Law on Corporate Income Tax 2025: A Turning Point In Vietnam’s Tax Policy

On 14/6/2025, the National Assembly of Vietnam passed the Law on Corporate Income Tax No. 67/2025/QH15 (“Law on Corporate Income Tax 2025”), which takes effect on 1 October 2025. This is a turning point in the tax policy of Vietnam, as it signals the change from preferential treatment based on geographical factors to promotion of innovation and sustainable development.

Expanded Taxable Entities: No More “Grey Zones” in Market Presence

Previously, Vietnamese law lacked a clear mechanism for taxing foreign enterprises with no physical presence or permanent establishment in Vietnam but that still derived income from the domestic market. This legal gap was particularly evident in cross-border digital business activities such as e-commerce, digital service provision, and content distribution.

Under the Law on Corporate Income Tax 2025, all foreign enterprises that do not have permanent establishments but generate income in Vietnam – whether through digital commercial platforms, phone apps, cloud storage services, or online games – are required to register, declare, and pay Corporate Income Tax. This obligation applies regardless of the enterprise’s place of incorporation, as long as revenue is earned from Vietnamese consumers.

This also means that cross-border service enterprises – from digital film platforms, office application with subscriptions, online education services such as Netflix, TikTok, Sportify to the vast range of globally available applications – shall no longer be “unaffected” by the Vietnam’s tax system.

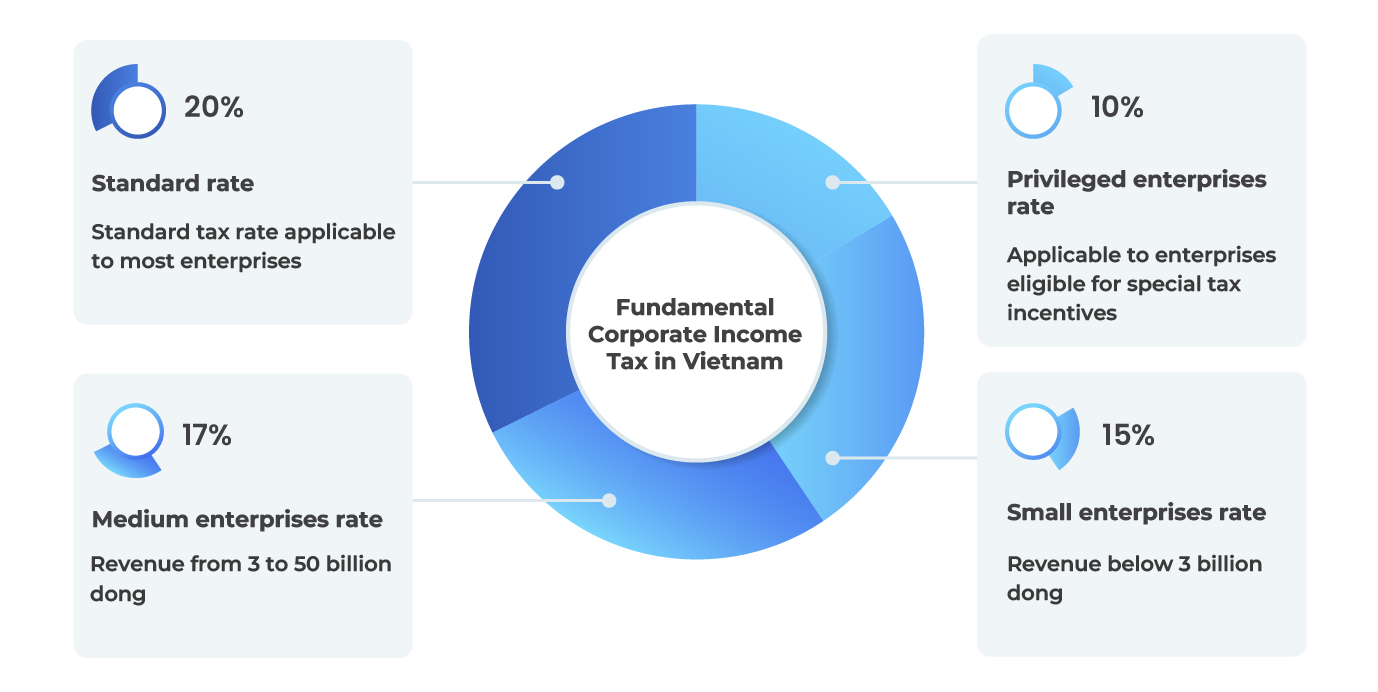

Preferential Tax Rates for Small and Medium Enterprises (SMEs)

Pursuant to Article 10, Law on Corporate Income Tax 2025, the standard Corporate Income Tax rate remains at 20%.

