6 Key Highlights of the Draft Law on Business Investment Replacing the Law on Investment

Amidst the push for regime reformation and foreign investment attraction made by Vietnam, the Draft of the Law on Business Investment is expected to replace Law on Investment 2020, providing a more modern, transparent, and competitive legal framework. The draft focus on the simplification of the procedures, the reduction of the approval mechanism, the expansion of market access rights, and the increase in transparency, in order to promote a more advantageous and competitive investment environment.

This article shall analyze the notable points and the potential impact on enterprises and investors.

6 Key Highlights of the Draft Law on Business Investment Replacing the Law on Investment

1. Conditional business sectors: Generalization and transparency promotion

One of the notable points in the Draft of the Law on Business Investment is the addition of the definition of “Business investment condition” in comparison to Law on Investment. According to Article 7.2, Draft of the Law on Business Investment:

“Business investment conditions are requirements and conditions on the capability, expertise, personnel, facilities, and management system that individuals and/or organizations must satisfy in order to conduct business investment activities in conditional business sectors, however, do not include technical regulations and standards issued by the competent authorities on the quality of goods and services.”

This sets a clear delineation between business conditions and quality standards of goods/services, in the absence of which confusion is commonly observed in practice. The Draft of Law on Business Investment adopts the approach of providing general definition, which enables Government to give more detailed provision on business conditions by issuing lists of conditional business sectors, thus allowing the Government greater flexibility and proactivity in the control of the provision of conditions for some specific businesss sectors.

Furthermore, the draft require adequate announcement of information regarding sectors and investment requirements on the National Business Registration Portal pursuant to Article 7.8, Draft of the Law on Business Investment, contributing the development of a transparent and easy-to-approach legal environment.

2. Investment incentive policy: Focus on strategic projects

The Draft makes fundamental changes regarding the targets of investment incentive. Previously, the a detailed list of targets was provided Article 15.2 of the Law on Investment, which covers investment projects with the total capital of at least 6.000 dong, public housing construction projects, investment projects located in the countrysie, investment projects employing disabled workers, hi-tech enterprises, science and technology enterprises, innovative startup investment projects, innovation centers, research and development centers; investment into the product distribution chain of small and medium enterprises, etc.

Opting for another approach. the Draft of the Law on Business Investment provide a general definition of investment incentive targets, which include “Important investment project that require large amount of capital or high labor use pursuant to the decision of the Prime Minister”

The changes aim to consolidate the new direction of Laws only providing general issues, thereby allowing the Government greater flexibility in the determination of appropriate investment-incentivized sectors from time to time while also facilitating Ministries and ministerial-level agencies to review and narrow down the previously investment-incentivized sectors, ensuring the focus of the new investment incentive policy.

At the same time, the incentive remains applicable to both new investment project and project expansion, ensuring promotion of re-investment and expansion of business scale.

3. New direction for investment incentive

Regarding investment-incentivized sectors

List of investment-incentivized sectors has been expanded to encompass new fields such as development of value chain, industry clusters, circular economy, digital economy, innovation. This aligns with the trend of sustainable development and digital transformation in Vietnam, while also enhancing the competitive strength with respect to foreign investment attraction.

