Introduction to legal issues involving Subcontractor and Subcontract

Presently, the majority of domestic contractors – even prominent ones – continue to serve as Subcontractors for foreign Principal Contractors or Main Contractors on important projects such as: airports, shipbuilding, infrastructure, renewable energy, or civil construction. However, issues such as subcontracting work, the subcontractor’s legal status, and intervention (influence and role, if any) of the Employer in such subcontracting of work remains worthy of contemplation.

A keen awareness of this concern emerged among many contractors, subcontractors and legal professionals when GS E&C unilaterally terminated a contract with Lithaco and requested the bank to perform their guarantee obligations[1]. This event produced a demand for clarification of the aforementioned issues so that potential disputes could and potentially would be prevented and thereby help save project implementation costs and reduce the negative impact on the progress of construction.

This article acknowledges 3 main topics:

- The Law of Vietnam on Subcontractors as well as Subcontracts;

- Action taken by parties considering the absence of legal regulations on Subcontractors and Subcontracts;

- Recommendations and solutions for harmonization of parties’ interest in subcontracts.

1. Legal regulations pertaining to Subcontractors

1.1. Definition of Subcontractor

Although viewed as a specialized law, neither the Law on Construction No. 50/2014/QH13 dated 18/06/2014 (“2014 Law on Construction”) nor the Law on Amendments to Construction Law (“2020 Law on Construction”) defines or clarifies the term “Subcontractor”. In total, this term is only mentioned 9 times in the 2014 Law on Construction and not once in the 2020 Law on Construction.

This “Subcontractor” term is only found in older legal documents, namely Article 3.25 of Law on Construction No. 16/2003/QH11 dated 26/11/2003 (“2003 Law on Construction” and Article 2.12 of Decree No. 37/2015/ND-CP dated 22/04/2015 (“Decree No. 37/2015”). Accordingly, it is defined as follows: “ A Subcontractor in construction is a contractor who has entered into a contract with either the main contractor or the principal contractor to undertake part of the work of the main contractor or the principal contractor”

Taking into account the above provisions, the first legal issue to be addressed is whether or not Lithaco could considered a subcontractor, since GS E&C entered into a contact with the Principal Contractor, Sumitomo – Civil Engineering Construction Corporation No. 6. According to the information conveyed by the media, Lithaco is considered a “second-tier subcontractor” – a fairly accurate term that entails the position and role of Lithaco, however, such terms are not recognized under the law of Vietnam.

Similarly, when Lithaco subcontracts part of their work – that work which was received from GS E&C to another or other contractors – what could these contractors be referred to as? Is it “third-tier subcontractors” or “n-tier subcontractors”? While “the cowl does not make the monk”, the absence of regulations governing these issues would likely result in multiple legal issues regarding interpretations of existing law, for example:

- Is the subcontracting of work by GS E&C to Lithaco in compliance with the Law of Vietnam? In other words, is the subcontract between GS E&C valid? This question also applies to the subcontracting of work by Lithaco to other subcontractors.

- If it is understood that the subcontracting of work by GS E&C to Lithaco is in compliance with the Law of Vietnam (or at least not null and void), is it also the same for the subcontracting of work by Lithaco to other subcontractors? This line of reasoning would also beg another question: What is the definite limitation for subcontracting of work?

Moreover, based on Article 3.1(i) Decree No. 37/2015, would an enterprise providing safety services (provision of staff and safety supervision to Lithaco), also be considered a Subcontractor? Or what about other enterprises providing plant, materials, and equipment to Lithaco, are they also considered Subcontractors?

Furthermore, if they are considered Subcontractors, are they subject to the regulations of the Law on Construction and its guidelines? If this interpretation is correct, it would result in a conflict of governing law since contracts for the provision of staff and safety supervision are strictly service contracts, directly subjected to the regulation of the Civil Code and the Labor Code.

Likewise, procurement contracts, either for lease or sale, of plant and equipment are simply ordinary lease contracts or sale and purchase contracts, and as such, they are directly governed by the Law on Commerce. That’s why retention money clauses are not required in these contracts and issues such as “payment-upon-paid” clauses do not often appear.

