Beneficial owners under 2025 Law on Enterprises – Who are they?

In continuation of the update on the Law Amending and Supplementing Certain Articles of the Law on Enterprises, which highlights the novelty of the concept “beneficial owner”, the following article furnishes the latest updates on guidance for this concept.

Beneficial owners identification

The definition of beneficial owner at Article 1(1)(d) of the Law Amending and Supplementing Certain Articles of the Law on Enterprises, effective from July 1, 2025 (the “Amended LOE”) has referenced to two prominent concepts to identify a beneficial owner: “actual ownership of charter capital” and “right to controll the enterprise”. To provide timely guidance for related activities of enterprises, the Government has issued Decree 168/2025/ND-CP on enterprise registration (“Decree 168”), effective from July 1, 2025, guiding these two concepts, accordingly:

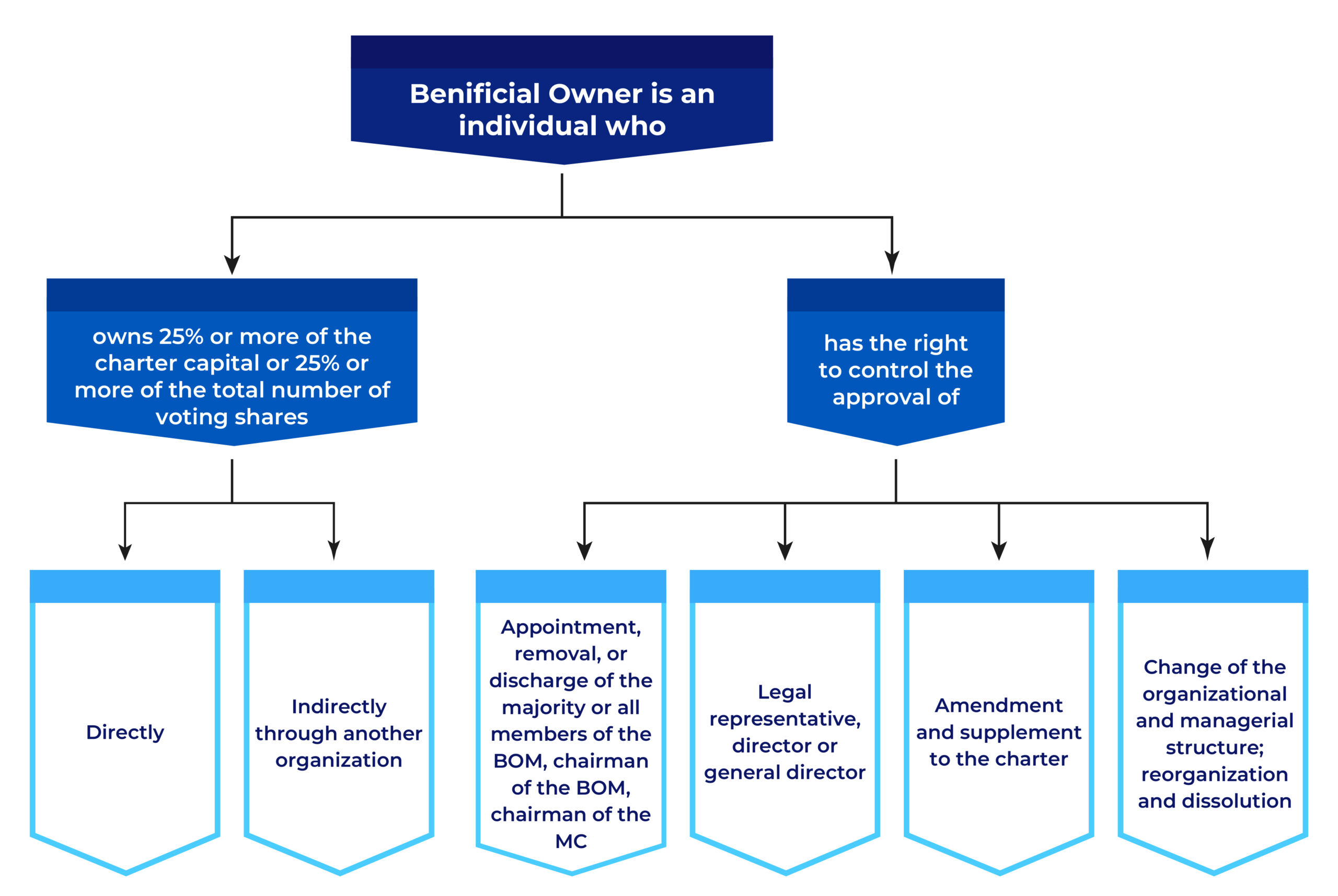

A beneficial owner is an individual who meets one of the following criteria:

Regarding ownership of charter capital: directly or indirectly owns 25% or more of the charter capital or 25% or more of the total number of voting shares of the enterprise;

- An indirect owner is an individual who owns 25% or more of the charter capital or 25% or more of the total number of voting shares of the enterprise through another organization.

Regarding the right to control the enterprise: has the right to control the approval of at least one of the following issues:

- appointment, removal, or discharge of the majority or all members of the board of management, chairman of the board of management, chairman of the members’ council;

- legal representative, director or general director of the enterprise;

- amendment and supplement to the charter of the enterprise;

- change of the organizational and managerial structure of the company;

- reorganization and dissolution of the company.

In light of the above definition, the enterprise is now able to identify individuals who are beneficial owners of the enterprise.

The concept “beneficial owner” under the laws on enterprises

Declaration and notification of the beneficial owner

The obligation to declare the beneficial owner of the enterprise to competent authorities extends throughout the operation process.

