When debt recovery is an art and lawyers are artists

With the complexity and ever-changing nature of modern life, the act of debt recovery quite possibly could be considered a form of art – “The art of debt recovery”. If given the choice, no one would choose to be in debt or choose to perform debt recovery. However, desirable or not is irrelevant to the obstacles and complexities that come with the art of debt recovery.

Similarly, debt suspension or extension also requires certain biases and conditions, or debtors would likely have to live with their “debt-evader” or “debt-escapee” statuses. Which means, debtors often have to live a reclusive lifestyle so that debt owners will not be able to find them.

Debt evasion (illustration)

For creditors, the difficulties and complexities in managing (1) the debt portfolio, (2) debt extension (if any), (3) as well as the debt repayment plan will likely lead to the relationship of many parties being pushed apart further than expected. If it is trivial, it will affect the mutual trust of the parties, and if it is serious, they will have to drag each other to the jurisdiction to resolve any emerging disputes.

Broken relationships because of “Debt”

There are a myriad of instances in which creditors resort to illegal or deceptive debt recovery measures to resolve their debts. In fact, these types of debt recovery measures, being condemned by society and communities is not uncommon, and yet, the debt is not recovered and the perpetrator is likely to face criminal liability. This explains why Ho Chi Minh City is proposing to the Ministry of Finance to put the “debt collection service” business on the list of prohibited business lines[1].

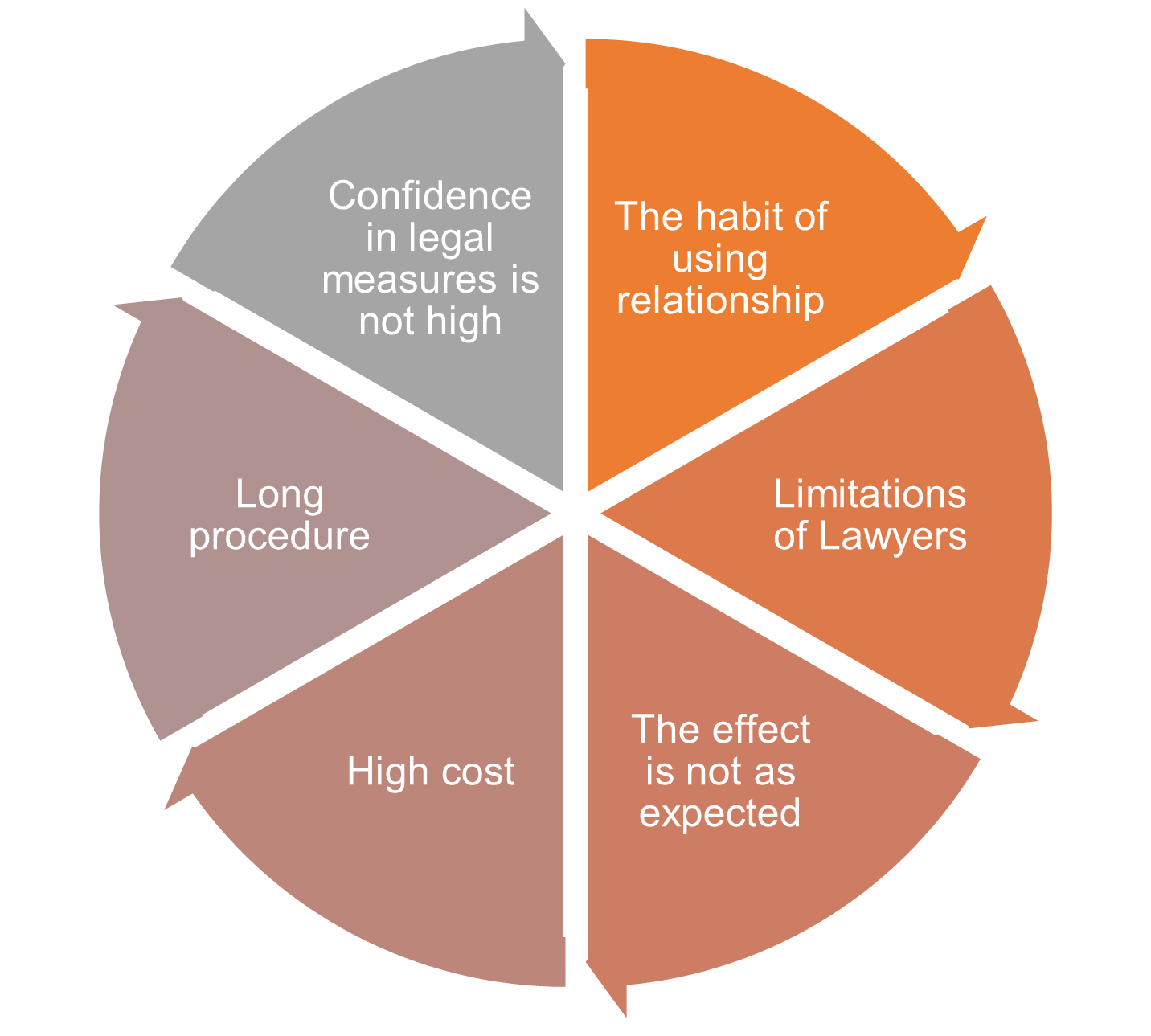

Clarification Regarding the Irrational Approach to Lawyers for Recovery

Over the course of our professional activities, we have encountered many instances in which customers hesitated to seek legal assistance to resolve debt recovery. There are a variety of reasons that may explain why customers are apprehensive in seeking support from lawyers. Among them include:

Firstly: whenever debts need to be recovered, creditors tend to rely on relationships, especially relationships of the nature of state power – relationships with agencies, police, investigative agencies, courts, procuratorates, etc. – relying on familial and friendly relationships at various levels.