However, the Law on Corporate Income Tax 2025 has added tax incentives that allow small and medium enterprises to enjoy a lower tax rate as follows:

- Tax rate of 15% shall be applicable to enterprises whose total revenue in the previous consecutive tax period did not exceed 3 billion dong.

- Tax rate of 17$ shall be applicable to enterprises whose total revenue in the previous consecutive tax period exceeded 3 billion dong but did not exceed 50 billion dong.

This decreased tax rate is not applicable to SMEs that are affiliates of more prominent enterprises. For small enterprises and cooperatives whose revenue has been determined to not exceed 3 billion dong but could not determine the cost, and foreign enterprises with revenue generated in Vietnam, the applicable tax shall be proportionate to the revenue.

If SMEs are originated from household, they could be exempted from corporate income tax within 2 years of the first taxable revenue.

Fundamental Corporate Income Tax in Vietnam

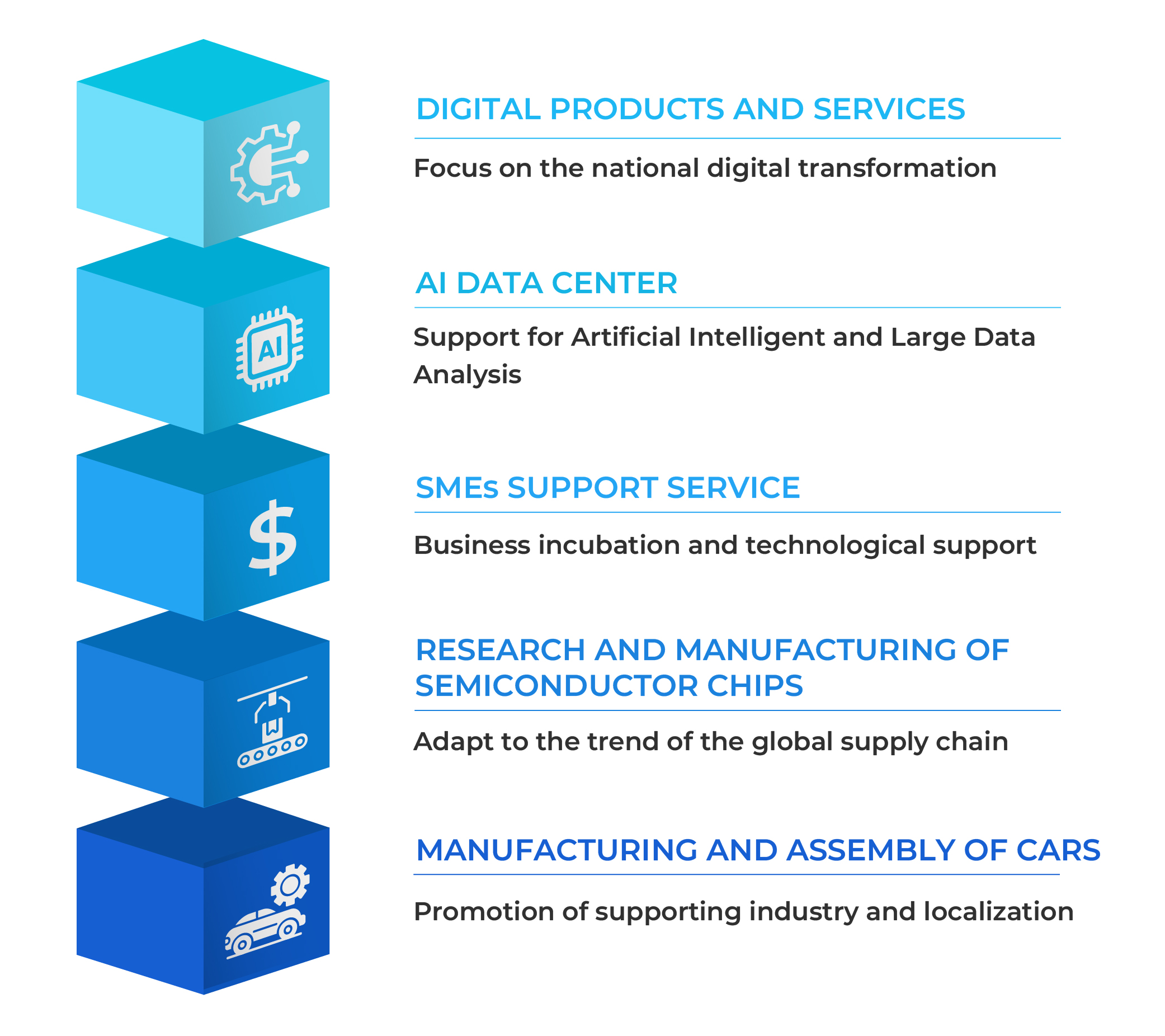

Expanded Sector-Based Incentives for Innovation and Sustainability

One of the most important points of Law on Corporate Income Tax 2025 is the expansion of the list of sectors eligible for tax incentives, the expansion especially focuses on advanced technology, innovation, and sustainable development support. To be specific, the new additions include:

- Key digital technology products and services that support national digital transformation.

- Research, development, design, manufacturing, packing, and testing of semiconductor chip, adapting to the trend of global technology supply chain shift

- Construction and operation of data center used for artificial intelligence (AI), digital infrastructure, and large data analysis.

- Manufacturing and assembly of car, promoting the supporting industries and increasing the localization rate.

- SMEs support service, such as business incubation, technological support and operation of coworking space.

This expanded focus clearly signals a shift from geography-based to innovation-driven ones, and aims to attract investment in high value-added sectors—enhancing Vietnam’s economic competitiveness in a deeply integrated global market.