Specifically, the enterprise founder or enterprise declares and notifies the provincial business registration authority of information about the beneficial owner of the enterprise as follows:

Where individuals directly or indirectly own charter capital/voting shares:

- Individual who is a shareholder owns 25% or more of the total number of voting shares;

- Individual who is a member owns 25% or more of the charter capital of the partnership or limited liability company with two or more

- members;

- Individual who is the owner of the single member limited liability company.

Where individuals have the right to control vital issues of the enterprise:

- The enterprise founder or enterprise must self-identify the beneficial owner of the enterprise to declare and notify the provincial business registration authority (if any).

Decree 68 re-emphasizes the obligation to declare information about the beneficial owner and has a point of note for enterprises in Article 18(3) of the Decree on Declaration of information about the beneficial owner and information to identify the beneficial owner of the enterprise.

“The enterprise founder or enterprise shall declare and notify the provincial business registration authority of information on a shareholder being organization owns 25% or more of the total number of voting shares. Information of shareholders being organizations includes: Name of organization, enterprise code/establishment decision number, date of issuance, place of issuance, head office address, ownership ratio of total number of voting shares.”

Although it is subject to the provision on declaration of information on the beneficial owner who is an individual, its content indicates that every joint stock company with shareholder(s) being organization owning 25% or more of the total number of voting shares must carry out a declaration and notification procedure with the provincial business registration authority.

Thus, the enterprise founder or enterprise, in addition to declaring and notifying on the beneficial owner who is an individual, must also declare and notify information on shareholders being organizations owning 25% or more of the total number of voting shares.

The organization’s declaration and notification information includes: Name of organization, enterprise code/establishment decision number, date of issuance, place of issuance, head office address, ownership ratio of total number of voting shares.

Obligations of enterprises regarding supplementing beneficial owner information

Updating information on beneficial owners

Enterprises are obliged to collect, update, and maintain records on information on the beneficial owner of the enterprise; provide information to competent state agencies to identify beneficial owners of enterprises upon request.

Recording information on the beneficial owner

Enterprises record the List of Beneficial Owners of Enterprises Declared and Notified to the provincial business registration authority as prescribed, in the form of paper documents or electronic documents.

Declaration of information about beneficial owners after July 1, 2025

For enterprises established before July 1, 2025

Article 3(1) of the Amended LOE stipulates:

“1. For enterprises registered before the effective date of this Law, the addition of information about the beneficial owner of the enterprise (if any), information to identify the beneficial owner of the enterprise (if any) shall be carried out simultaneously at the time the enterprise carries out the procedure for registering changes to the enterprise registration content, notifying the latest change to the enterprise registration content, except in cases where the enterprise requests to add information earlier.”

By this provision, it can be determined that if an enterprise is established before the effective date of the Amended LOE (July 1, 2025), the addition of information on beneficial owners (if any), information to identify beneficial owners of the enterprise (if any) will be carried out simultaneously at the time the enterprise carries out the registration procedure or/and notifies the latest change to the enterprise registration content.

In case the enterprise apply for the addition of information on beneficial owners (if any), information to identify beneficial owners of the enterprise (if any) earlier than the time carrying out the registration procedure or/and notifying the change to the enterprise registration content, the enterprise can still carry out with procedures and documents as prescribed.

For enterprises established after July 1, 2025

Individuals and enterprises that establish enterprises after July 1, 2025 are required to declare a list of beneficial owners in the company registration dossier.

Individuals and enterprises shall declare and notify the business registration authority about the beneficial owners of the enterprise according to Form No. 10 – List of beneficial owners of enterprise and Form No. 11 – Declaration of information to identify the beneficial owners of enterprises of Appendix I of Circular 68/2025/TT-BTC.

LIST OF BENEFICIAL OWNERS OF ENTERPRISE

|

No. |

Full name | Date of birth | Gender | Number, date of issue, issuing authority of individual’s legal documents | Nationality | Ethnic | Contact address | Beneficial owner of the enterprise | Note (if any) | ||

| Ownership ratio of charter capital | Ownership ratio of total number of voting shares |

Right to control |

|||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|

|

……, dated…… LEGAL REPRESENTATIVE/ (Signature and fullname)

|

LIST FOR IDENTIFICATION OF THE BENEFICIAL OWNERS OF ENTERPRISE

|

No. |

Name of organization | Enterprise code/ establishment decision number |

Date of issuance | Place of issuance | Head office | Ownership ratio of total number of voting shares | Note (if any) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

8 |

|

……, dated…… LEGAL REPRESENTATIVE/ (Signature and fullname)

|

|||||||

The definition of “Beneficial owner” is not only a step forward in enhancing transparency in corporate ownership but also a signal of higher demands for accountability and corporate governance in Vietnam. Full compliance with the requirements for declaration, record-keeping, and updating of information not only ensures legal adherence for businesses but also contributes to building a healthy, sustainable, and trustworthy business environment.

Disclaimers:

This article has been prepared and published for the purpose of introducing or informing our Clients and potential clients on information pertaining to legal issues, opinions and/or developments in Vietnam. Information presented in this article does not constitute legal advice of any form and may be adjusted without advance notice.

Managed by

|

Tran Thi Thanh | Associate

Phone: (84) 28 6276-9900 Email: thanh.tran@cnccounsel.com |

|

Tran Anh Thy | Junior Associate

Phone: (84) 28 6276-9900 |

Contact Us:

For further information, please contact:

CNC Vietnam Law Firm

Address: The Sun Avenue, 28 Mai Chi Tho, Binh Trung Ward, Ho Chi Minh City, Vietnam

Phone : 028 6276 9900

Hotline: 0916 545 618

Email: contact@cnccounsel.com

Website: cnccounsel

Pingback: Choosing the Right Business Structure in Vietnam – CNC | Công ty Luật TNHH CNC Việt Nam