Secondly: customers’ trust in legal measures is not high. The clearest evidence of the lack of confidence in legal procedures is reflected in many aspects that VCCI has recently announced, such as the duration of time for initiating and executing the proceedings, the rampant state of “lobbying”, cadres with low qualifications and capabilities, low implementation value, etc. (see more reports here[2]), whose effects may not be immediately visible.

Third: the lack of understanding of the legalities of debt collection resulting in customers often being reluctant to implement legal procedures.

Fourth: debt collection fees are also a matter of concern for customers.

Fifth: there are many instances in which clients may have used legal services, but the results were less that described or expected. There are a plethora of potential explanations for these situations, such as the practical capacity of the Lawyers involved in consulting, supporting clients, the goodwill of partners, etc.

Sixth: it is not uncommon for lawyers to neglect compliance with professional ethics in their practices, and may resort to cheating and/or taking advantage of clients to turn a profit, or perhaps increase profit.

Potential reasons for the limited use of lawyers for Debt Recovery

Because of the aforementioned reasons, customers only resort to lawyers if there is no other option such as relationships, disguised debt recovery, etc… This is also consistent with the survey results of VCCI on opinions and recommendations of enterprises on the exclusion of dispute resolution via the Courts. According to the survey, up to 60-percent (60%) of businesses that have experience with the courts stated that the reason is lengthy litigation time and 42-percent (42%) cited the reason related to “lobbying”.