1.2 Nominated Subcontractor

Similar to how the term “Subcontractor” is defineed, the definition for subcontractors nominated by the employer (also known as “Nominated Subcontractor”) is non-existent throughout the 2014 Law on Construction, 2020 Law on Construction, or even the 2003 Law on Construction. At present, this term is only provided for in two legal documents, namely, Decree No. 37/2015 and Circular No. 09/2016/TT-BXD dated 10/03/2016 (“Circular No. 09/2016”).

Accordingly, nominated subcontractors are subcontractors who are nominated to the main contractor or the principal contractor by the employer to perform a portion of the specialized work with high technical requirements or when the main contractor/principal contractor fails to meet the requirements on safety, quality, and contract implementation progress set by the employer

However, the above definition has several flaws pertaining to both its approach and scope as follows:

- Firstly, the aforementioned definition has the potential of being arbitrarily abused due to requirements such as “specialized work with high technical skill requirements” and “fails to meet the requirements on safety, quality, contract implementation progress” are not thoroughly clarified.

- Secondly, requirements such as “specialized work with high technical skill requirements” and “fails to meet requirements” are not necessarily the basis for the Employer to nominate subcontractors

- Thirdly, assuming that these requirements truly are the reason for the nomination of subcontractors by the employer so that the project/package could be “salvaged” when the main contractor or the principal contractor fails to perform their obligations (such as delay), what happens if the nominated subcontractor (i) also fails to meet the requirements on safety, quality, contract implementation progress; (ii) is rejected by the main contractor/principal contractor; (iii) gets into a dispute with the main contractor/principal contractor. Furthermore, in case there exist disputes between the Nominated Subcontractor and the Main Contractor/Principal Contractor, is the Employer responsible for the resolution of such disputes? If that is the case, wouldn’t it be an unreasonable responsibility that the Employer has to bear? And more importantly, how would such interpretations be applied in the context that the Employer is funded by the state or the Employer is a state agency?

Meanwhile, it should be noted that the appointment of nominated contractors has long served the purpose of performing part of the work of the project/package in advance while awaiting the appointment of the main contractor/principal contractor or maintaining continuity when the Employer had relied on part of the Subcontractor’s design and the appointment of that Subcontractor is vital.[2]

Learn more about Nominated Contractor via this article

1.3 Subcontract

Despite their importance, Subcontracts have not been accorded sufficient attention under the laws of Vietnam. This issue is demonstrated via two aspects as follows:

- Firstly, regarding stipulations on subcontracts, the law of Vietnam practically has no specific provision for Subcontracts aside from Article 47 of Decree 37/2015. This demonstrates that stipulations on subcontracts are still lacking.

- Secondly, regarding model forms for subcontracts, while model forms for construction contracts are continuously promulgated and updated by the Ministry of Construction, no such forms exist for subcontracts. This has been the trend initiated from the Ministry of Construction’s promulgation of model forms for construction contracts enclosed with Dispatch No. 2507/BXD-VP and Dispatch No. 2508/BXD-VP dated 26/11/2007 and followed by model forms for construction contracts enclosed with Circular No. 09/2011/TT-BXD dated 28/06/2011, Circular No. 09/2016/TT-BXD dated 10/03/2016.

Furthermore, the Ministry of Construction also promulgated Circular No. 30/2016/TT-BXD dated 30/12/2016 on guidelines for engineering, procurement, and construction contracts. At the same time, the Ministry of Planning and Investment also introduced a series of popular contract forms used in bidding, especially, the Model Form for Contracts for Construction enclosed with Circular No. 03/2015/TT-BKHDT dated 06/05/2015 and Circular No. 30/2016/TT-BKHDT dated 26/07/2016, which is recommended for use in conjunction with EPC/ Turnkey Contracts published by the International Federation of Consulting Engineers (“FIDIC”)

In other words, there is a large rift between the treatment of subcontracts and construction contracts with main contractors/principal contractors under the law of Vietnam

>>>Learn more about Construction Contracts in Vietnam via this article.

