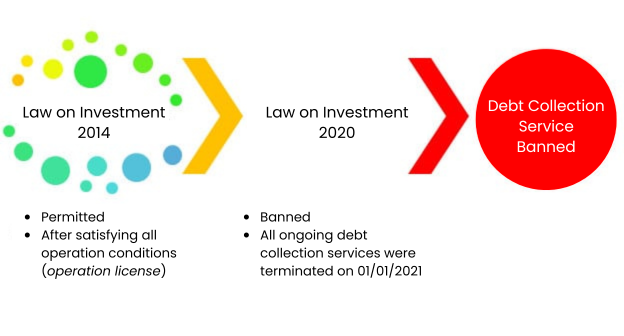

1. Banning of Debt Collection Service

One notable point that has been receiving attention from civilians and businesses is the ban on debt collection services[1] according to the Law on Investment (Modified) No. 61/2020/QH14. Accordingly, from 01/01/2021 when the Law on Investment No.61/2020/QH14 went into effect – all debt collection services were terminated.

[insert pictures]Consequently, after 01/01/2021:

– Debt collection services are no longer a restricted business line according to the Law on Investment No 67/2014/QH13 and other Elaboration Decrees[2];

– Businesses with Enterprise Registration Certificates licensing debt collection services continued their operation until the Law on Investment No. 61/2020/QH14 became effective (1/1/2021), after that point, all debt collection services were terminated and businesses that operated in this business line carried out actions to liquidate contracts before 01/01/2021[3].

Changes of Law on Investment 2020 in comparison with Law on Investment 2014

2. Why was Debt Collection Service banned?

The Creditor and the Debtor are positions that many would find undesirable. In fact, whenever money is lent or goods and services are provided, the lender/good, service provider would expect a corresponding amount of money to be returned and vice versa, the borrower/ buyer would be happy to rid themselves of the debt.

The fact that debtors may not be able to pay back the money within due time may lead to the loss of trust of others in debtors themselves, or in worse cases, it leads to the loss of prestige, honor, and credit of said person or business within the community.

Thoughts of Creditor and Debtor

In reality, victims of threats or bullying from anonymous debt collectors or creditor’s representatives are not uncommon. In some cases, the application of relentless adamant measures coupled with unrestraint action had resulted in devastating consequences.

In order to reclaim their money, many creditors resorted to hiring gangsters and hoodlums which likely lead to committing violence and violating the law. These circumstances may have been one of many reasons for the ban on debt collection services on 01/01/2021 as stipulated in the 2020Law on Investment.

3. Is banning debt collection services an optimal solution?

A ban as a solution has a bad track record of achieving the desired results, some bans had even backfired and caused damage to the livelihood of civilians.

In this particular situation, the 2020 Law on Investment forces even licensed businesses to stop their debt collection operations. This also meant that debt owners would lose one of their means to protect their legal rights and benefits when they could no longer contact authorized agencies to recover their loan.

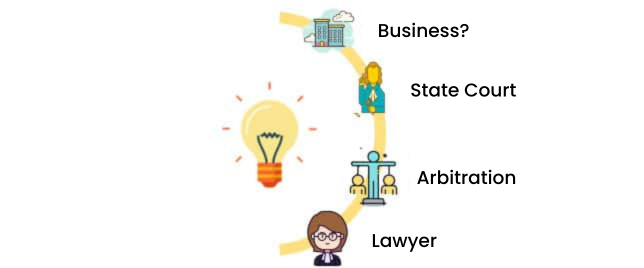

Consequently, when the 2020 Law on Investment became effective on 01/01/2021, debt owners ultimately turned to other alternatives such as Court, Arbitration, or Legal practitioners for the recovery of money that rightfully belonged to them.

Debt owner’s means of debt recovery

However, each alternative has its own set of pros and cons. For instance, in the case of taking the matter to court, the expected timeframe for a civil case to be adjourned is no less than 12 months[4]. This ridiculous time span definitely caused many creditors to procrastinate seriously pursuing the case in court.

As for Arbitration, the steep proceeding fee is one of its unappealing features and this matter is further exacerbated by the tendency to downplay the expense for legal matters of many creditors. Moreover, the prerequisite to begin the arbitration process is the prior agreement of disputing parties on choosing arbitration as the dispute resolution process. Therefore, despite being viewed as an effective alternative dispute resolution, Arbitration isn’t the most opted for solution.

With respect to the use of law firms and legal practitioners, the primary problem of this method is its popularity as many creditors remain clueless about this approach. According to a statistical report from the Vietnam Bar Federation in 2016, the ratio of lawyers to civilians is 1 per 16,000 – one lawyer for every sixteen-thousand citizens.

In other words, debt collection service is still the most prevalent means of debt recovery that many creditors turn to, and now that the business line of debt collection has been banned, and other alternatives have their fair share of flaws, it is inevitable that businesses look for loopholes to continue this line of business such as providing debt collection service under the pretense of a labor lease.

From our perspective, to attain the desired outcome, the policy and the legal framework, as well as other regulations relevant to the banning of debt collection services must be straightforward and transparent.

4. Misconceptions of legal services about debt recovery.

When debt collection service was terminated on 01/01/2021, there was a high probability that creditors would resort to law firms and legal practitioners for the protection of their legal rights and benefits.

With the protection provided by legal services about debt recovery, more and more people were encouraged to make transactions.

However, a doubt surrounding said legal services persists, namely: How do legal services about debt recovery work after the ban on debt collection service on 01/01/2021?

Questions regarding the legal services about debt recovery

These questions primarily stem from the fact that many legal practitioners on behalf of their clients request the customer, borrower, or guarantor to make payments, clear obligations, or consider other similar actions.

