to limited liability companies and joint stock companies. This section compares these business structures in Vietnam from a practical perspective, helping investors identify which option aligns with their commercial objectives and timeline.

| Structure | Legal Personality | Ownership / Establishment | Profit Generation | Setup Time | Control & Flexibility | Ease of Repatriation | Key Advantages | Main Risks | Typical Users |

| Representative Office | ❌ | Direct license | ❌ | 2–4 wks | Low | N/A | Quick setup, simple reporting | No income generation | Market exploration |

| Branch | ❌ | Direct license | ✅ | 2–3 mos | High (parent) | Moderate (after audit) | Parent identity, no capital req. | Parent liable | Consulting, services |

| Single-Member LLC | ✅ | Direct / Nominee | ✅ | 1.5–3 mos (Direct) / ≈3 mos (Nominee) | Full | High | Simple governance | Capital controls & licensing | Wholly owned subsidiary |

| Multiple-Member LLC (JV) | ✅ | Direct | ✅ | 2–4 mos | Shared | High | Combines local & foreign inputs | Transfer approval needed | JV in restricted sectors |

| Joint Stock Company | ✅ | Direct | ✅ | 2–4 mos | Flexible | High | Scalable, fund-raising, M&A | Higher compliance | Large projects |

| BCC | ❌ | Direct (contractual) | ✅ | 1–2 mos | Shared by contract | Complex | No entity, PPP-ready | Tax complexity | Infrastructure projects |

| Nominee Domestic Co. | ✅ | Indirect | ✅ | 2–3 wks (+ transfer phase) | Indirect (control by contract) | Restricted until conversion | Quick start | Legal risk, double cost | Fast-moving investors |

Insights:

- The progression RO → Branch → Company mirrors market-commitment growth.

- LLCs & JSCs dominate foreign investment.

- Nominee structures are bridges, not shortcuts.

- Proper licensing and capital account setup determine repatriation ease.

#8. Hidden Legal and Compliance Considerations

Check early:

- Investment registration and sector licences

- Charter capital adequacy

- Office lease & land use

- Labour & work-permit compliance

- Tax and transfer-pricing records

Regulators increasingly scrutinise beneficial ownership and AML compliance — transparency and documentation are non-negotiable.

#9. Common Investor Scenarios & Recommended Business Structures in Vietnam

Because there is no single “one-size-fits-all” model, understanding how business structures in Vietnam apply to different investor types is essential. This section outlines common investor scenarios and the corresponding types of business structures in Vietnam that best support their market entry and growth strategies.

| Investor Profile | Goal | Recommended Structure | Why |

| Market Explorer | Test demand / liaison | Representative Office | Fast and low cost |

| Regional Service Firm | Consulting, IT, logistics | Branch or LLC | Revenue + brand continuity |

| Manufacturer / Trader | Import / export | Wholly Foreign-Owned LLC | Independence + profit repatriation |

| Infrastructure Investor | PPP / concession | BCC or JV | Legal flexibility + local tie |

| Fast-Moving Investor | Immediate entry | Nominee Local Co. | Speed + later conversion |

| Strategic Partner / JV | Shared venture | JV LLC or JSC | Risk sharing + market access |

#10. Choosing the Right Business Structure in Vietnam

The following decision framework guides investors through the key questions to identify the most suitable business structure in Vietnam for their planned operations.

Step 1 — Purpose

- Q1: Do you need to generate revenue / sign commercial contracts?

- No → Set up a Representative Office (RO). (Stop.)

- Yes → Go to Step 2.

Step 2 — Speed to Market

- Q2: Do you need to start operating within ~30 days?

- Yes → Consider a Nominee Domestic Company as a temporary bridge. Plan conversion to FDI in 2.5–3 months. Go to Step 3.

- No → Proceed with Direct FDI (IRC → ERC). Go to Step 3.

Step 3 — Sector Conditions

- Q3: Is your sector conditional/restricted or better navigated with a Vietnamese partner?

- Yes → Lean toward a Joint Venture LLC (or BCC for project/PPP style). Go to Step 4.