2. Practical implementation

2.1 Back-to-back obligation

To ethically or legally avoid liability or to prevent risks relative to or originating from faults attributable to subcontractors in general and nominated subcontractors in particular, main contractors and principal contractors often utilize a method known as back-to-back obligations.

Up to now, Vietnamese law in general and in legal practice in particular do not provide for “back-to-back obligations”, whether in forms of detailed guidelines or even a simple definition. However, from observing their nature, back-to-back obligations are understood to be the transfer of obligations of one party (usually the principal contractor or the main contractor in this context), toward another party (specifically, the employer) to other third parties (the subcontractors)

Meanwhile, the obligation of the subcontractor is to completely grasp the obligations and responsibilities of the main contractor/principal contractor, thus enabling them to flawlessly perform these obligations and prevent breach of subcontracts that would subsequently constitute an obligation violation by the main contractor/principal contractor under the main contract[3]

Regarding their manifestation, there are four common applications of “back-to-back obligations by main contractors/principal contractors, namely:

First, the time for completion of works, in particular, and the time of completion of any other subcontractor’s obligation, under any interpretation or any agreement, must not exceed (be later than) the time of completion of work, the time of completion of any other obligation of the main contractor/principal contractor under the main contract.

Second, the subcontractor is responsible for all damages and/or losses that the main contractor/principal contractor is required to compensate for to the employer. These damages or losses have yet to include other potential damages and losses that the main contractor/principal contractor might incur, such as costs for extensions of time for completion or claims against the main contractor/principal contractor by other contractors

Third, the main contractor/principal contractor is only obligated to make payment to the subcontractor when the former has received payment from the employer (payment upon being paid)

Fourth, the dispute resolution results between the employer and the main contractor/principal contractor under the main contract is the result for the dispute between the main contractor/principal contractor. Conversely, the subcontractor is unable to independently initiate a lawsuit against the main contractor/principal contractor if no lawsuit relevant to dispute between the two parties has been filed by the main contractor/principal contractor.

2.2. Appointment of Nominated Subcontractor

With these existing legal issues, a new approach to the appointment of a Nominated Subcontractor should be adopted, especially regarding the following aspects:

Firstly, should the main contractor/principal contractor be entitled to Profits and Attendance (PA) when they accept the appointment of nominated subcontractor? If so, is there a basis and method for calculation of PA? How would the payment of PA to the main contractor/principal contractor be made? (one-time payment immediately upon the nominated subcontractor’s appointment or completion of work or periodic interim payment based on the volume of work done under the main contract/principal contract?)

Secondly, what are the utilities or responsibilities that the main contractor/principal contractor must provide or maintain at the construction site for the subcontractor’s usage (either free or charged per agreement)? In practice, the list of utilities

Thirdly, what are the bases for the main contractor/principal contractor to reject the appointment of a nominated subcontractor?

Fourthly, performance bond, advance payment guarantee provided

None of the above questions have been satisfied by the laws of Vietnam at the moment.