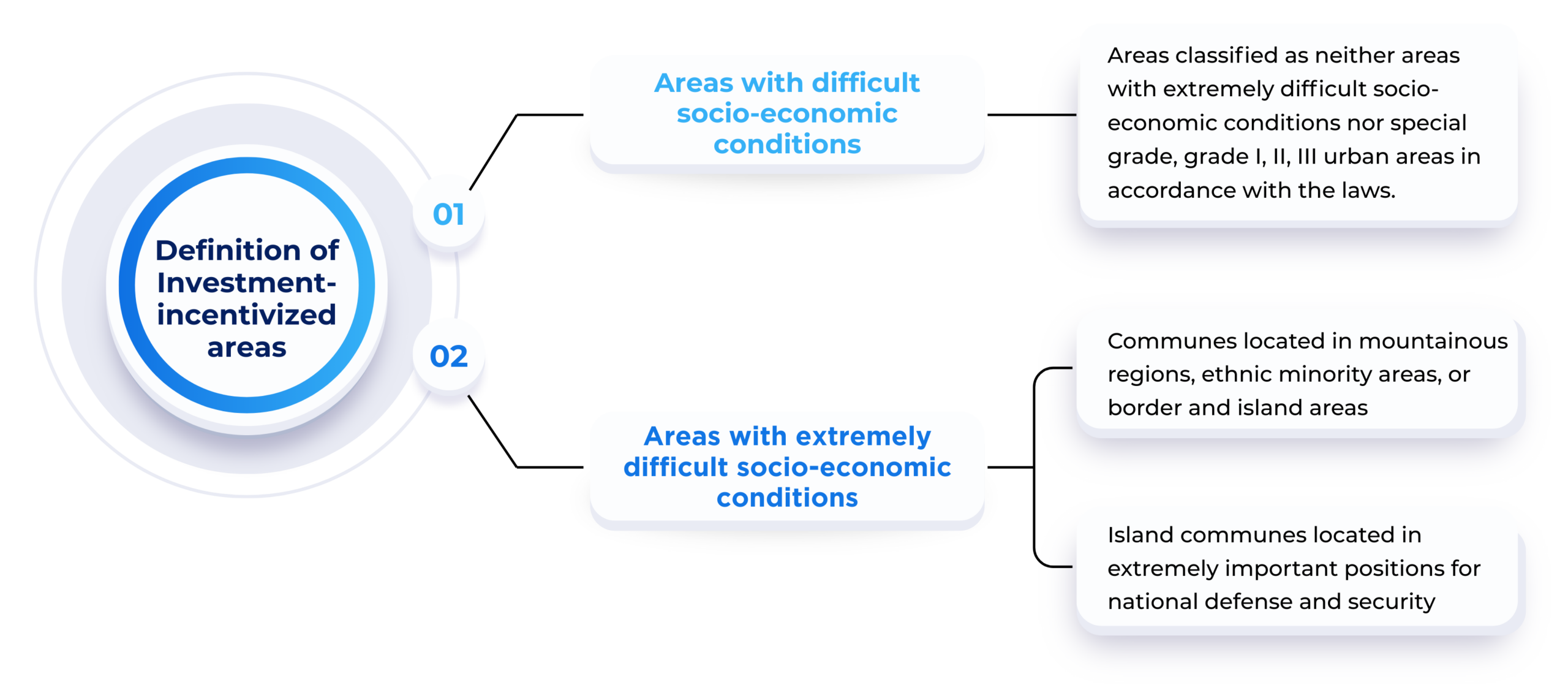

Regarding investment-incentivized areas

Not much changes are made to the provisions on investment incentivized areas aside from the detailed provision on areas with difficult socio-economic conditions and areas with extremely difficult socio-economic conditions.

According to Article 17.2, Draft of the Law on Business Investment, areas with extremely difficult socio-economic conditions include:

- Communes located in mountainous regions, ethnic minority areas, or border and island areas in accordance with the regulations of the Government/Prime Minister;

- Island communes located in extremely important positions for national defense and security; or island communes with particular natural conditions in accordance with the Government/Prime Minister;

Areas with difficult socio-economic conditions are areas classified as neither areas with extremely difficult socio-economic conditions nor special grade, grade I, II, III urban areas in accordance with the laws.

Definition of Investment-incentivized areas

4. Investment projects are no longer required for the establishment of economic organizations by Foreign Investors

Article 22 of the current Law on Investment reads “Prior to the establishment of an economic organization, foreign investors must have an investment project and perform the procedures for the issuance of or amendment to the Investment Registration Certificate, except for the establishment small and medium-sized start-up enterprises and start-up investment fund in accordance with the laws on support for small and medium enterprises.”.

Meanwhile, the Draft of the Law on Business Investment specifies that “Foreign investors might establish economic organization for the implementation of investment project prior to performing the procedures for the issuance of or amendment to the Investment Registration Certificate, provided that the market access conditions applicable to foreign investors pursuant to Article 9 of this Law are complied with throughout the procedures for the establishment of the economic organization ”

In comparison to the available regulations, the draft has introduced fundamental changes to the investment procedures applicable to foreign investors. This demonstrates that the draft is moving towards easing administrative procedures, increasing flexibility, and reducing preparation time for foreign investors, while still ensuring control mechanisms through market access conditions. However, the new provisions would also mean that further guidance should be provided so that legal risks could be avoided, for example: In the event that the Investment Registration Certificate could not be obtained for a project subsequent to the establishment of an economic organization, how should the established legal person be addressed?

5. Improvement to the investment guideline approval procedures

The Draft of the Law on Business Investment reviews and adjusts the authority over investment guideline approval held by the National Assembly, the Government, and the People’s Committees. The purpose is to reduce cases where projects require guideline approval, thereby reducing procedural time, easing the admistrative burden, and facilitating business investment activities. This is an important improvement that helps enhance the competitive strength of Vietnam’s investment environment.

To be specific, the Draft of the Law on Business Investment changes the authority for approving investment guidelines from the provincial People’s Committees to the Chairperson of provincial People’s Committees to ensure consistency with the principles on the organization and operation of local government in accordance with the Law on the Organization of Local Government.

Concurrently, this draft only stipulates the authority over investment guideline approval held by the Prime Minister and the Chairperson of provincial People’s Committees as projects that currently fall under the National Assembly’s approval authority have been delegated to the Prime Minister in order to streamline procedures. For projects of importance that require specific mechanisms or policies not yet provided for by law, or projects under the direction of the Politburo, the Secretariat of the Party Central Committee, the Government Party Committee, the Prime Minister shall approve the investment guidelines upon obtaining the consent of the Standing Committee of the National Assembly

Furthermore, as replacement for the People’s Committee, the Chairperson of provincial People’s Committee shall be responsible for the approval of the majority of projects in the area, especially projects that does not involve land bidding or contractor selection via bidding, which emphasize personal responsibility and expedite the processing time. At the same time, the Draft of the Law on Business Investment also specifies cases where approval of investment guidelines are not required in order to simplify the procedures and addresses issues arising out of the performance of this procedure pursuant to Article 26, Draft of the Law on Business Investment.