- No → Wholly Foreign-Owned remains fully viable. Go to Step 4.

Step 4 — Mode of Operation

- Q4: Is your activity primarily services delivered under the foreign parent’s brand, with limited need for local asset ownership or trading?

- Yes → A Branch of the foreign company may fit (parent liability; service-heavy). Alternatively, a WFOE LLC for limited liability. Go to Step 5.

- No / Trading–Manufacturing–Distribution → Company (LLC/JSC) is generally required. Go to Step 5.

Step 5 — Control vs Partnership

- Q5: Is tight control your priority?

- Yes → Single-Member LLC (100% foreign-owned). Go to Step 6.

- No / Shared control OK → Multiple-Member LLC (JV) or JSC. Go to Step 6.

Step 6 — Scale & Capital Strategy

- Q6: Do you expect future fund-raising, ESOP, M&A exits, or multiple investors?

- Yes → JSC (share classes, convertibles, easier transfers/exit). Go to Step 7.

- No → LLC (single or multiple member) for simplicity. Go to Step 7.

Step 7 — Profit Repatriation Plan (Design at Day 0)

- Q7: Are dividends alone sufficient for returning value?

- Yes → Ensure capital account, audit/tax finalization workflow, and compliance calendar are set. Go to Step 8.

- No / Want redundancy → Add lawful alternatives. Keep transfer-pricing files and registrations (SBV/MOST/franchise) ready. Go to Step 8.

Step 8 — Nominee Pathway (If Used)

- Q8: Are you using a Nominee to enter fast?

- Yes → Lock the three-phase timeline and protections today:

- Nominee Incorporation (2–3 wks) + Founders/Nominee Agreement, escrow/share pledge.

- Operate & Prepare (1–2 mos): open capital account, line up IRC, remittance docs.

- Transfer & Convert (3–6 wks): share transfer, new IRC/ERC, re-register tax/bank.

Also pre-draft SHA/Charter for post-conversion governance. Go to Step 9.

- No → Go to Step 9.

- Yes → Lock the three-phase timeline and protections today:

Step 9 — Governance & Risk Controls

- Q9: Do you have board/owner reserved matters, vetoes, transfer restrictions, deadlock rules, and exit mechanics written into the Charter/SHA?

- Yes → Go to Step 10.

- No → Draft now (this is where “control” truly lives).

Step 10 — Exit Route

- Q10: Is your preferred exit feasible under the chosen structure?

- JSC → Easiest for share deals/IPO.

- LLC → Simple for controlled groups; transfers require approvals.

- Branch → Easiest to close; no equity value.

- BCC → Ends by contract/project; no equity resale.

Confirm dealability before you incorporate. (Stop.)

#11. Final Thoughts

Choosing among the various business structures in Vietnam is not just about compliance — it’s about strategy.

Your choice shapes how fast you can act, how much control you retain, and how easily you can repatriate profits or exit.

At CNC, we often remind clients:

In Vietnam, the right structure isn’t just legal — it’s strategic.

💼 Ready to Choose the Right Business Structure for Your Vietnam Investment?

Each investor’s path to Vietnam is unique — the right business structure in Vietnam depends on your purpose, timeline, and long-term growth plan.

Our experienced lawyers can help you design the most suitable business structure in Vietnam, and manage every stage of the process — from company incorporation and licensing to ongoing corporate compliance.

📞 Call us: +84 (28) 3823 9399 | Hotline: 0196 545 618

📧 Email: contact@cnccounsel.com

🧾 Website: https://cnccounsel.com

📚 Explore More of CNC’s Most-Viewed Articles on Doing Business in Vietnam

You may also like some of our most-read insights from CNC’s Investing in Vietnam series:

- Company Incorporation Costs in Vietnam — a detailed breakdown of setup procedures, capital requirements, and hidden costs.

- Franchise Legal Services in Vietnam — how to structure and register your franchise agreements lawfully.

- Beneficial Ownership under Vietnam’s Enterprise Law — a timely look at transparency and control requirements.