2.3. Actions taken by the Subcontractor

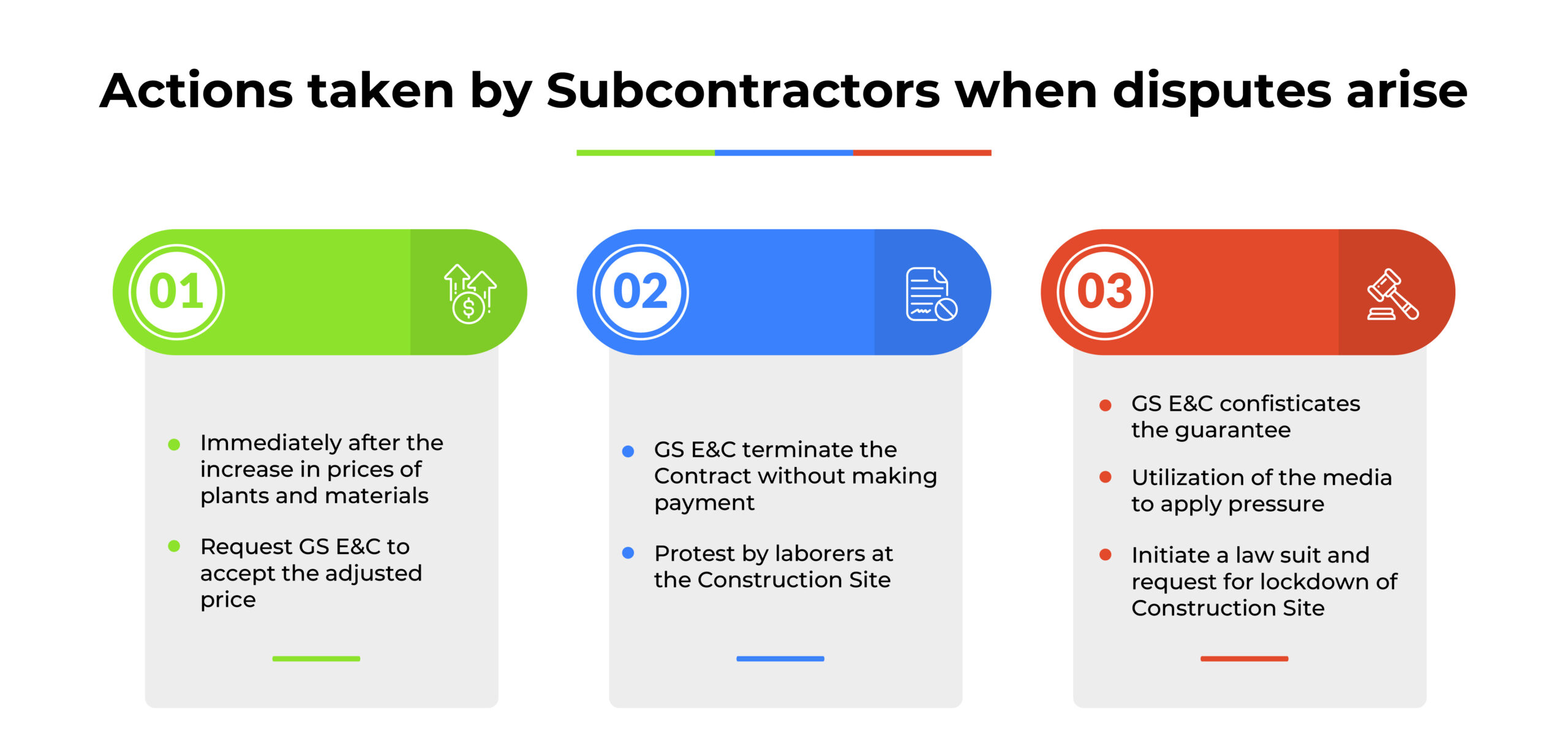

In order to resolve the disputes, the action takens by Lithaco could be summed up via the following chart[4]:

Actions taken by Subcontractors when disputes arise

Against pressure from Lithaco, the media, and (certain) interventions from the Employer, GS E&C has exercised certain restraint, especially the cease of request for the fulfillment of guarantee obligations by the bank to facilitate the resolution of disagreements between parties[5]. This demonstrates that the actions taken by Lithaco achieved certain effectiveness.

However, among the actions mentioned above, the legal measures are rather unclear and obscure; the dispute resolution is not explicitly showcased; the argument and reasoning given by Lithaco are not really all that convincing. This is demonstrated via the following aspects:

Firstly, any increase in material prices due to the market condition, pandemic outbreak or any other element, does not automatically empower Lithaco to readjust the unit price or the contract price. Furthermore, the increase in material prices itself could not explain the procrastination or delay in completion of work, as such, this could not be a reason for Lithaco to deny their contractual obligations.

Secondly, notwithstanding whether the notice of contract termination by GS E&C is issued in accordance with the subcontract and whether the reasons for the notice of contract termination by GS E&C are convincing or not, GS E&C must take accountability for such action. Therefore, the mobilization and incitement of employees to protest at the site is not a reasonable approach, as it directly affects the legitimate rights and benefits of the Employer and the Project

Thirdly, the obligation of the guarantor is to perform the obligations that the guarantor has committed to. The performance of such obligations could not be and should not be made based on the effects on the public image, pressure from the media, or disruption of the project caused by Lithaco to force GS E&C to withdraw the payment request.