6. Simplification of offshore investment procedures

The draft has removed the list of conditional offshore investment sectors and specified the competent authority for the issuance of Offshore Investment Registration Certificate. The draft also makes corresponding changes to the provision on the authority over investment guideline approval held by the National Asembly, the government, and the People’s Committee.

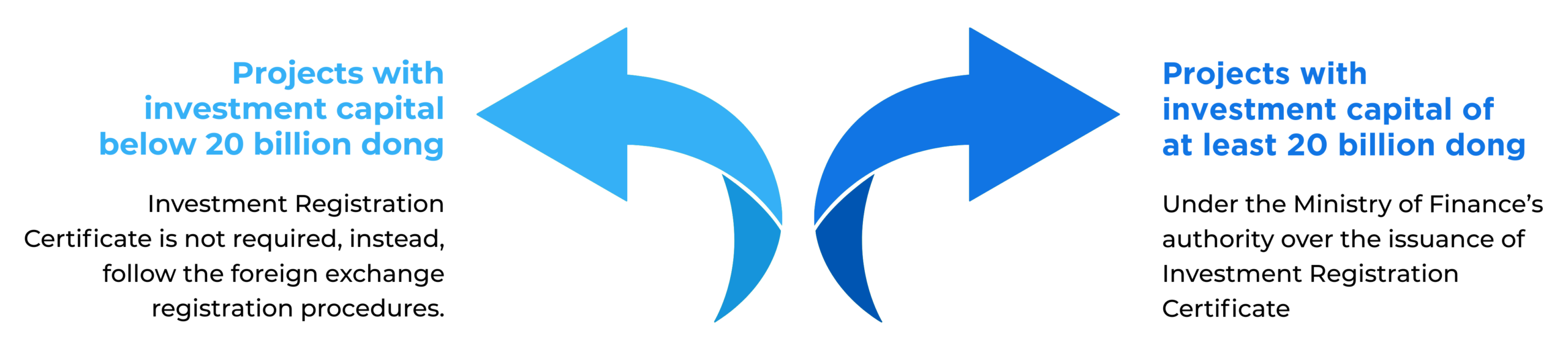

Concurrently, the Draft of the Law on Business Investment also changes the authority over the issuance of Offshore Investment Registration Certificate, accordingly:

- Offshore Investment Registration Certificate issued for projects with the investment capital of at least 20 billion dong shall be under Ministry of Finance’s authority.

- For offshore investment projects with the investment capital below 20 billion dong: Procedures for the issuance of Offshore Investment Registration Certificate are not required. In these cases. Investor shall perform the foreign exchange registration procedures in accordance with the foreign exchange laws.

Authority over the issuance of Offshore Investment Registration Certificate

Conclusion

The Draft of the Law on Business Investment does not simply serve technical adjustment purposes, but also represents a shift in Vietnam’s approach to investment management. The model of “National Assembly set the legal framwork – Government provide the details” allows for flexibility and alignment with the international practices, however, it also require strict control mechanism to prevent arbitrary and inconsistent application made by the local governments.

The draft is expected to deliver comprehensive improvement, elevating Vietnam’s position in the foreign investors’ eyes, though its effectiveness depends on the transparency and consistency in application, as well as the proactive preparations made by enterprises.

Before the Draft of the Law on Business Investment is passed and the new Law on Investment come into effect, this is an opportune moment for investors to review their strategies, stay updated on new regulatory directions, and be ready to adapt to or seize opportunities to benefit from the new laws.

Contact Us

For further information, please contact:

CNC Vietnam Law Firm

Address: The Sun Avenue, 28 Mai Chi Tho, Binh Trung Ward, Ho Chi Minh City, Vietnam

Phone: 028 6276 9900

Hotline: 0916 545 618

Email: contact@cnccounsel.com

Website: cnccounsel

We would be delighted to welcome you at CNC’s office, where you’ll have the opportunity to consult with the lawyer best suited to your circumstances. Of course, if you are unable to meet in person, simply email us via contact@cnccounsel.com or call us via (+84-28) 6276 9900.

Managed by

|

Nguyen Thi Kim Ngan I Partner

Phone: (84) 28 6276 9900 Email: ngan.nguyen@cnccounsel.com |

|

Tran Thi Hanh Nhan | Associate

Phone: (84) 32 703 0033 Email: nhan.tran@cnccounsel.com |

Disclaimers:

This article has been prepared and published for the purpose of introducing or informing our Clients and potential clients on information pertaining to legal issues, opinions and/or developments in Vietnam. Information presented in this article does not constitute legal advice of any form and may be adjusted without advance notice.