In these situations, the legal practitioners simply perform their responsibilities, obligations, and roles consistent with the Law on Lawyers and other guiding documents, including[5]:

Legal Services provided by Legal Practitioners

In order to carry out the committed tasks, legal practitioners have to continuously utilize abilities within their arsenal so that the best result may be achieved. For example, the ability to negotiate, analyze, draft documents, and contact competent authorities.

The services mentioned above are within the scope of the Law on Lawyers and not related to restricted business lines listed in Addendum 4 of the Law on Investment, in which Lawyers are included

Succinctly, the issuance of the Law on Investment No. 61/2020/QH14 is the basis for the claim that: after 01/01/2021, only law firms or authorized legal practitioners may assist clients with debt recovery.

5. Legal Debt Recovery Benefits

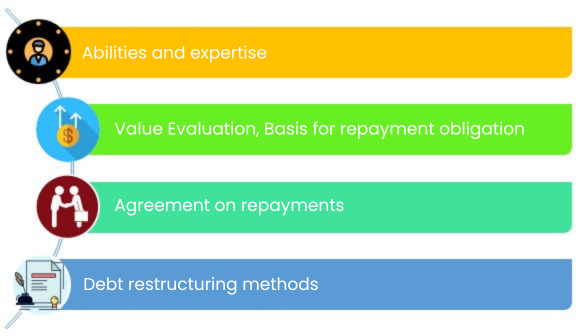

There are reasons why many creditors deem the process of debt collection arduous and costly, and the following explanations, to some degree, may shed some light on this particular circumstance:

Firstly, many creditors have yet to find an efficient solution for debt recovery, either due to the lack of capabilities or the lack of approaches.

Most creditors primarily rely on the good faith of debtors for the repayments of their debts in due time. However, when the debtors delay payments, many creditors are likely to find themselves at a loss and continue their wait.

Secondly, Evaluations on value, basis for repayment obligation, and interests (if any) are required in multiple cases of debt collection

The simple thought of “debtors would have the obligation to pay back the money they owe” is probably all that occurred to some of the creditors upon the lending money. However, if that is the case, they have neglected that in a loan agreement, there are other elements such as the due date, basis for repayment obligations, interest rates, etc.

Therefore, cases of creditors not having a firm grasp on these elements, which in turn leads to illegal activities to collect debts aren’t uncommon

Thirdly, the agreement between parties about the repayments

Many creditors most likely would find themselves in a bind when drafting provisions for the contract even when the process of negotiation on repayment went smoothly.

Finally, the debt restructuring methods

It is not a simple task for both parties to carry out debt restructuring, interest payment obligation reduction, or other agreements necessary for the borrowing party to make financial arrangements for the repayment.

The many challenges that creditors encounter in the debt collection process.

Because of the reasons outlined above, legal practitioners are the optimal choice to help both parties in solving the problems evolving from debt collection. As it happens, advice on actions to be taken would be provided, not only to the creditors but also the debtors for each particular circumstance, as necessary.

If required, legal practitioners, may, on behalf of creditors, file a case or report to the competent authorities if there are signs of a criminal case. Vice versa, the legal practitioners may also represent the debtor in negotiating with the creditor or reporting to the competent authorities should there be signs that the creditor is engaging in illegal activity.

Although there are voices both for and against the ban on debt collection services as stipulated in the 2020 Law on Investment, it is clear that the legal practitioners’ role in debt recovery is undeniable.

When the 2020 Law on Investment went into force, Legal Practitioners should be an indispensable means to defend creditors’ legal rights and benefits, thereby encouraging more people to make transactions.

CNC hopes that this article will be of service to anyone seeking more information on legal services

about debt recovery and its benefits.

For further information

CNC is honored to assist clients and provide solutions to the problems evolving from lending, guarantee, or sales of goods and services. Requests for our support may be sent to the following email address or phone number:

Mrs. Nguyen Thi Kim Ngan I Partner

T: (+84-28) 6276 9900

Mrs. Phuong Nguyen I Junior Associate

T: (+84-28) 6276 9900

E: phuong.nguyen@cnccounsel.com

CNC ©| Law Firm

The Sun Avenue, 28 Mai Chi Tho, An Phu Ward, District 2

Ho Chi Minh City, Vietnam

T: (+84-28) 6276 9900 | H/L: (+84) 916 545 618

cnccounsel.com | contact@cnccounsel.com

Disclaimer:

This article is prepared or used for the purpose of introducing or updating clients on information about matters and/or the developments of legal perspective in Vietnam. The information contained within this article does NOT constitute advice of any kind and could be subjected to changes without prior notice.

[1] Article 6.1.(h) [Prohibited business lines], Law on Investment No. 61/2020/QH14 dated 17/06/2020.

[2] Article 7.4 and Appendix 4.35, Law on Investment No. 67/2014/QH13; Article 3.10 of Decree 96/2016/ND-CP dated 1/7/2016 and Article 104/2007/ND-CP dated 14/06/2007.

[3] According to Mr. Vu Dai Thang, Vice Minister of Ministry of Planning and Investment, source (https://tuoitre.vn/khai-tu-dich-vu-kinh-doanh-doi-no-thue-tu-1-1-2021-20200710124445889.htm).

[4] See Article 111, Article 190.1, Article 191, Article 194, Article 195.2 Criminal Procedure Code 2015.

[5] Article 5.4 [Principles for Practice by Lawyer] Law on Lawyer No.65/2006/QH11 dated 29/06/2006 amended, supplemented by Law No. 20/2012/QH13 dated 20/11/2012 and Criminal Procedure Code No.101/2015/QH13 dated 27/11/2015.