Although Lithaco’s actions against the contract termination and seizure of bank guarantee, from the legal perspective, is unclear and uncertain, these actions are rather typical and probably some of the most effective methods that Lithaco – as a subcontractor – could employ within the context of the Law of Vietnam on Subcontractor and Subcontract.

However, the above actions should not be encouraged nor supported. This is because the consequence of such actions is the public image and credibility of the Employer, the possibility of further delays in the project, the increase in expenses due to the prolongation of contract terms, and finally, the establishment of unnecessary precedents. A reasonable remedy to these issues would be to have the law account for the practical issues. This would not only protect the involved parties, but also establish the legal framework for the project to be implemented smoothly.

3. Recommendation and Solution

3.1. Selection of Appropriate Subcontract Model

As analyzed above, a model subcontract template should be promulgated by the Ministry of Construction and/or Ministry of Planning and Investment to act as the foundation for the sustainable development of subcontracting activities, thus preventing or limiting potential disputes from occurring. Drawing from the experience of countries worldwide is a worthwhile approach to consider.

On the other hand, the Conditions of Subcontract Templates published by FIDIC in 2011 (“FIDIC Contract 2011”) and Conditions of Subcontract Templates published by FIDIC in 2019 (“FIDIC Contract 2019”) are not really the best model to choose from, since these contract templates and their structures make plenty of references back to the main contract or the principal contract (which is FIDIC Contract 1999, FIDIC Pink Book 2010 or FIDIC Yellow Book 1999) and the principle of back-to-back obligations are mostly applied.

However, the approach and structure of conditions of subcontract templates published by FIDIC in 1994 (“FIDIC Contract) have certain differences and interesting ideas. Specifically, there is next to no reference to the main contract or the principal contract in the FIDIC Contract 1994, aside from Clause 12 [Subcontractor’s Equipment, Temporary Works and Materials]. In other words, FIDIC Contract 1994 is not restrictive regarding the conditions and bases of its application, regardless of which FIDIC contract the main contract or principal is based on. Therefore, FIDIC Contract 1994 could be a viable option for practical application in Vietnam

>> To learn more about FIDIC Contract 2011, please visit this article

>>> To learn more about FIDIC Contract 2019, please visit this article

3.2. Prohibition of Payment upon paid clause in Subcontract

From financial and legal perspectives, the fact that the principal contractors/main contractors are obligated only to pay the subcontractors upon receipt of corresponding payment from the employer should not be allowed. At the same time, any agreement on such a matter should be deemed null and void due to the following reasons:

Firstly, if it is allowed that the principal contractors/main contractors are only obligated to make payment to the subcontractor upon receipt of payment from the Employer, it would render the subcontractor unable to reliably make financial arrangements. The delay or procrastination of payment with time at large would directly affect the construction at the site, threatening to delay the entire project, and package. To put it simply, no party could perform business activities without a sustainable, predictable, and manageable financial source.

Secondly, if the principal contractors/main contractors are not obligated to make payment for the work done periodically by the subcontractors until the receipt of payment from the employer, the main contractors/principal contractors’ obligation to pay contractual benefits would no longer exist. In other words, the principal contractors/main contractors would no longer have any obligations or liabilities. Simultaneously, this would also mean that the main contractors/principal contractors are held harmless regardless of whether they are involved in the mistakes, violations, or causes that lead to the delay in payment from the employer. This contravenes the principle specified in Article 351, Civil Code 2015 on civil liability due to breaches of obligations

Thirdly, there are higher risks of disputes between subcontractors and the main contractors/principal contractors on the payment duration, payment value, interest rate, and rights to suspension of works and contract termination if the main contractors/principal contractors are entitled to this privilege. In fact, the United Kingdom is one of the many countries that banned this payment upon-paid clause.[6]

4. Conclusion

Overall, Vietnam’s Subcontractors and Subcontracts laws are still in their early stages and requires much refinement to be genuinely effective in their functions to reduce the possibility of disputes and prevent project implementation costs

Among the available solutions, the most important and feasible are the following three, (i) addition of the definition of Subcontractors in order to clarify the nature of a subcontractor; (ii) prohibition of payment upon paid clause in subcontracts, where the principal contractor or the general contractor pay only the subcontractor upon receipt of equivalent payment from the Employer; and (iii) promulgation of model forms for subcontracts based on FIDIC Contracts 1999 or other contract models.