Expansion of fields with Tax Incentives

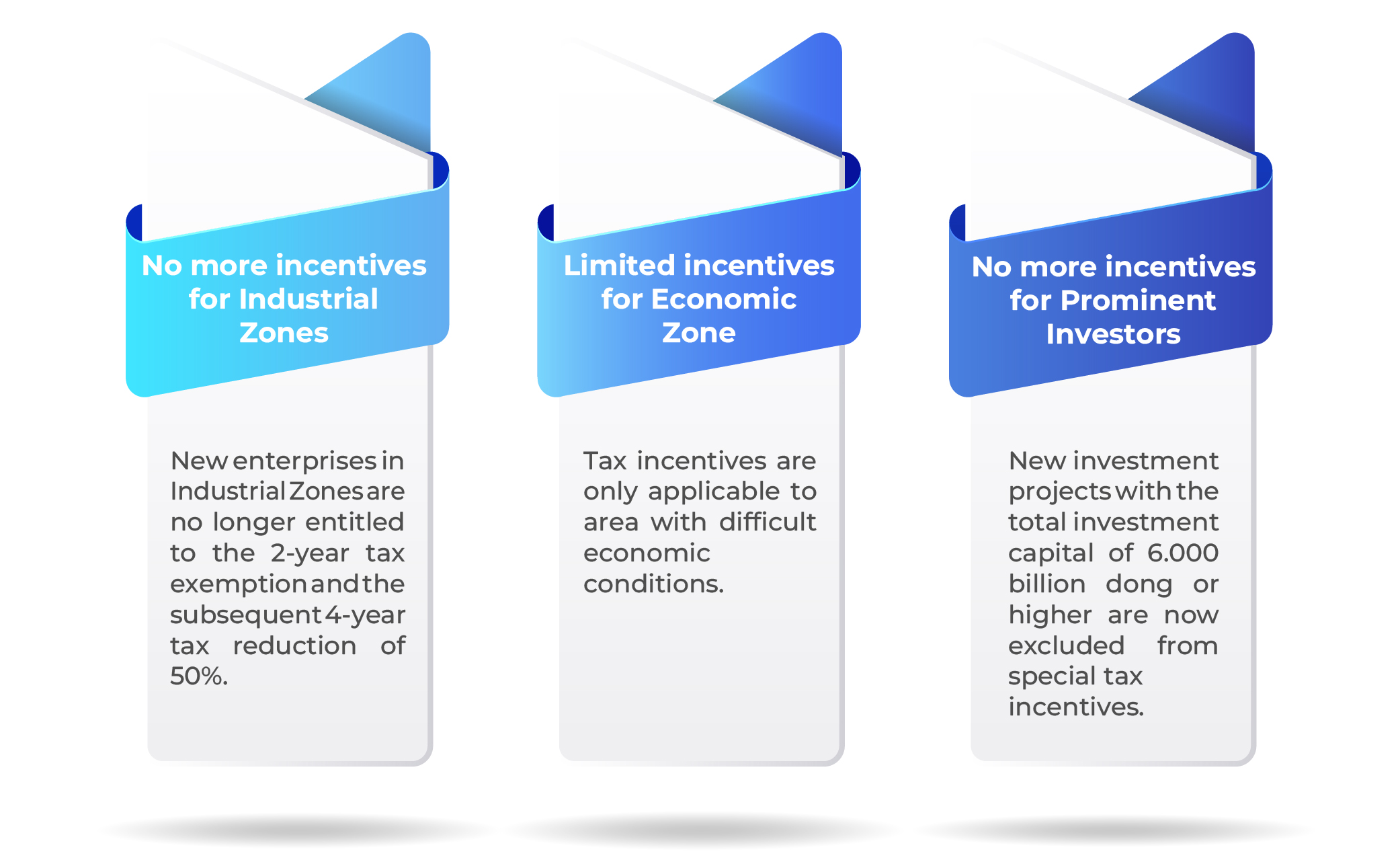

Elimination of Location-Based Tax Incentives (Industrial Zones)

According to Article 12, Law on Corporate Income Tax 2025, enterprises located inside Industrial Zones shall no longer enjoy CIT incentives merely based on geographical location. In other words, new investment projects or expanded projects located within Industrial Zones shall no longer qualify for the previously common incentives—2 years of tax exemption followed by 4 years of 50% tax reduction.

For economic zones, the tax incentives are also decreased and now only applicable to areas with difficult or extremely difficult socio-economic conditions.

Notably, new investment projects with the total investment capital of 6.000 billion dong or higher – which previously enjoyed automatic special tax incentives – are now no longer automatically eligible for corporate income tax incentives, unless they are in prioritized sectors or located in prioritized areas in accordance with the new laws.

These changes reflect the strategic change in the tax incentive policy of Vietnam: Instead of allocating the tax incentives equally based on the geographical factors, the new policy focus the resources on the areas in need of investment and high value sectors, thereby enhancing the effectiveness of the incentives and facilitating sustainable economic development

Change to the tax incentive policy

Transitional Provisions

The new Law on Corporate Income Tax 2025 maintains the grandfathering provision from previous regulations, allowing enterprises with existing investment projects currently enjoying tax incentives to choose between (i) continuing to apply the previously granted incentives or (ii) applying the new incentives under Law on Corporate Income Tax 2025, provided that all the requirements set by the new regulations are satisfied.

More notably, the law introduces a new and significant change: investment projects that were previously ineligible for tax incentives may now qualify for new incentives under this Law. This represents a meaningful departure from prior regulations.