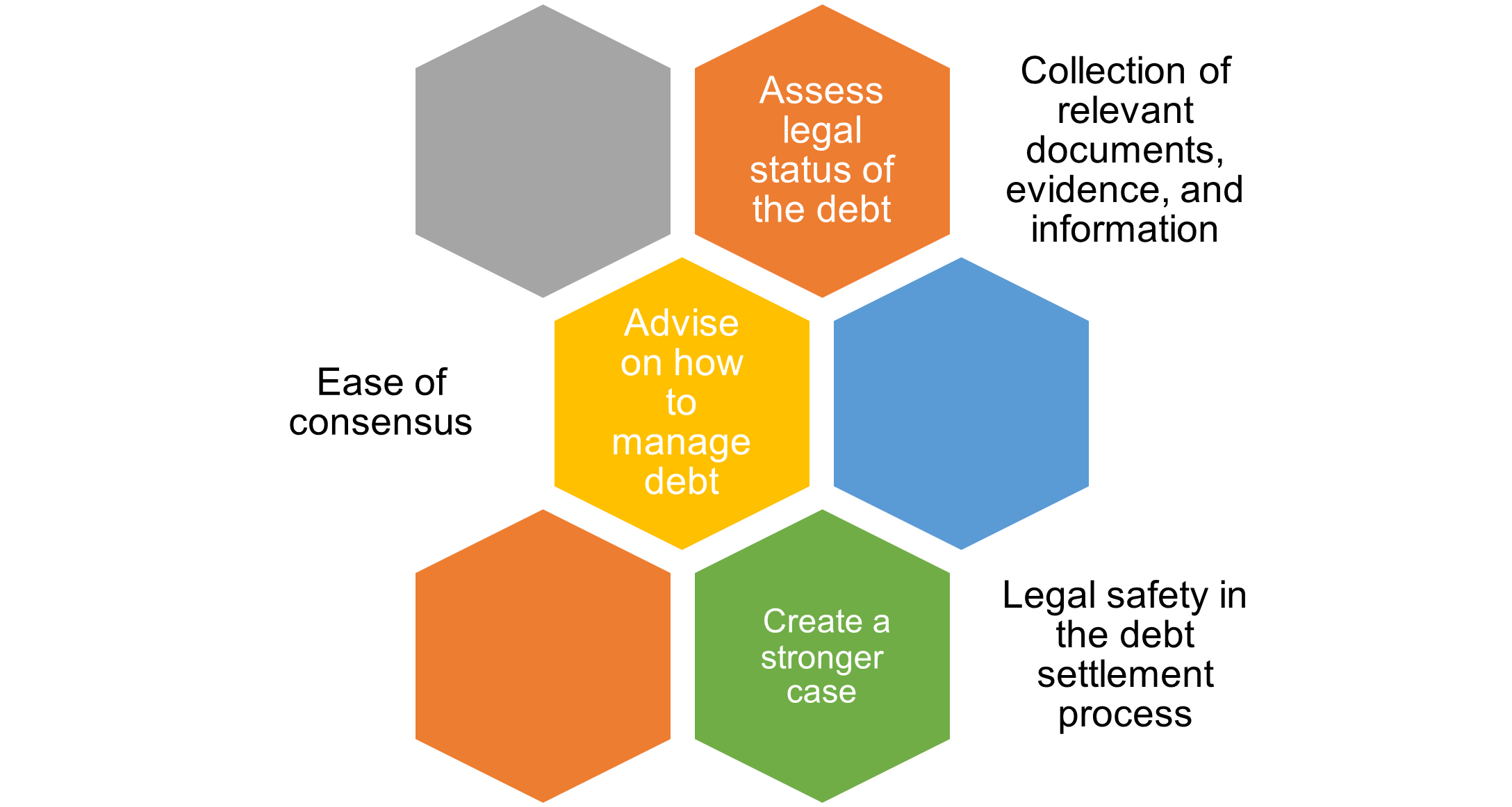

What are the benefits of having lawyers participate in debt recovery?

What are the benefits and effects of the participation of lawyers in debt recovery or restructuring?

The benefits that clients may experience from choosing an experienced and ethical Lawyer for their problem may include:

Firstly: the lawyer will help the client develop a comprehensive and objective view of their legal position with respect to certain debts. This is an important issue that helps customers effectively understand their rights and obligations toward a suitable solution and action plan.

Secondly: for each file/case, the lawyer will effectively and efficiently plan and propose a feasible legal measure to settle the debt in the optimal interests of the client.

Thirdly: the participation of lawyers will settlement the process of the case advantageously and favorably, thereby creating more opportunities for a consensus to be attained.

Fourth: in many instances, a qualified lawyer will work with the client to consolidate their case, which serves as a basis for negotiation(s), as well as a better result if legal measures are deemed necessary.

Fifth: with their knowledge, skills, experience, and relationships, lawyers possess the knowledge of how discover and obtain information related to potential debt recovery or debt restructuring. Common methods that Lawyers may advise clients on include assessing shareholders/members of the business or brothers and cousins of the “debtor”, assessing the primary business partners, or guarantee unit, etc.

Sixth: another very important benefit is that the lawyer will ensure legal security for each client’s behavior with respect to the debt, thereby minimizing the risks. Moreover, the company of a lawyer reassures the client.

Benefits of having a lawyer participate in debt recovery

Demerits

Aside from the merits, there are many cases in which customers abuse legal procedures in jurisdictions to delay overdue debt obligations. In these cases, clients have repeatedly asked their lawyers to methodically delay the proceedings, which, in turn, affects the reputation of the Lawyer, and causes psychological inhibition and objection to the participants – judges, arbitrators, etc. – in the proceedings.

There have also been cases in which continuing to use Lawyers to ensure the agreements attained, are guaranteed to be implemented in practice. The client immediately notified the termination of the legal service contract and performed the work themselves. As such, the risk rests entirely on the client, because:

First: the customer loses the consultant, support, and companionship with the customer and can give advice to the customer during the transaction process.

Second: the counterparty will change their mind as soon as he discovers that in the correspondence, exchanges, or meetings with the client, that legal representation – along with the values that the Lawyer had established in advance – no longer exists. This would likely result in a potential reverse of established values.

Third: the client might fall for various traps set by the counterparty without realizing it, until there are actual consequences (such as not reaching the minimum value, payment deadlines becoming unfeasible, payment values losing attractiveness, etc.), or worse, the client might willingly accept unfavorable terms.

Fourth: costs might be increased if support from Lawyers is once again required, because in such cases, the lawyer must review the entire file, and the case, and at the same time consider the challenges and complications that the client and the lawyer must encounter to achieve the final results.

Fifth: it is very likely that the counterparty will lack goodwill to cooperate and take precautionary measures when the role of the lawyer in the settlement process is not transparent and seamless.

When debt recovery lawyers are artists

The above-mentioned reasons do not come about as a coincidence that debt collection is considered an art form, and people like us – legal professionals – are artists. We are able to speak and perform with appropriate timing and in the most eloquent and optimal way to ensure that outstanding debts have the potential to be recovered and without the parties losing future opportunities to work and cooperate with each other in the future.

To learn more about how CNC Lawyers are available to exercise their debt collection efforts, see Debt Collection Services.

For further inquiries and support, please contact CNC Law Firm Vietnam via our contact information below:

Address: The Sun Avenue, 28 Mai Chi Tho, An Phu Ward, Thu Duc City, Ho Chi Minh, Vietnam

Phone (84): 28-6276 9900.

Email: contact@cnccounsel.com | Website: http://cnccounsel.com

[1] https://vneconomy.vn/tphcm-tiep-tuc-de-xuat-cam-kinh-doanh-dich-vu-doi-no-thue-20190904155926933.htm

[2] https://vneconomy.vn/vi-sao-doanh-nghiep-it-khoi-kien-ra-toa-20181121110749019.htm

Pingback: Debt Collection in Judgment Enforcement Phase – CNC | Công ty Luật TNHH CNC Việt Nam