Contact

Our team of experts are most honored to support Main Contractors, Principal Contractors, and Subcontractors in the resolution of disputes emerging from Subcontracts such as Completion of work delays, Extensions of Time for Completion, payment delays, and other legal issues.

To include your contribution to, “The Law of Vietnam on Subcontractors and Subcontracts” article, please contact:

CNC VIETNAM LAW FIRM CO. LTD

Address: 28 Mai Chi Tho Street, An Phu Ward, Thu Duc City, Ho Chi Minh City, Vietnam

Phone: (84) 28-6276 9900

Hotline: (84) 916-545-618

Email: contact@cnccounsel.com

Website: cnccounsel

Managed by

Le The Hung | Managing Partner

Điện thoại: (84) 916 545 618

Email: hung.le@cnccounsel.com

Nguyen Thi Kim Ngan | Partner

Điện thoại: (84) 919 639 093

Email: ngan.nguyen@cnccounsel.com

Disclaimer:

This article was prepared to be used for the purpose of introducing or informing clients about issues and/or developments of legal perspectives in Vietnam. The information presented in this article does not constitute advice of any kind and may be subject to change without prior notice.

List of Referenced Materials

- Law on Construction No. 16/2003/QH11 dated 26/11/2003

- Law on Construction No. 50/2014/QH13 dated 18/06/2014

- Law on Construction Amendment No. 62/2020/QH14 dated 17/06/2

- Decree No. 37/2015/ND-CP dated 22/04/2015

- Circular No. 09/2011/TT-BXD dated 28/06/2016

- Circular No. 09/2016/TT-BXD dated 10/03/2016

- Circular No. 30/2016/TT-BXD dated 30/12/2016

- Circular No. 03/2015/TT-BKHDT dated 06/05/2015

- Circular No. 30/2016/TT-BKHDT dated 26/07/2016

- Dispatch No. 2507/BXD-VP dated 26/11/2007

- Dispatch No. 2508/BXD-VP dated 26/11/2007

- Conditions of Subcontract published in 2011 by FIDIC, recommended for use in conjunction with FIDIC Red Book 1999, Pink 2010

- Conditions of Subcontract published in 2019, recommended for use in conjunction with FIDIC Yellow Book 1999

- Conditions of Subcontract published in 1994, recommended for use in conjunction with FIDIC Red Book 1987

- Housing Grants, Construction and Regeneration Act 1996, Section 133 (1)

[1] See more: https://tuoitre.vn/tong-thau-metro-so-1-neu-li-do-cham-dut-hop-dong-voi-nha-thau-phu-lithaco-20200512134133041.htm

[2] See more at: https://marketing.hsf.com/20/6452/landing-pages/newsletter-65—july-2014–e-.pdf

[3] Sub-Clause 1.3(a)(g) [Subcontract Interpretation], Sub-Clause 2.1 [Subcontractor’s Knowledge of Main Contract]. Sub-Clause 2.2 [Compliance with Main Contract], Conditions of subcontract published by FIDIC in 2011

[4] See more: https://tuoitre.vn/vi-sao-nha-thau-viet-nam-khieu-nai-nha-thau-chinh-goi-thau-cp2-metro-so-1-20200509142721415.htm

[5] See more: https://tuoitre.vn/nha-thau-han-quoc-o-tuyen-metro-so-1-rut-yeu-cau-thanh-toan-de-dam-phan-lai-20200520100657644.htm

[6] See more: http://constructionblog.practicallaw.com/conditional-payment-clauses-in-the-uk-and-middle-east/#:~:text=UK%3A%20prohibition%20on%20conditional%20payments%20For%20construction%20contracts,receiving%20payment%20from%20a%20third%20person%20is%20ineffective

Pingback: Principal Contracts: Noteworthy issues – CNC | Công ty Luật TNHH CNC Việt Nam