Conclusion

The changes introduced under the Law on Corporate Income Tax 2025 represent a decisive shift in Vietnam’s tax strategy. These changes not only directly reshape the structure of tax incentives but also redefine how businesses approach investment planning, operations, and tax compliance in the coming period.

Both domestic and foreign enterprises are urged to proactively reassess their business models, update tax planning, and realign investment strategies to take full advantage of the new incentive framework, while ensuring strict compliance with tax obligations under the new law.

With the law taking effect on 1 October 2025, now is the critical time for businesses to prepare—by assessing financial and tax impacts, and adapting business strategies—to capitalize on new opportunities and mitigate risks amid a rapidly evolving regulatory landscape.

Contact Us:

For further information, please contact:

CNC Vietnam Law Firm

Address: The Sun Avenue, 28 Mai Chi Tho, Binh Trung Ward, Ho Chi Minh City, Vietnam

Phone : 028 6276 9900

Hotline: 0916 545 618

Email: contact@cnccounsel.com

Website: cnccounsel

We would be delighted to welcome you at CNC’s office, where you’ll have the opportunity to consult with the lawyer best suited to your circumstances. Of course, if you are unable to meet in person, simply email us via contact@cnccounsel.com or call us via (+84-28) 6276 9900.

It would be a pleasure for CNC’s lawyers to help you build a solid legal foundation, thus ensuring the success and sustainable development of your project!

Managed by

|

Tran Pham HoangTung | Partner

Phone: (84) 901 334 192 Email: tung.tran@cnccounsel.com |

|

Tran Thi Hanh Nhan | Associate

Phone: (84) 916 545 618 Email: nhan.tran@cnccounsel.com |

Disclaimers:

This article has been prepared and published for the purpose of introducing or informing our Clients and potential clients on information pertaining to legal issues, opinions and/or developments in Vietnam. Information presented in this article does not constitute legal advice of any form and may be adjusted without advance notice.